BTC Technical Analysis: Will Bitcoin Tank Under $20,000 This Week?

The BTC price action shows a relief rally over the weekend, but the lack of bullish momentum threatens a downtrend breaking under $20,000.

Key Technical Points:

- The Bitcoin (BTC) market price dropped by 12% last week.

- The 3% bullish recovery over the weekend retests the bearish breakout of $21,875.

- With a market cap of $410 billion, the intraday trading volume of Bitcoin has decreased by 10% to reach $22.94 billion.

Past Performance of BTC

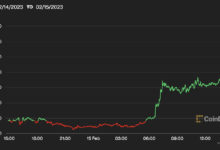

The Bitcoin (BTC) price action shows a bullish failure to rise above the $25,335 level and the 100-day EMA due to the increased supply pressure. The correction phase breaks below the 50-day EMA and the long-coming support trendline, accounting for a 12% price drop last week. Moreover, the Bitcoin market price tanks below the $25,000 mark and retests it over the weekend with a 3% recovery with minimal intraday trading volume.

Source — Tradingview

BTC Technical Analysis

The BTC prices may shortly restart the bearish trend with a boom in trend momentum as a post-retest reversal rally. Moreover, the upcoming trend may test the crucial bottom support at the $18,847 mark resulting in a drop below the psychological mark of $20,000. As the market price falls below the 50-day EMA, the possibility of a bullish crossover between the 50 and 100-day EMA nullifies. The RSI indicator displays an extraordinary rise in the underlying bearishness as the RSI slope falls to the oversold boundary. Moreover, as the negative histograms intensify, the MACD indicator signals a selling opportunity with the increasing bearish gap between the fast and slow lines. Hence the technical indicators maintain a bearish bias for the upcoming trend. In brief, the BTC technical analysis projects a high likelihood of a downtrend crossing under the psychological mark of $20,000.

Upcoming Trend

BTC prices can reach the bottom of $18,875 if the buyers fail to assert dominance at the crucial support level of $20,000. However, the bullish reversal crossing above $21,875 can retest the 50-day EMA at $23,000. Resistance Levels: $21,875 and $23,000 Support Levels: $20,000 and $18,847

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur