Bitcoin (BTC) and Ethereum (ETH) Fees Plummet As Speculative Frenzy Cools, According to Crypto Analytics Firm

A prominent crypto analytics firm says that Bitcoin (BTC) and Ethereum (ETH) fees are plummeting as the speculative frenzy around digital assets loses steam.

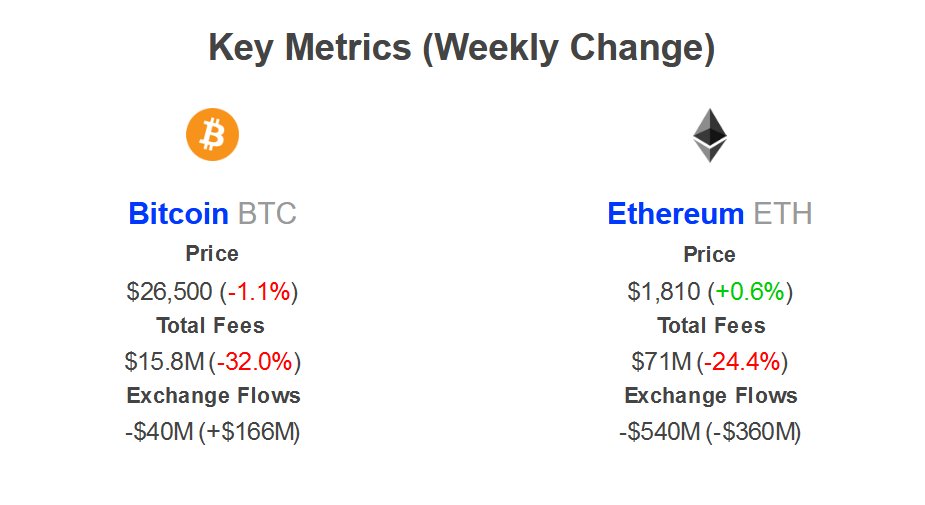

New data from market intelligence platform IntoTheBlock reveals that the total fees associated with the crypto king and the leading smart contract platform have dropped 32% and 24.4% this week, respectively.

“Bitcoin and Ethereum fees have taken a notable dive this week, dropping by 32% and 24% respectively. Looks like the speculative frenzy might be simmering down. Will this trend continue or is it just a temporary pause?”

Source: IntoTheBlock/Twitter

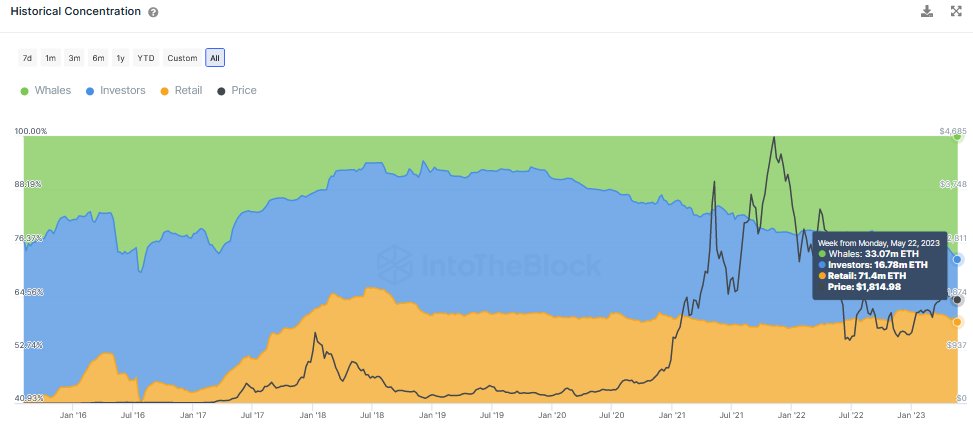

IntoTheBlock also notes that whale activity centered around the top altcoin has kicked into high gear as deep-pocketed ETH investors now hold about 3.5 million more tokens than they did earlier in 2023.

“Ethereum whales are on the rise! They now hold 30.07 million ETH, up from 26.56 million ETH in early 2023. The increasing holdings of addresses holding over 0.1% of the supply suggest ongoing accumulation.”

Source: IntoTheBlock/Twitter

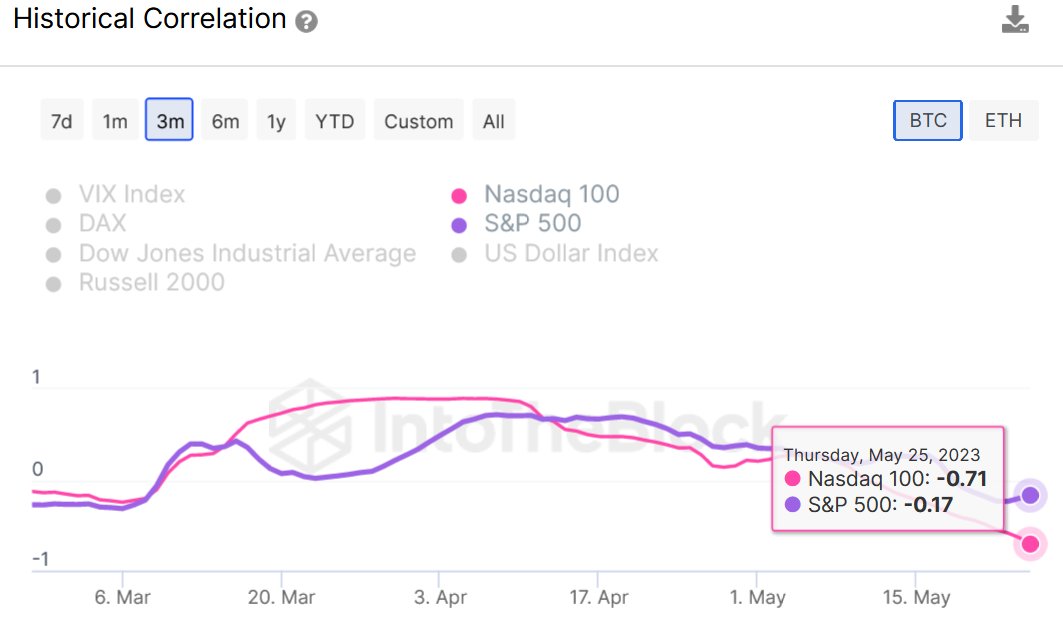

Moving on to the top crypto asset by market cap, the analytics firm finds that BTC and stocks are increasingly exhibiting a lack of correlation or negative correlation, which could mean that fresh capital is on its way to Bitcoin.

“Bitcoin and stocks are currently exhibiting a remarkable lack of correlation, and are even displaying a negative correlation! Studies show that allocating 10-20% of your assets in uncorrelated assets can significantly decrease risk. Could this emerging trend attract fresh capital to Bitcoin?”

Source: IntoTheBlock/Twitter

Bitcoin is trading for $26,791 at time of writing, a 0.94% increase during the last 24 hours while Ethereum is moving for $1,833, a 1% increase in the last day.

Generated Image: Midjourney

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  NEM

NEM  Dash

Dash  Zcash

Zcash  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur