Ethereum Classic (ETC) Retraces After 165% Increase in Two Weeks

Ethereum Classic (ETC) likely initiated a bullish trend reversal on June 18. However, it has been falling since July 29, potentially retracing in response to the entire preceding upward movement.

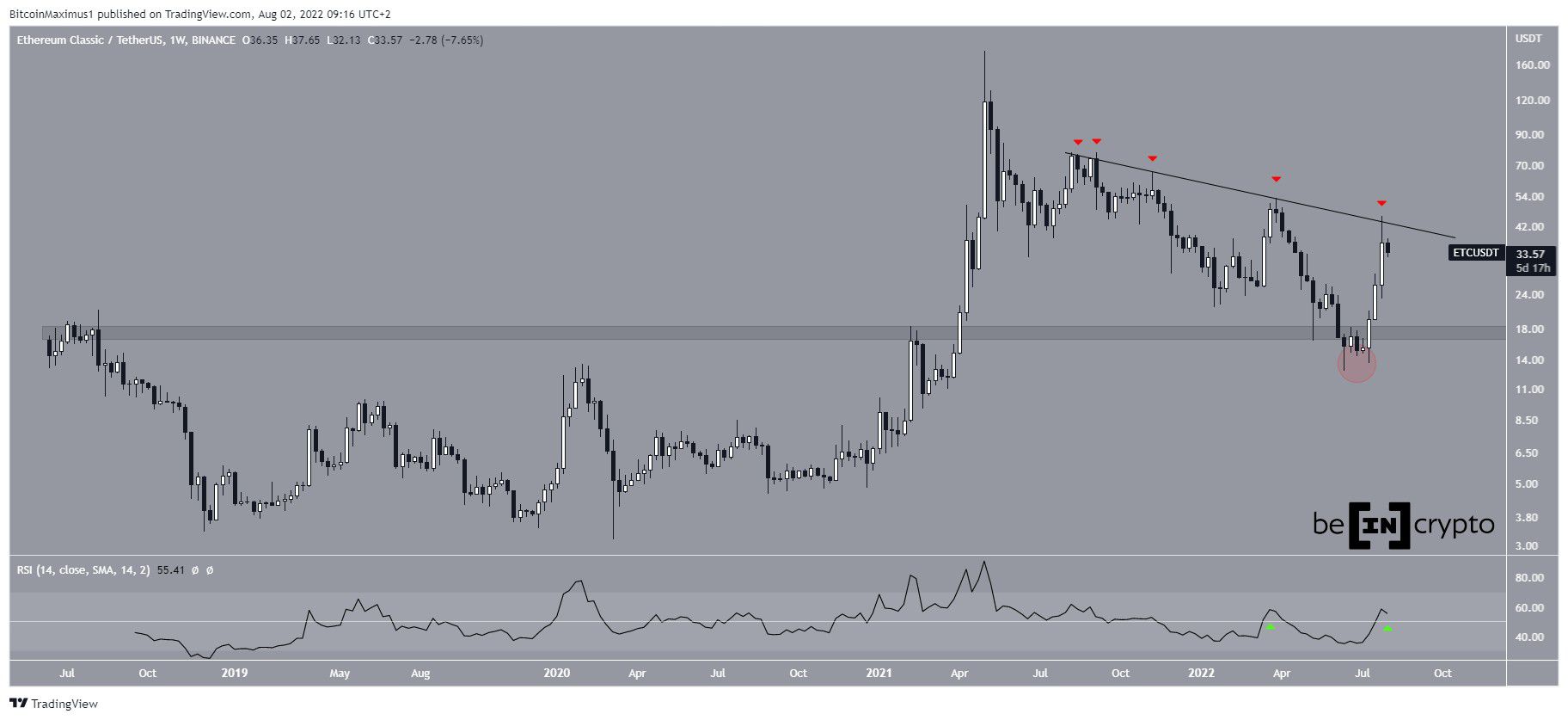

ETC has been falling since reaching an all-time high price of $179.83 in May 2021. The downward movement has so far led to a low of $12.47 in June.

The downward movement seemed to cause a breakdown from the $17 horizontal area. This is a crucial area since it had acted as resistance throughout 2018-2021. However, ETC bounced shortly afterwards and reclaimed the area, rendering the previous breakdown as only a deviation (red circle).

The upward movement took the price to a descending resistance line that has been in place since Aug. There, it made its fifth breakout attempt (red icons). Since lines get weaker each time they are touched, an eventual breakout from this line is likely.

Furthermore, the weekly RSI has moved above 50 (green icon). It remains to be seen if the indicator manages to hold on above this line or falls below it, similar to what occurred in April. If it manages to hold on above 50 and the price breaks out from the resistance line, it would confirm that a long-term bullish reversal is in place.

ETC/USDT Chart By TradingView

Ongoing upward movement

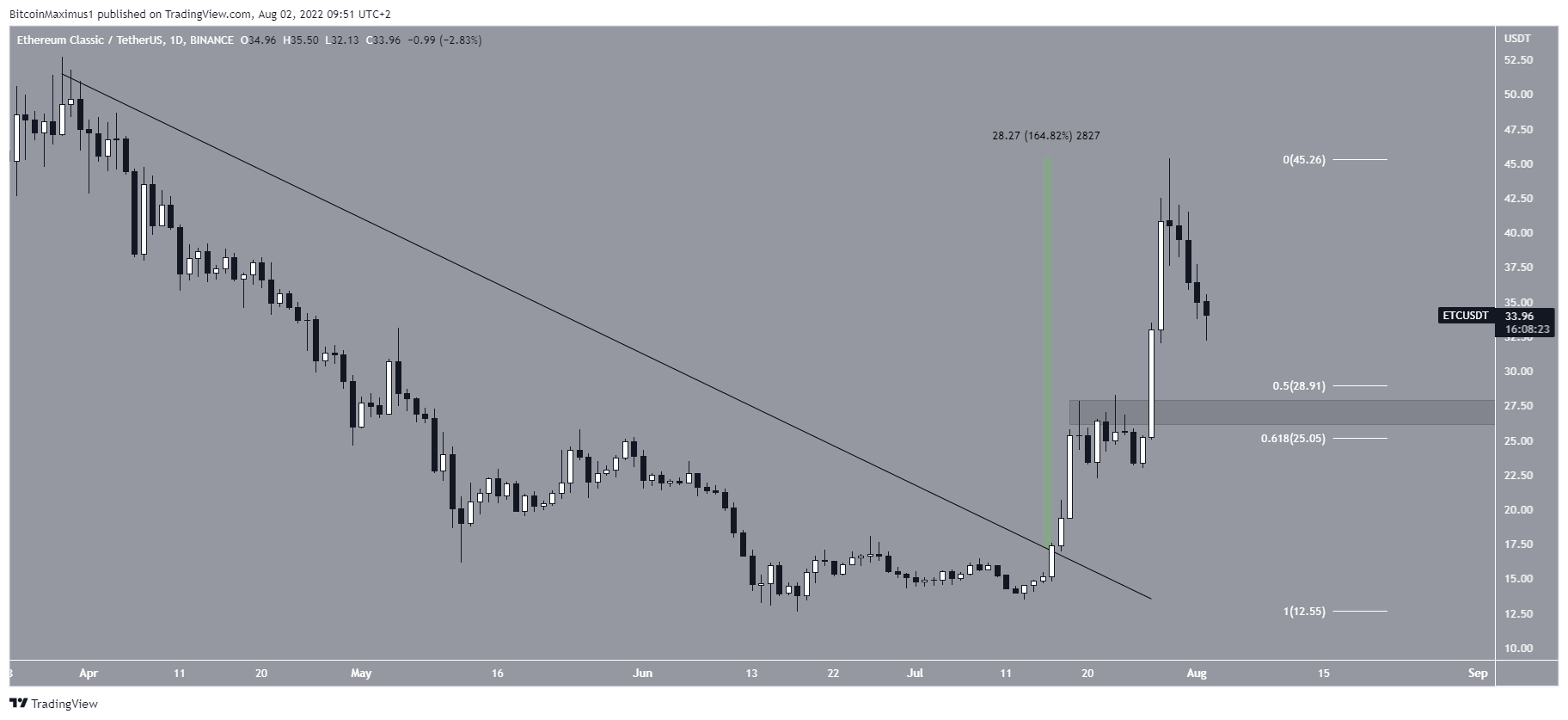

The daily chart shows that ETC broke out from a shorter-term descending resistance line on July 15. Afterward, it proceeded to increase by 165% in a period of 14 days. This led to a high of $45.36 on July 29.

However, the price has been decreasing since. It is currently approaching the 0.5-0.618 Fib retracement support area between $25 and $29. This also coincides with a horizontal area that previously acted as support. So, it is likely that the price bounces once it gets there.

Furthermore, the daily RSI has moved above 50, a sign that is associated with bullish trends.

ETC/USDT Chart By TradingView

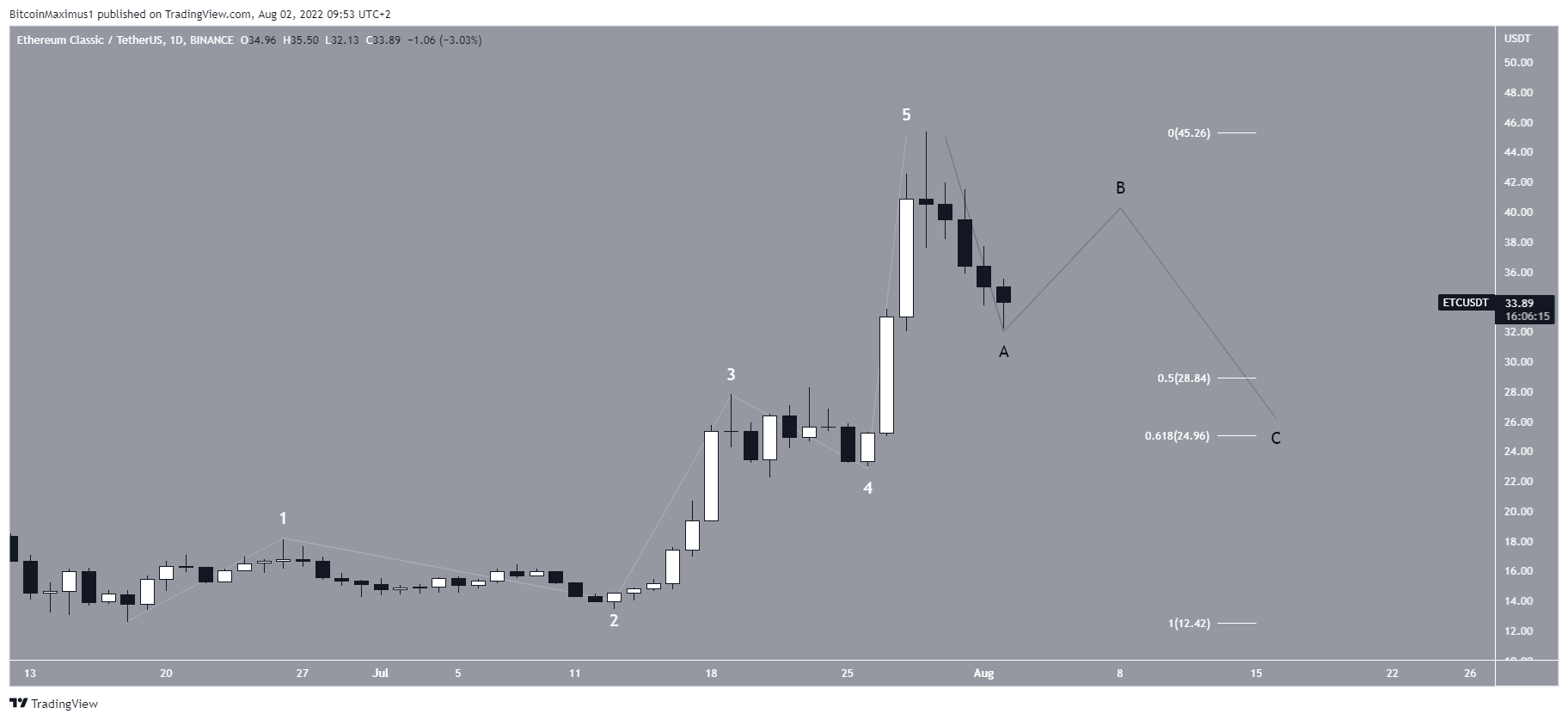

ETC wave count analysis

Cryptocurrency trader @Altstreetbet tweeted a chart of ETC, stating that it is the first large cap altcoin to begin a bullish count.

Source: Twitter

The most likely wave count suggests that since the June 18 low, ETC has completed a five-wave upward movement (white). Therefore, it has begun a new bullish trend.

The ongoing decrease is likely part of an A-B-C corrective structure (black). The most likely area for the correction to end would be between the 0.5-0.618 Fib retracement support levels at $25-$29.

ETC/USDT Chart By TradingView

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Zcash

Zcash  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur