Binance Coin Price Forecast: BNB poised for a quick 12% run-up

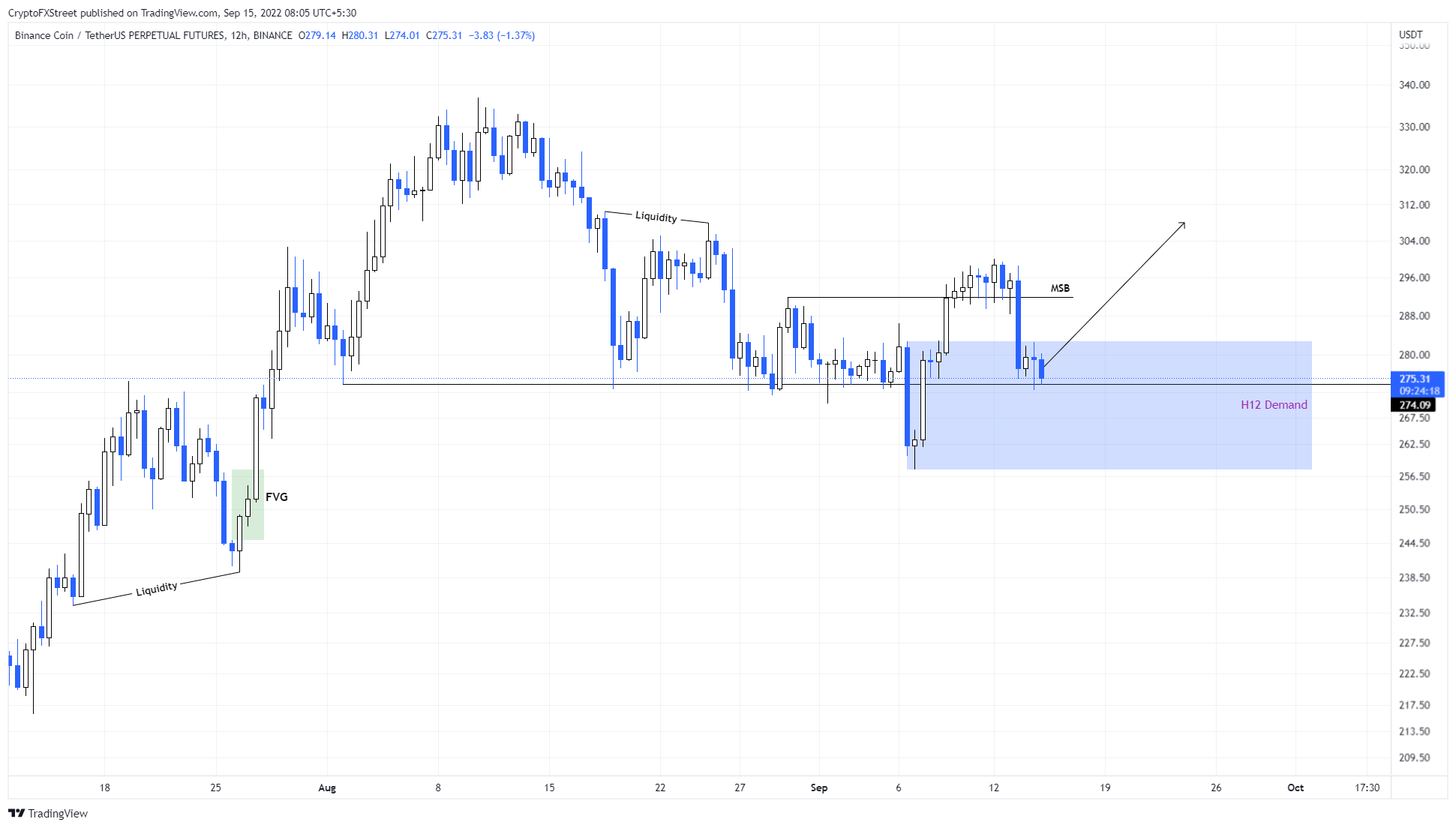

- Binance Coin price digs into the twelve-hour demand zone, extending from $282.73 to $257.74.

- A retest of the $274.09 support level inside the demand zone could catalyze a 12% ascent to $310.40.

- A daily candlestick close below the demand zone’s lower limit at $257.74 will invalidate the bullish thesis for BNB.

Binance Coin price created a bullish structure shift in the second week of September, which is currently being tested. A resurgence of buyers coupled with a spike in bullish momentum is required for BNB to see its next leg-up.

Binance Coin price teases bears

Binance Coin price has been bouncing off the $274.09 support level since August 2. Although BNB slipped below the said barrier on September 6, a subsequent recovery pushed BNB up by 15% over the next three days.

This move was pivotal in two ways.

- It caused BNB to flip the $274.09 hurdle into a support floor.

- It created a bullish market structure break, i.e., BNB set up a higher high at $298.48 relative to the August 30 swing high at $291.94.

These developments signal an incoming rally and a potential start of an uptrend. To add credence to this outlook, BNB confirmed the formation of the $282.73 to $257.74 demand zone.

As discussed in the previous article, the pullback is here as BNB currently hovers inside the demand zone. Investors can open a long position here and expect BNB to trigger a 12% run-up to collect the buy-stop liquidity resting above the swing highs at $307.86 and $310.40.

BNB/USDT 12-hour chart

While the bullish outlook makes logical sense, investors should note that the market has been bearish since late 2021. In such a case, a spike in selling pressure should not come as a surprise. If Binance Coin price produces a daily candlestick close below $257.74, it will invalidate the aforementioned demand zone and also the bullish thesis for BNB by producing a lower low.

Such a development could see BNB drop lower and fill the imbalance that extends from $257.74 to $245.01. If sellers drive this move home, Binance Coin price could aim to collect the sell-stop liquidity resting below the $239.40 and $233.71 swing lows.

Note:

The video attached below talks about Bitcoin price and its potential outlook, which could influence Binance Coin price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Hedera

Hedera  LEO Token

LEO Token  Dai

Dai  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Gate

Gate  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  NEM

NEM  Dash

Dash  Zcash

Zcash  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur