Cardano Might See Investment Inflows Following Issues with Ethereum: Crypto Market Review, September 16

Despite the successful Ethereum Merge, most altcoins, even those that benefited from the update, are moving into the red zone. Ethereum Classic, which gained more than 200% to its value ahead of the Merge, is not showing anything exceptional in the last few days as the asset’s value plunged by more than 12%.

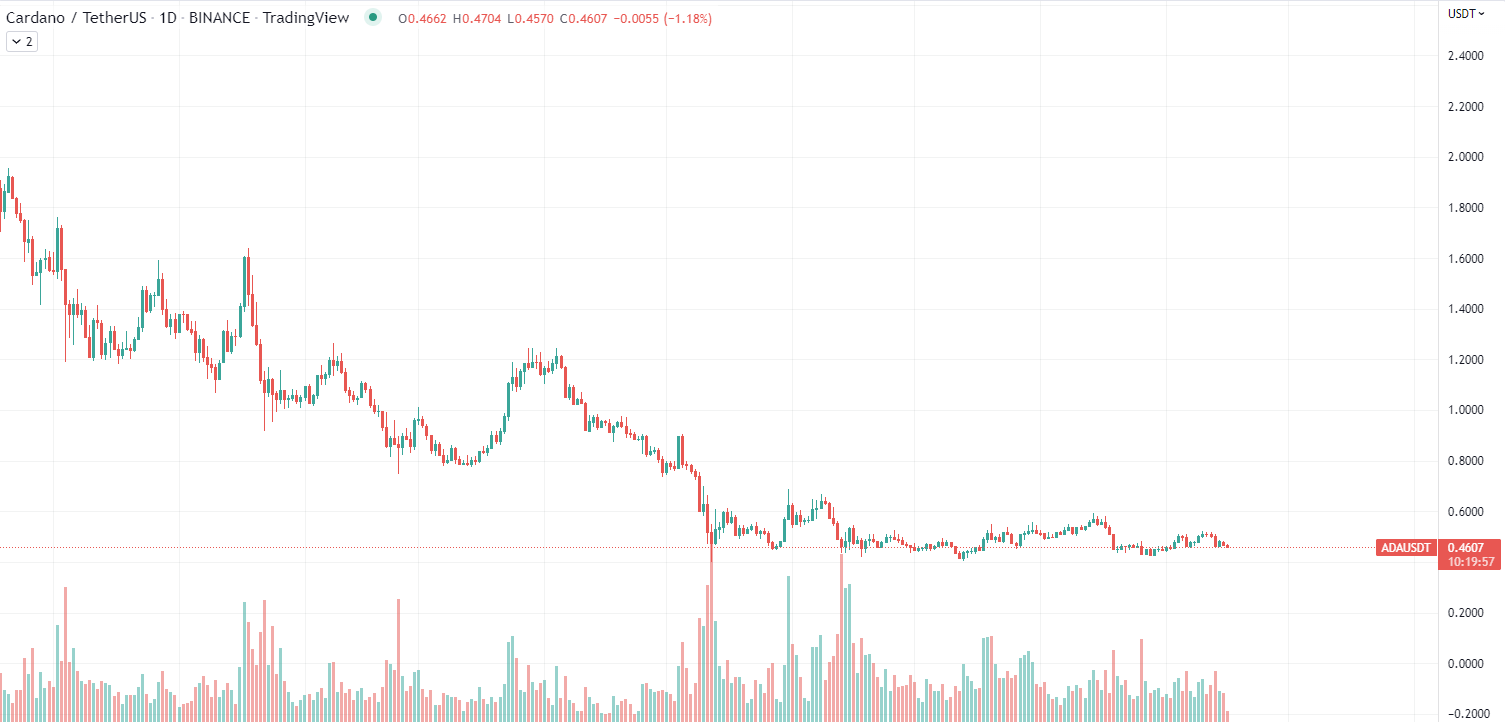

Cardano also remained anemic with less than 5% of the average daily volatility and fading trading volume. Despite being one of the alternatives to Ethereum in terms of network usage and purpose, investors do not seem to be interested in Hoskinson’s blockchain which, in fact, provides numerous advantages to developers and users.

Luckily, there is a hidden growth factor for Cardano, which is a potential regulatory clampdown on Ethereum that would cause an outflow of funds from the second biggest network on the market toward certain alternatives, one of which is Cardano.

Ethereum follows «sell the news» rule

With the successful Merge update, the selling pressure on the Ethereum market was close to being nonexistent, as no major issues were noticed during the transition. However, we saw a rapid increase in negative trading a few hours after the PoW went down.

In only a few hours, Ethereum lost almost 10% of its value, making Merge a negative event for investors in thr short-term perspective. In the meantime, it is safe to say that the reaction of the second biggest cryptocurrency on the market has nothing to do with the fundamental update itself.

In the last few weeks, Ethereum beat the majority of the cryptocurrency market by more than 50% in terms of price performance, and the Merge is probably the main reason for it. Ethereum-unrelated factors mostly caused the correction we are seeing today, like negative sentiment among investors and the overall depression on the digital assets market.

Bitcoin or Ethereum?

With the Merge update, Ethereum has differentiated itself maximally from Bitcoin, which is why we are going to see a great experiment in the next few years that will determine which network will prove to be more decentralized and sufficient, even though they have two completely different purposes.

Bitcoin cannot be used for building decentralized applications, NFT collections and other solutions that will increase its usage. The scalability of the network is also a big issue. That is why the most popular and only usage for BTC is payments. With relatively low fees, users are able to transact almost any volume overseas and avoid usage of third parties.

The PoW mechanism is often considered the one and only way to provide real value to digital assets as they acquire a certain cost basis and should not drop below it. Unfortunately, this thesis was debunked numerous times when the price of the first cryptocurrency plunged below the 1 BTC mining cost level.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur