Crypto stable following sell-off, while crypto stocks sink lower

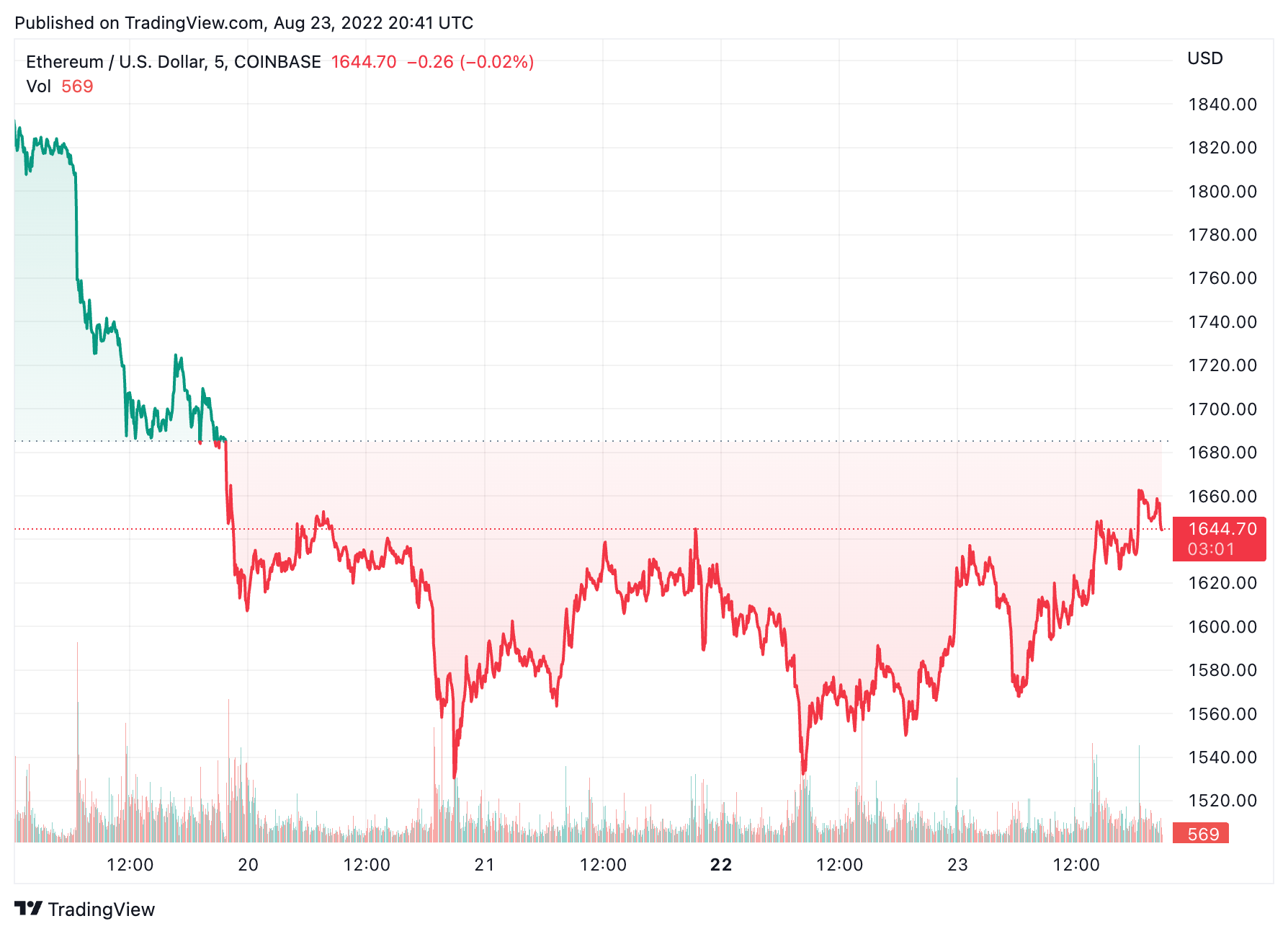

Crypto markets showed signs of recovering at the top of the week following a sharp sell-off last Friday.

As has been the theme of the month so far, ether was the big winner on Tuesday as it gained more than 4.2% over the past 24 hours trading at $1,644. Meanwhile bitcoin was up 1.9% trading at $21,541, according to CoinGecko.

Elsewhere, EOS – which jumped over 17% following court ruling on the Block.one settlement last week – has maintained its momentum despite the sell-off, now up 40.1% over the past week, trading hands for $1.79.

Here’s what commentators and key players have suggested as a reason for last week’s sell-off.

Marco outlook and liquidations blamed for crash

The global crypto market cap briefly dipped below $1 trillion on Tuesday before recovering to $1.08 trillion – a gain of about 2.5% over the past 24 hours. The market cap first flirted with the $1 trillion mark on Saturday following a dramatic drop in digital asset prices.

21Shares suggested a raft of long-liquidations may have caused the downtrend in the crypto market, the asset manager wrote on Tuesday:

“According to data gathered by Coinglass, over 157K traders got liquidated on Friday, resulting in total liquidations of over $600M [million]; bitcoin traders lost over $239M, while Ethereum lost over $224M. With around $562M worth of long positions and $79M in shorts, this marks the biggest liquidation of long positions on futures since June 13, a few days before bitcoin’s price fell below $20K.”

Meanwhile other market commentators have attributed the plunge in prices on Friday to a widespread risk aversion in the market.

BlockFi wrote in its weekly market report on Monday that the meeting of Federal Reserve officials in Jackson Hole on Friday would be the “key event for the week,” as traders watch out for Fed signposting on future rate hikes – which have moved crypto markets throughout the summer.

LedgerPrime shared similar sentiments in its weekly market update on Tuesday, noting that investors “seem worried about further aggressive interest rates and a slowing economic backdrop, driving them to sell assets seen as risky such as tech or crypto, and buy the US dollar.”

The crypto investment firm went on to say, “as trader’s appetite for risk assets continues to collapse across the board, the US dollar seems to gain speed, setting track for its highest week in value in over 20 years.”

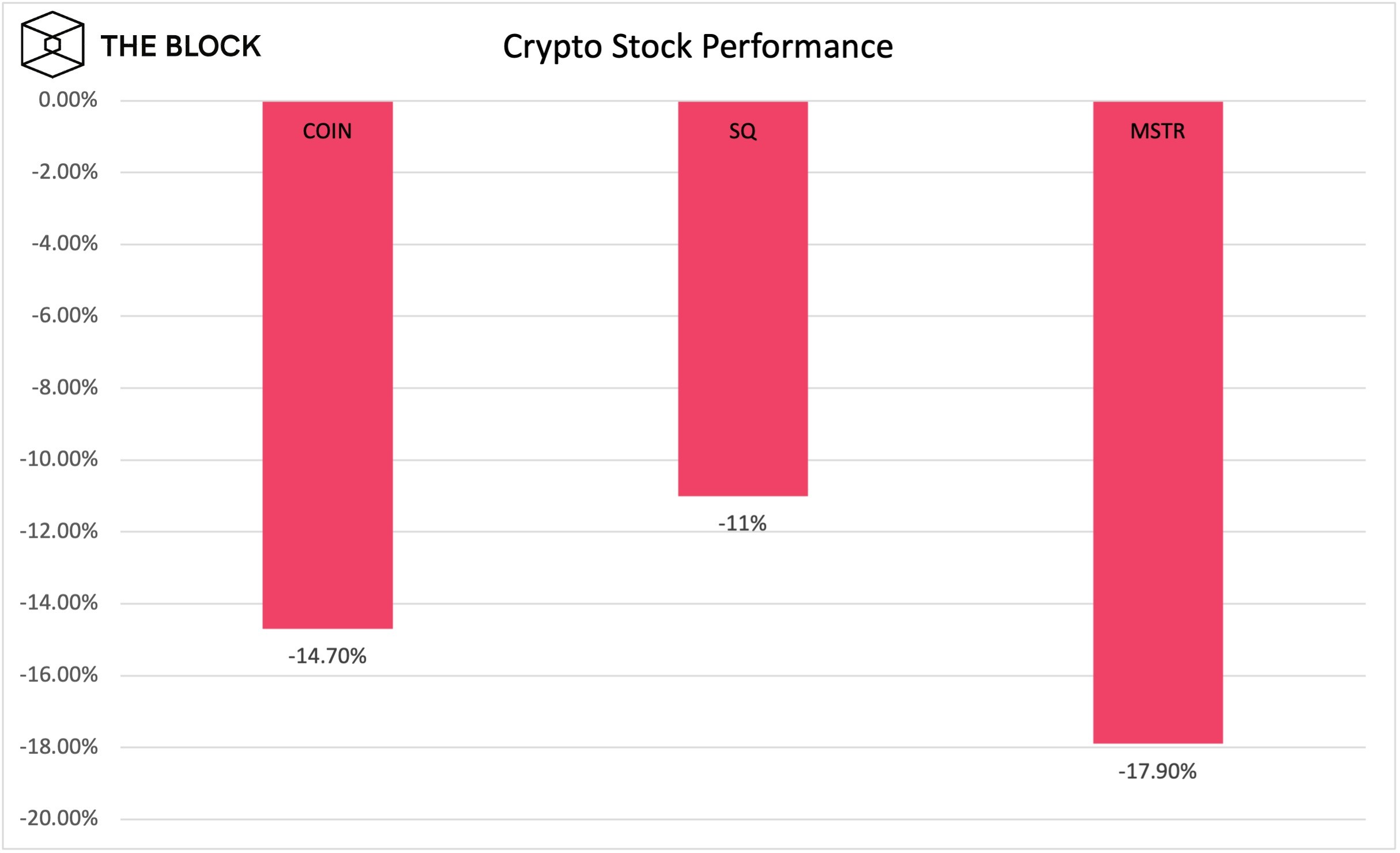

Double trouble for crypto stocks

Crypto-related stocks – those with exposure to cryptocurrencies on their balance sheet or with business models closely linked to blockchain technology – have suffered twofold over the past five days.

Digital assets and equites have both seen a large sell-off since August 18, with the S&P 500 and the Nasdaq 100 down 3.76% and 4.65% in that time. Coinbase, MicroStrategy and Block all closed on Tuesday.

Since the close on August 18, Coinbase lost 14.7%, while Jack Dorsey’s Block lost 11% and MicroStrategy shed almost 18%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur