Biggest Movers: SHIB Rebounds on Saturday, as ATOM Moves Away From 3-Week Low

Following three consecutive days of declines, shiba inu rebounded on Saturday, as the meme coin appears to have found a support point. Cosmos was also higher, in what has mostly been a bearish start to the weekend. As of writing, the global crypto market cap is down 1.31%.

Shiba Inu (SHIB)

Shiba inu (SHIB) was back in the green on Saturday, as the token rallied following three straight days of declines.

The world’s twelfth-largest cryptocurrency rose to an intraday peak of $0.00001397 to start the weekend.

This came less than a day after prices of the meme coin were at a low of $0.00001270, which was below a key support point.

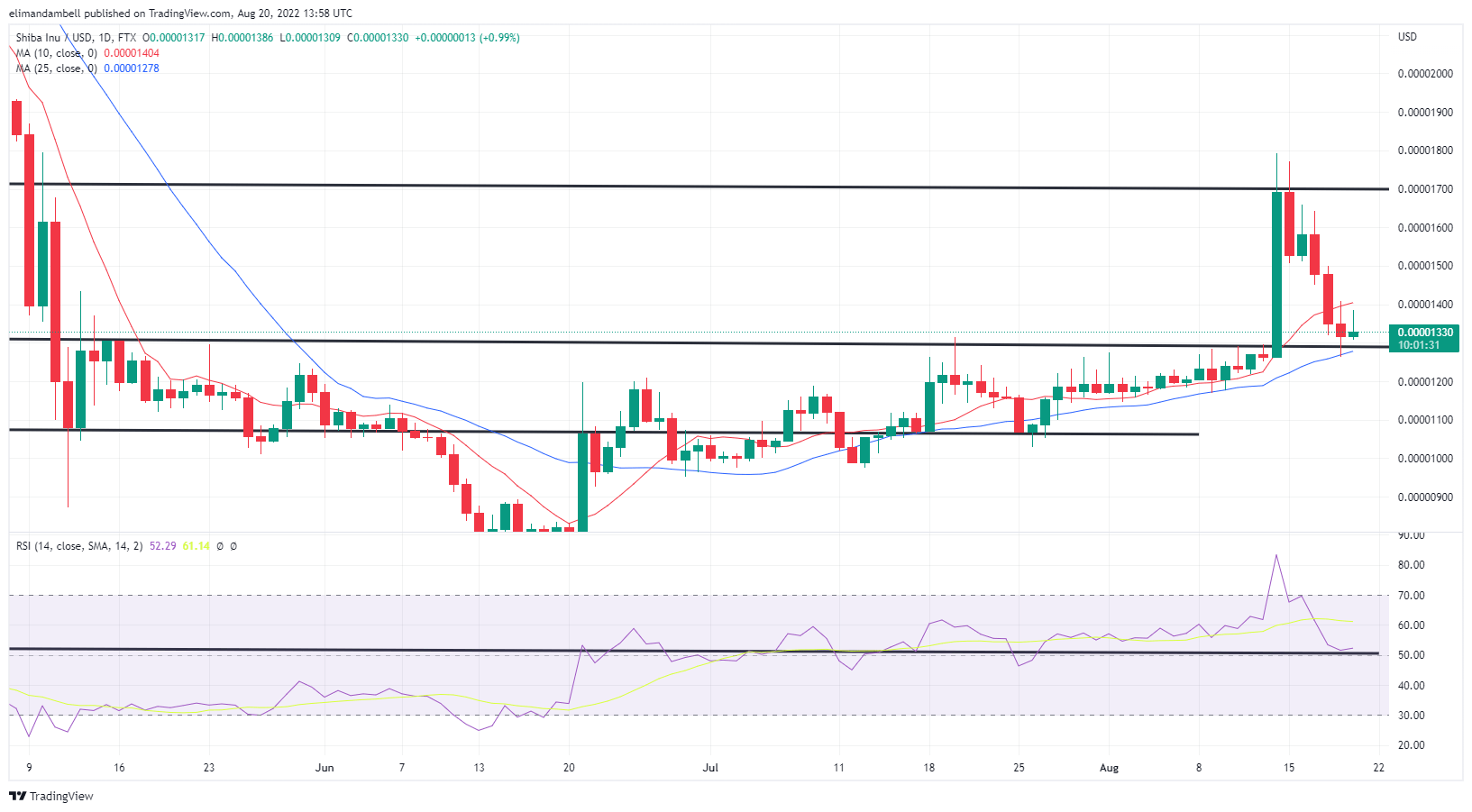

SHIB/USD – Daily Chart

Looking at the chart, this price floor was the $0.00001290 mark, however bulls resisted any further declines, pushing SHIB/USD back into the $0.00001300 region.

As of writing, the 14-day relative strength index (RSI) is tracking at 52.13, which is marginally above a floor of 51.44.

Should the index continue to climb, and move towards a ceiling of 58, then we may see SHIB move closer to $0.00001500.

Cosmos (ATOM)

Cosmos (ATOM) was also trading slightly higher to start the weekend, as it too recovered from a recent losing streak.

Saturday saw ATOM/USD race to a high of $11.02, which is over $1.00 higher than yesterday’s bottom below $10.20.

Yesterday’s bearish pressure was not enough to send ATOM below $10.00, with bulls returning to the market, after a brief move below a key support point.

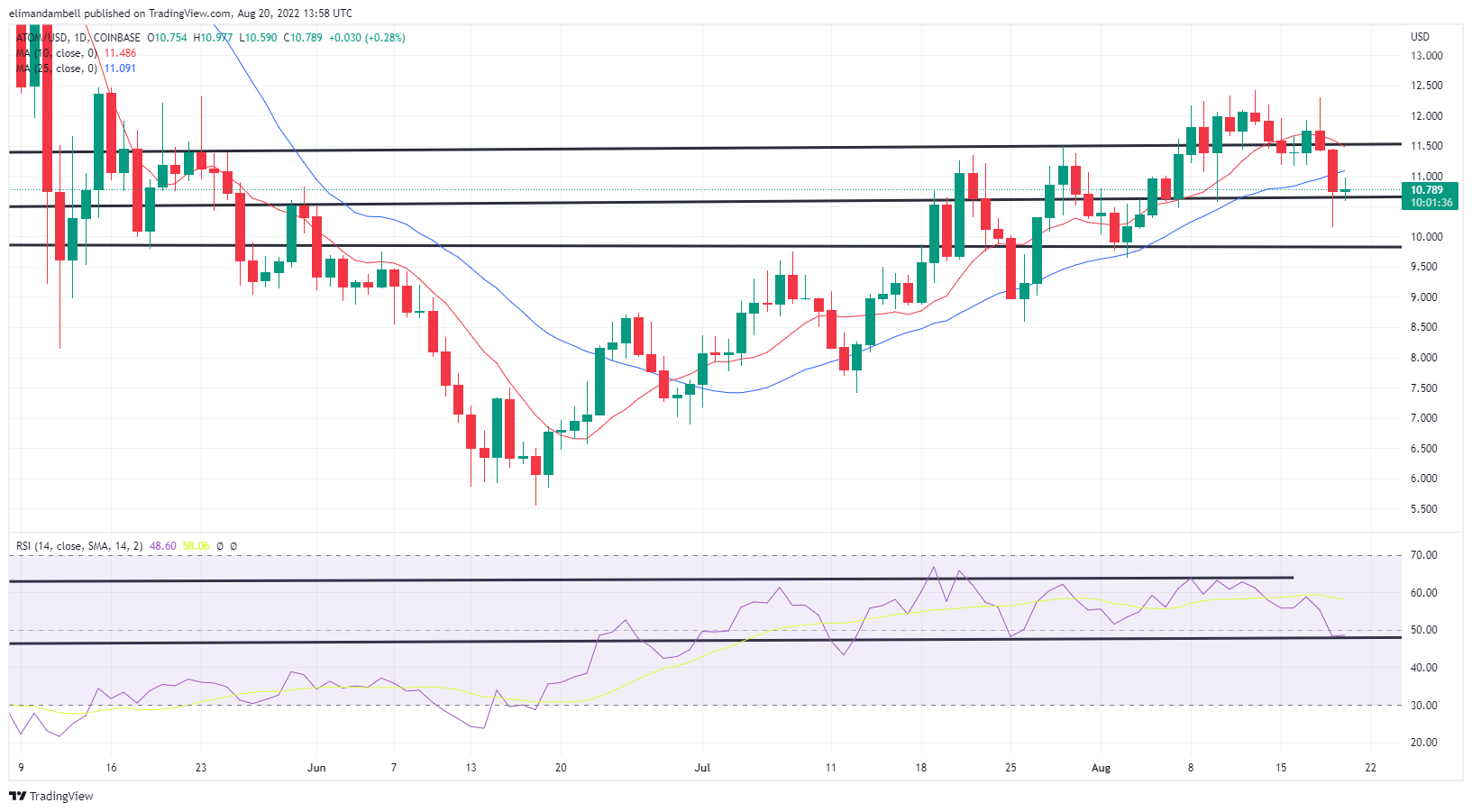

ATOM/USD – Daily Chart

The floor at $10.65 was marginally broken on Friday, however sentiment has since shifted, with some now anticipating a move nearer to a ceiling of $11.55.

As with SHIB, should ATOM bulls want to extend today’s rally, the RSI will need to significantly rise.

Currently the index is tracking at a floor of 48.05, however it would need to move towards a ceiling of 53 for prices to reach the potential target.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  NEM

NEM  Dash

Dash  Zcash

Zcash  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur