Analyst Warns Of The Elimination Of The Middle Class; Can Bitcoin Help?

The economic situation of the United States has been getting worse in recent times, recording inflation rates that have not been seen in 40 years. Given this, the Fed obviously have their work cut out for them, and they have reportedly begun taking measures against this. Fed Chair Jerome Powell had made a speech a little over a week ago where he had described the Fed’s position as “hawkish” and warned of “pain” to come as measures are put in place.

Market Strategist Warns Of The Consequences

The Fed has not exactly been shy about what the consequences of the high inflation rates and the Fed’s stance would be. The Fed boss had explained that it would take some time to fix the economy and normalize the price volatility, letting everyone know that there would be a price to pay for this.

One of the “pain” that is expected to be felt was recently highlighted by market strategist Todd ‘Bubba’ Horwitz. Horwitz, who is the chief market strategist at Bubba Trading, has painted a pretty gruesome picture based on the Fed’s stance in a recent interview with Kitco.

The strategist explains that the equities markets would take a bit hit as the stock market could record another 50% decline. He explained that this is all part of a plan to create the “Great Reset.” A side effect of this reset would be that the middle class would be completely eliminated.

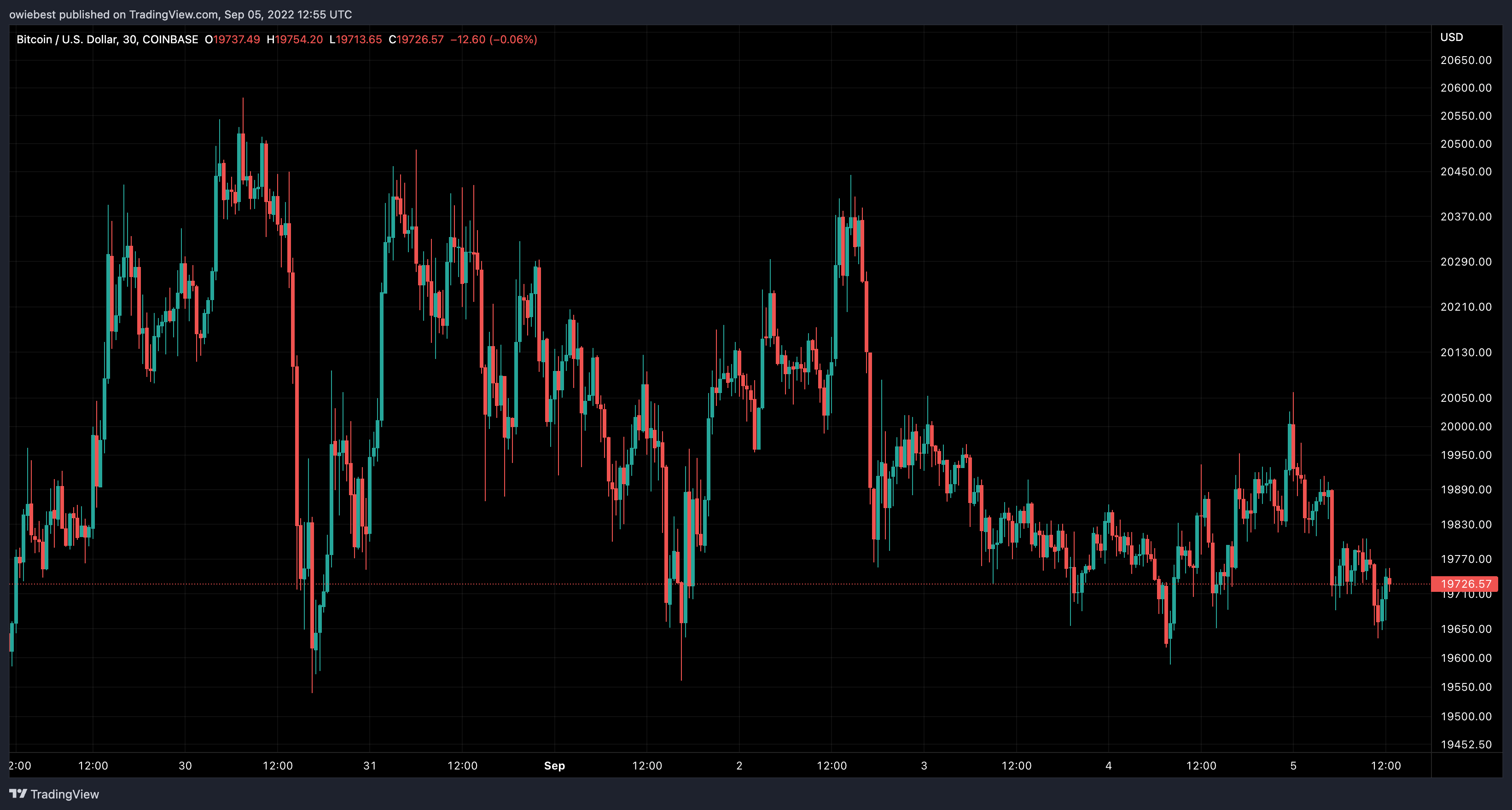

BTC trading below $20,000 | Source: BTCUSD on TradingView.com

Horwitz referred to Powell’s comments as “those of an idiot,” pointing out that the worst is yet to come. “Wait until the price of oil starts skyrocketing again,” Horwitz said. “What do you think is going to happen to inflation then? We’re going to have a food shortage this year. We’re going to have food riots in many countries.”

Is Bitcoin The Answer?

In the past, bitcoin has been able to perform quite independently from the equities markets. However, with the rise in institutional adoption, the line between the performance of bitcoin and that of the stock market has been blurred.

The correlation between bitcoin and the equities market is higher than it has ever been, meaning that whatever impacts the stock market will likely spill over into the price of bitcoin. But the digital asset still remains free of the control of any centralized body, making it a better option in times when great distress is predicted for the market.

For bitcoin to be a viable option, if Horwitz’s forecasts are correct, it would have to break the current correlation and begin moving on its own. This way, its price will be solely determined by the supply and demand rather than what is happening in the equities market.

Last year, BTC’s performance was way better than that of the top stocks, but this was when the correlation was much lower. However, bitcoin has often proven to be a better alternative against high inflation due to its decentralized nature.

Featured image from BBC, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  Zcash

Zcash  Decred

Decred  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur