DEXs Only Share 1% of Market Open Interest Orders, Argues Analyst

A DeFi analyst on Twitter argued that the trendy comparison between two of the most significant decentralized crypto exchanges (DEXs), dYdX and GMX, was out of place.

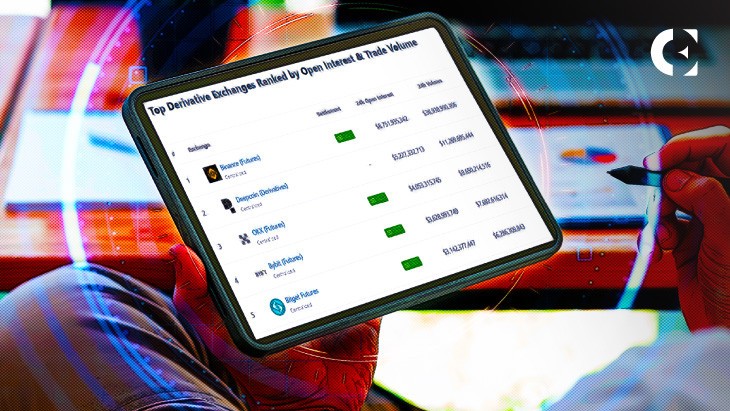

The analyst brought data from the market tracking website, CoinGecko, to illustrate that DEXs only share approximately 1% of the market Open Interest (OI) orders and volumes compared to centralized exchanges (CEXs).

This talk of $dYdX vs. $gmx vs. $gns vs. pick-ur-GMX-fork misses just how small decentralized perps exchanges are compared to CEXes.

At ~1% share of OI and volumes, there’s plenty of room for growth for multiples players. pic.twitter.com/Gf07PzX8rK

— DeFi Surfer (@DeFiSurfer808) February 6, 2023

A few weeks back, a crypto enthusiast posted the market chart of dYdX and GMX side-by-side, comparing the prices. Given that dYdX’s share was worth below $2 and GMX’s share sold over $46, the Twitter user added a negative comment that the DyDx foundation had robbed its users of money to pay venture capitalists. In contrast, GMX makes them enjoy the feeling of shareholders.

$DYDX vs $GMX, Community vs VC. another example show us the differences. @dydxfoundation @GMX_IO. $DYDX rob our money to the VC’s pocket; $GMX make us enjoy the feeling of shareholders! pic.twitter.com/nPL1hN5x1o

— 博士山说币 Boxhill Crypto (@boxhillcoin) January 12, 2023

According to CoinGecko, Binance’s 24-hour OI orders were over $8.6 billion, while derivative volumes were about $38 billion. On the other hand, dYdX had only $314 million OI and $813 million perpetual. Interestingly, the cumulative OI of the top three DEXs was not up to one billion.

Contextually, Open Interest refers to the total number of outstanding derivative contracts, such as options or futures awaiting settlement. An increase in open interest implies new or additional money into the market, while a decrease in OI indicates money flowing out of the market.

CoinGecko tracks 64 crypto derivative exchanges, with Binance Futures, Deepcoin Derivatives, and OKX Futures in the top 3 rankings. The market tracker also hinted that the total derivatives volume was $141 Billion, with a 24.57% change in the last 24 hours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  EOS

EOS  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur