Bitcoin’s overall sentiment is decidedly negative

Indicators and Google searches indicate that general Bitcoin sentiment is very pessimistic.

Summary

- Bitcoin’s sentiment trend is still negative

- The relationship between sentiment and asset price

Bitcoin’s sentiment trend is still negative

As is shown by a tweet from Jameson Loop, a big Bitcoin supporter and co-founder of Casa, most Google suggestions redirect to negative searches:

Bitcoin is. pic.twitter.com/dJoXCPz7ko

— Jameson Lopp (@lopp) September 18, 2022

The first is “Bitcoin is dead“. As of 18 June, this search term had reached an ATH of 100/100, according to Google Trends.

Not surprisingly, it perfectly coincided with the end of the first major bearish phase, when BTC had retested $19,000 support for the first time since December 2020.

In fact, there is an indicator on the 99bitcoins portal that reports the number of Bitcoin deaths over the time period in question.

A “Bitcoin Obituary” is defined as any content that explicitly expresses the end of Bitcoin, describing it, for example, as useless or worthless.

To date, Bitcoin has died 461 times. The last one was on 3 July 2022 and was recorded by the following tweet:

There will come a day when you wish you sold #Bitcoin for $20,000!

Take a look at the historic chart to see how far of a fall is possible, if you are interested in risks associated with an unraveling Ponzi scheme.

— Peter ⚒ Spina | Greek mode | Gold & Silver Maxim. (@goldseek) July 3, 2022

The phrase that made this statement qualify as an obituary was:

“Bitcoin is an Unraveling Ponzi Scheme”.

It is no coincidence that this research is back in fashion, just now that the value of BTC has broken a new support, pushing below $18,500.

This could be technical confirmation of a bearish pattern, which could drag Bitcoin toward $10,000, a level hailed by many analysts.

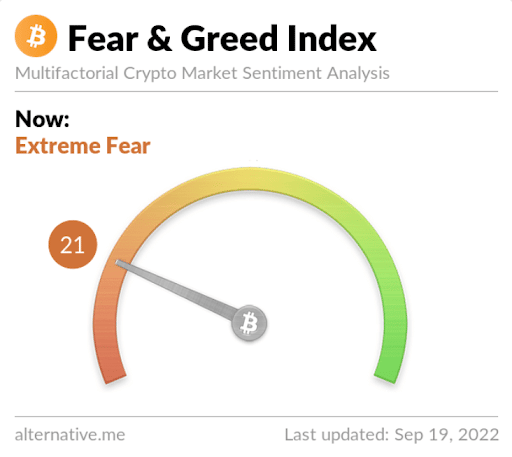

Another important factor that adequately summarizes Bitcoin’s market sentiment is the well-known Fear & Greed Index.

Currently, it stands at 21, which indicates Extreme Fear on the part of investors.

Level reported by the Fear & Greed index

This situation occurs precisely in persistent bearish phases, or following a series of negative events.

The relationship between sentiment and asset price

Unfortunately, people’s views are closely influenced by asset prices. If these fall, then it results almost instantly in a loss of investor confidence.

In this case, however, in the same way that one assesses the future potential of a company, one should analyze the underlying technology and the capabilities of the ecosystem to meet a given need in the market.

This will provide a more or less adequate estimate of the intrinsic value of the asset under consideration, lending some additional level of rationality to investment decisions.

Most people do not do this and allow themselves to be guided by the strong emotions of the moment, such as the famous FOMO (Fear Of Missing Out), fear, greed, or simply uncontrolled general hype.

This explains why almost all retail investors buy when the price is high, and sell when the price is low.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur