Analyst Says Ethereum, Polkadot and Four Additional Crypto Assets Are Top Altcoin Picks for Accumulation

A popular analyst says he has his radar locked on a number of altcoins that are high on his list for accumulation including Ethereum (ETH) and Polkadot (DOT).

Crypto strategist Michaël van de Poppe tells his 624,700 Twitter followers that he believes the crypto markets are giving long-term bulls the opportunity to accumulate digital assets at deeply discounted prices.

In addition to leading smart contract platform Ethereum and interoperability chain Polkadot, Van de Poppe says he’s currently accumulating Cosmos (ATOM), an ecosystem of blockchains designed to scale and communicate with each other.

The crypto strategist also says he has his eye fixed on SKALE (SKL), a blockchain network that aims to allow developers to create and provide decentralized chains that are completely compatible with Ethereum, as well as Mina Protocol (MINA), a project designed to speed up the blockchain identification process.

Still,

This period is a period where you can accumulate your investments nicely.

Remember, $VRA did a 200x for me, and some more coins have been a gainer.

I’m putting it on;

– $ETH

– $ATOM

– $DOT

– $SKL

– $MINA

– $CCDAnd some more.

What about you?

— Michaël van de Poppe (@CryptoMichNL) September 2, 2022

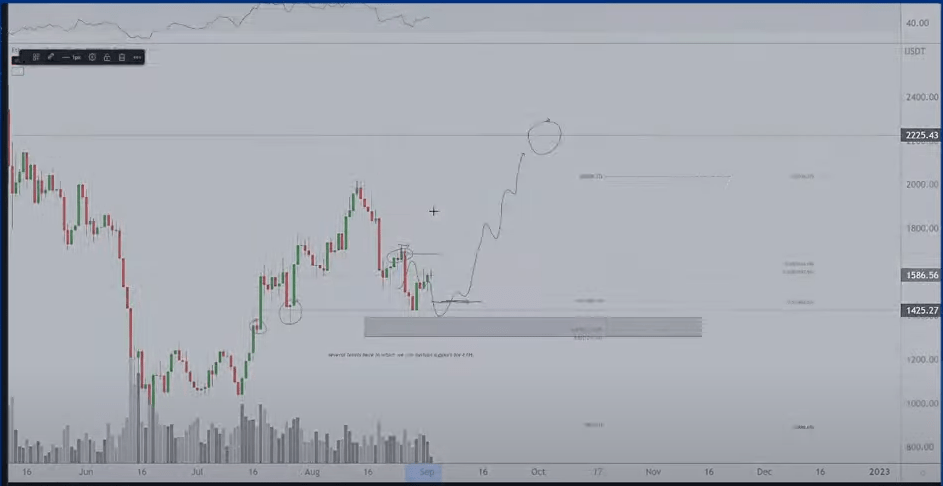

Looking closer at Ethereum, Van de Poppe forecasts in a new strategy session that ETH must hold its immediate support to possibly ignite a rally to his target above $2,000.

“Clearly, you want to see it test around $1,450 to $1,475. If that holds, we can continue. You want to see a crack of $1,685.”

Source: Van de Poppe/YouTube

Looking at Van de Poppe’s chart, the analyst predicts a potential Ethereum rally to $2,225. At time of writing, ETH is swapping hands for $1,556.

As for Bitcoin (BTC), Van de Poppe says the king crypto is currently trading within a narrow range in the lower timeframe between $19,000 to $20,600.

“You technically want to see it hold above this area here ($19,800)… If we do lose $19,800 to $20,000, probably we’re going to sweep the lows here ($18,900). And then question will become whether we get a very high volume candle liquidity grab and then reverse immediately and then we can go to the other side of the range ($20,600).”

Should BTC surge to $20,600, Van de Poppe predicts a breakout rally to $22,000.

At time of writing, BTC is valued at $19,866.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur