Bitcoin Slips Below $20,000 After Fed Chair’s Comments in Jackson Hole

Bitcoin (BTC) continued its bearish action on Friday night and slipped below the key $20,000 mark to $19,907, according to CoinMarketCap. It’s a monthly low for August and the first time Bitcoin went below $20k since July 14.

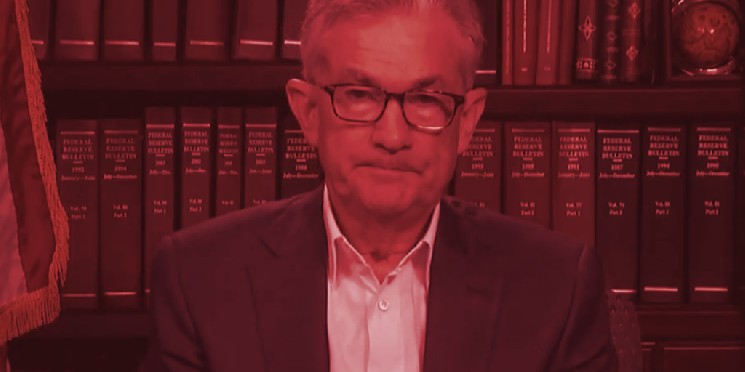

The top cryptocurrency has been in free fall since Federal Reserve Chair Jerome Powell’s remarks in Jackson Hole about raising interest rates further to control raging inflation.

The market capitalization of Bitcoin has tumbled from $1.27 trillion in November 2021 to under $383 billion today. Bitcoin is now down 6.4% in the past week.

Ethereum (ETH), the second largest cryptocurrency by market cap, has fared even worse in the past 24 hours, down 10% to $1,468 at the time of writing.

With its market capitalization under $180 billion, ETH is lost nearly 69% of its value from its all-time high of $4891.70, recorded in November 2021, suggests data from CoinMarketCap.

Amid the bearish price action, over $250 million from 87,144 traders have been liquidated in the crypto market over the past 24 hours, according to data from Coinglass.

Ethereum leads liquidations with $108.60 million, followed by Bitcoin with $65 million over the same period. Most liquidations for the two leading cryptocurrencies came from blown-out long positions.

Other cryptocurrencies, including Binance Coin (BSC, down 2.91%), Solana (SOL, down 6.34%), and Avalanche (AVAX, down 8.06%), have also posted bad losses over the past 24 hours, according to CoinMarketCap.

Bitcoin and Ethereum react to Fed Chair’s remarks

The market’s bearish action is linked to Fed Reserve Chair Jerome Powell’s latest remarks at the Fed’s annual economic conference.

Following his remarks, both stock and crypto markets reacted brutally; the Dow, Nasdaq, and S&P 500 each closed down more than 3% on Friday. A 75-basis point hike is expected when the Fed meets next month, according to Insider.

Digital asset fund volumes were also on the slower side last week, as per the Coinshares report.

As per data from DefiLlama, the total value locked (TVL) across all blockchains is down over 5.45% in the past 24 hours, indicating reduced user interest in DeFi.

Popular DeFi platforms like Lido, DAI’s creator MakerDAO, Curve, Uniswap and Compound have seen all their TVL slip by double digits over the past month.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur