Bitcoin fluctuates as Federal Reserve raises key interest rate by 75 basis points

The US Federal Reserve has raised the US federal funds rate to 2.5%, an increase of 75 basis points.

Wednesday’s decision was largely expected, with the market pricing in a rise of 75 basis points ahead of time. The move is intended to fight inflation, which hit a 40-year high of 9.1% in June. Investors had placed a one-in-four chance of a 100 basis points prior to this; however, this was priced out earlier in the week.

Today’s increase takes the Fed’s rates to the level that policymakers previously have said represents the neutral rate — the rate which supports maximum employment in the economy, while keeping inflation constant.

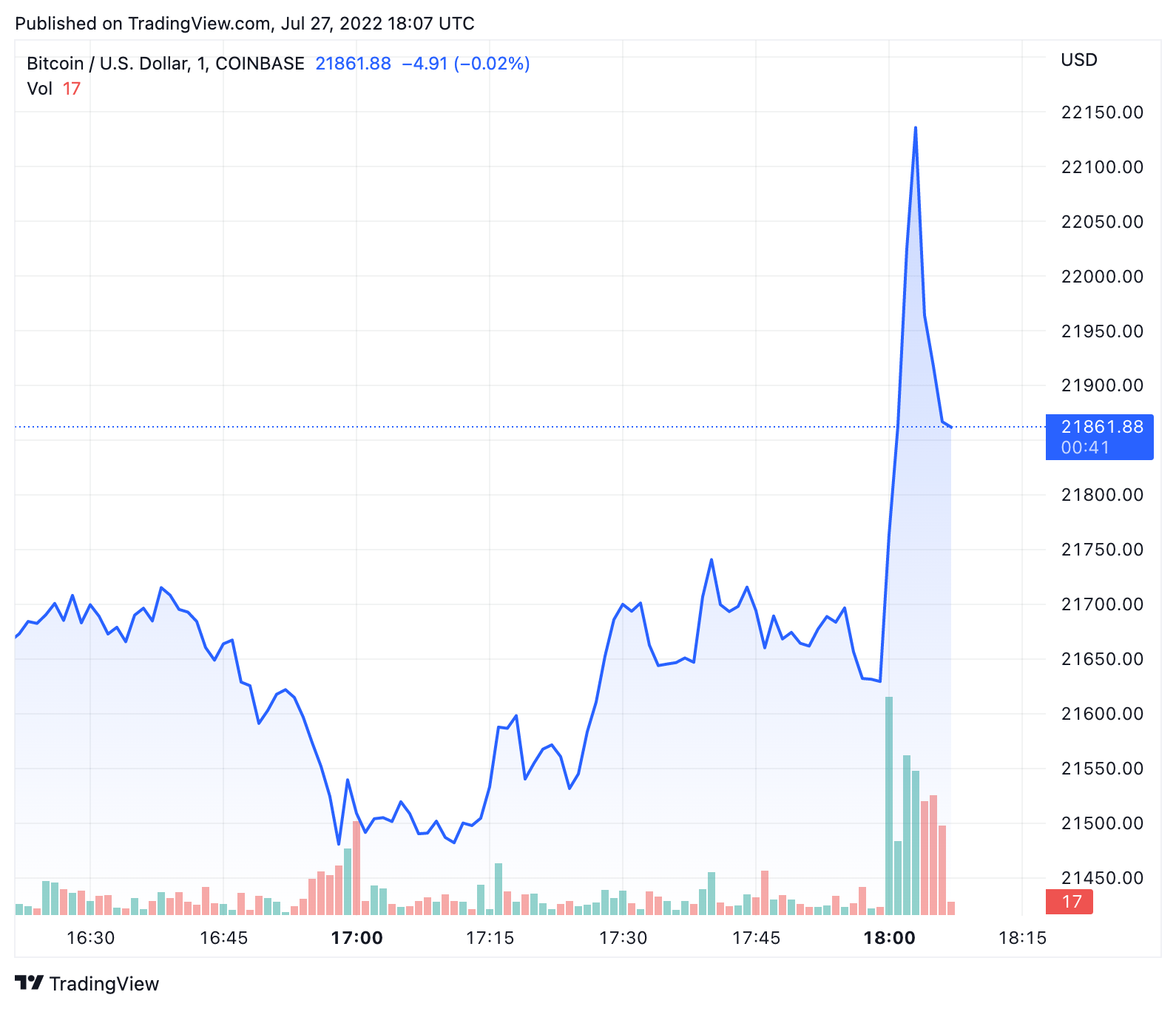

The price of bitcoin jumped up 3.31% on the news, having traded close to $21,500 prior to the announcement. At the time of writing, bitcoin is trading hands at about $22,000 according to CoinGecko.

Commentators consensus

Wall Street firms were predicting an 89% chance of a 75 basis point increase, while most commentators shared similar views.

Barclays bank predicted this hike following June’s CPI report . The investment bank said at the time, with “inflation surpassing expectations on the heels of the strong June employment report, we now expect the FOMC to hike the target range for the funds rate by 75 basis points at its upcoming meeting on July 26-27.”

The bank expects another aggressive rate hike in September, with the terminal rate hitting 3.25-3.5% by the end of the year.

Michael Brown, head of market intelligence at London based FX firm Caxton, echoed this sentiment, telling The Block today that he expects a move above neutral in September. This would take policy into restrictive territory, Brown said.

Brown noted that the impact on crypto is unlikely to be positive, given that in a rising rate environment, with equities struggling, it’s unlikely that crypto will be able to shrug off monetary policy developments. «As the cost of capital increases, leveraged positions, favored by crypto traders, become significantly less attractive,” he added.

Speaking to The Block ahead of time, Sam Kazemian, founder of the algorithmic stablecoin Frax, shared a similar view. Kazemian said the expected hike will further depress volatile asset prices, leading to fewer stablecoins in liquidity pools or lending protocols.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur