ChainLink price analysis: LINK starts down a negative path at $7.6

ChainLink price analysis for August 1, 2022, reveals the market following a partial bearish movement, obtaining some positive momentum, signifying a gain of positivity for the LINK market. The price of ChainLink has remained negative over the past few hours. On July 31, 2022, the price crashed from $8 to $7.5. However, the market started to increase in value soon after and regained most of its value. Moreover, ChainLink has peaked and reached $7.6, just shying away from the $8 mark.

The current price of ChainLink is $7.6, with a trading volume of $476,692,576. Chainlink has been down 1.40% in the last 24 hours. ChainLink currently ranks at #23 with a live market cap of $3,613,991,413.

Contents hide

1 Token Summary

2 LINK/USD 4-hour price analysis: Latest developments

3 ChainLink price analysis for 1-day

4 ChainLink Price Analysis Conclusion

Token Summary

LINK/USD 4-hour price analysis: Latest developments

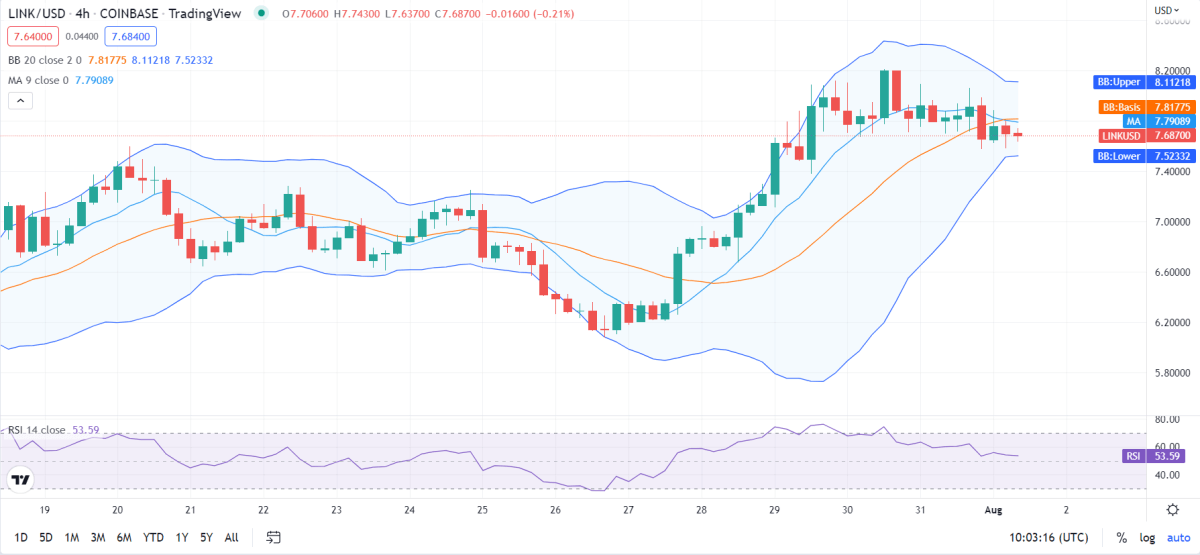

ChainLink price analysis reveals the market’s volatility following a closing movement. This means that the price of ChainLink is becoming less prone to the movement towards either extreme, showing consistent dynamics. The Bollinger’s band’s upper limit is $8.1, which is the strongest resistance for LINK. Conversely, the lower limit of Bollinger’s band is $7.5, which is the most substantial support for LINK.

The LINK/USD price appears to be moving under the price of the Moving Average, signifying a bearish movement. The market’s trend seems to be dominated by bears. The LINK/USD price appears to be moving downwards, illustrating a decreasing market. The market appears to be showing bearish potential. the price moves towards the support attempting to break it, which might cause a reversal movement; the bulls might still have a chance yet.

LINK/USD 4-hour price chart Source: TradingView

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 53, showing a stable cryptocurrency stock. This means that the cryptocurrency falls into the central neutral region. Furthermore, the RSI appears to move downwards, indicating a decreasing market. The dominance of selling activity causes the RSI score to decrease.

ChainLink price analysis for 1-day

ChainLink price analysis reveals the market’s volatility following an increasing movement, which means that the price of ChainLink is becoming more prone to experience variable change on either extreme. The Bollinger’s band’s upper limit is $7.9, serving as LINK’s strongest resistance. Conversely, the lower limit of Bollinger’s band is at $5.8, which is the most substantial support for LINK.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to have shown bullish dynamics in the last few days. The price started moving downward, and the market started opening its volatility. This change can play a crucial role in the development of ChainLink. However, the bulls have managed to maintain their trend.

LINK/USD 1-day price chart Source: TradingView

Chainlink price analysis shows the Relative Strength Index (RSI) to be 60, signifying a stable cryptocurrency. This means that the cryptocurrency above is in the upper neutral region. Furthermore, the RSI path seems to have shifted to a linear movement. The constant RSI score also means equivalent buying and selling activities.

ChainLink Price Analysis Conclusion

Chainlink price analysis reveals the cryptocurrency follows an uncertain trend with much room for activity on either extreme. Moreover, the market’s current condition appears to be following a slightly negative approach, as it shows the potential to move to the devaluation extreme.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Maker

Maker  Hedera

Hedera  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur