Chainlink Faces Rejection Twice at the $8.20 Overhead Resistance

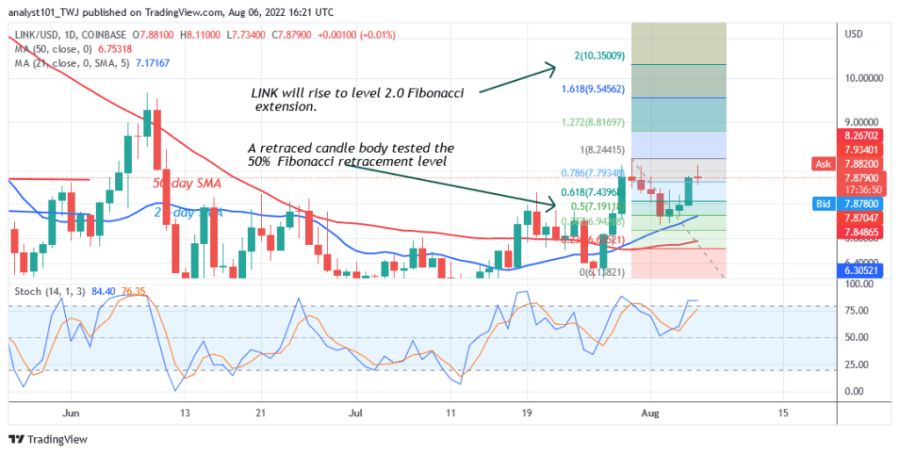

Chainlink (LINK) is in an uptrend as the price is above the moving average lines. The uptrend has been resisted since July 30 at the $8.20 high.

The current resistance level is the historical price level of May 16. Bulls have been unable to sustain upward momentum above the $8.20 high as Chainlink trades in the overbought area of the market.

During the uptrend on July 30, the cryptocurrency dipped above the moving average lines as bulls bought the dips. Today, buyers are struggling to break through the same resistance level. The price of LINK will continue to rise to a high of $10 if the bulls break the recent high. The altcoin will be forced to move between $6.00 and $8.20 if it is rejected at the recent high.

Chainlink indicator reading

Chainlink is at level 60 of the Relative Strength Index for period 14. The cryptocurrency is in the uptrend zone and is capable of further upward movement. The price bars are above the moving average lines, which indicates further upward movement. The altcoin is above the 80% area of the daily stochastic. LINK has reached the overbought zone. The 21-day line SMA and the 50-day line SMA are up, indicating an uptrend.

Technical Indicators:

Key Resistance Zones: $10, $12, $14

Key Support Zones: $9, $7, $5

What is the next move for Chainlink?

Chainlink has been trading in the uptrend zone since July 19. Currently, the uptrend has stalled at the $8.20 resistance zone. On July 29, the uptrend tested the 50% Fibonacci retracement level with a retreating candlestick. The retracement suggests that LINK will rise to the 2.0 Fibonacci extension level, or $13.19.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coin Idol. Readers should do their own research before investing funds.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur