Bitcoin Cash (BCH) Makes Another Attempt to Breach $166 Mark!

Bitcoin Cash is an improved, advanced, and more capable blockchain than its parent BTC. BCH’s last released block size was 32 MB, while BTC was just 1 MB. This indicates the difficulty level in solving a BCH-based block. With the news of mining operations slowly shifting towards Proof of Stake, miners have increasingly inclined to shift towards Proof of Work blockchains, making BCH an ideal candidate.

BTC is undoubtedly the crypto-king, but the time required to mine a block on BTC is too high, and larger numbers of miners have further made their operations more competitive. BCH currently ranks at 29th position with a market capitalization of $2.5 billion, with close to 91% of its entire supply already in circulation in the market. Hence, the prospect of higher block rewards and increasing value of the BCH token couldn’t be a far-fetched story.

BCH has brought back its days of a positive outlook. The technical outlook shows a sudden rise in buying activity; could this be a result of shifting to mining-based blockchains? Click here to know about it.

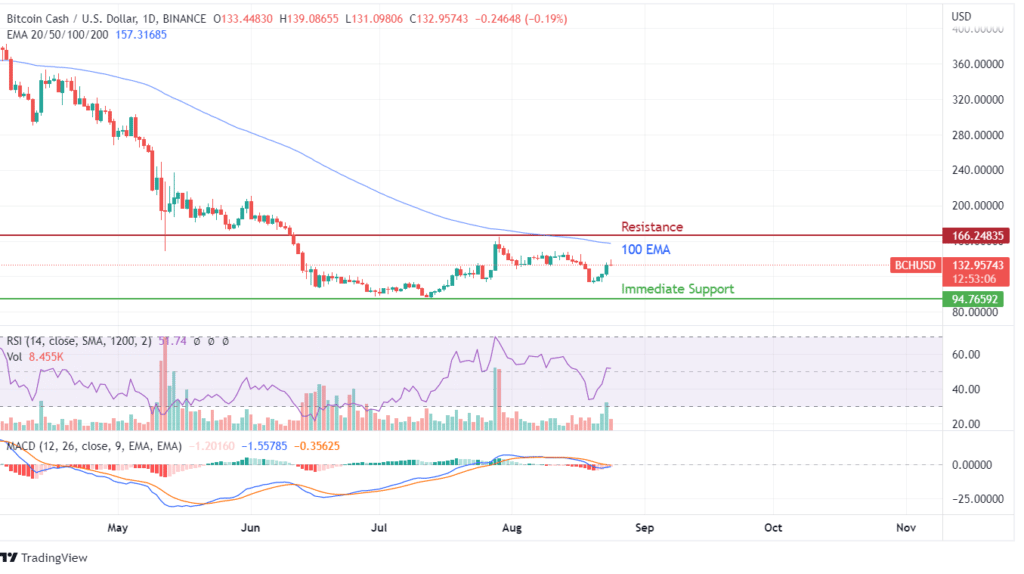

Bitcoin Cash’s price action is similar to Bitcoin, with the only difference of BTC copying BCH’s price action. Short term outlook for the BCH token has showcased a small potential to continue moving towards the 100 EMA curve and mark the positive breakout as a pivot point. The historical price action-based resistance is active at the $166 level, which remains quite lower than its historical highs of $1542 reached in May 2021.

The Bitcoin Cash’s probability of retesting this high remains out of grasp considering current developments of Bitcoin Cash, but the outlook is slightly positive. RSI indicator has jumped from near oversold zones to above 45, indicating higher buying action, while the MACD indicator is on track to create a bullish crossover and confirm the positive outlook.

Weekly charts of Bitcoin Cash showcase a neutral stance considering the last week’s red candle, but the formation of two back-to-back green candles strengthens its outlook. On the other hand, the monthly chart is still in a negative outlook as week-on-week price action has failed to continue with a positive stance or hit higher highs.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur