First Mover Asia: Crypto Is Flat Before Fed Chair Speech; Japan’s SBI Building a Metamask Competitor for Yen-Denominated NFT Trading

Good morning. Here’s what’s happening:

Prices: What’s next for crypto prices? Traders are waiting for a speech by Fed chair Jay Powell before they make their next moves. In Japan, one digital assets company wants to build the market for NFT trading in Yen.

Insights: Digital asset financial services firm SBI is building a Metamask competitor for yen-denominated NFT trading. Could the initiative aid Japan’s Web 3 efforts?

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. And sign up for First Mover,our daily newsletter putting the latest moves in crypto markets in context.

Prices

CoinDesk Market Index (CMI)

1,076

−12.9 ▼ 1.2%

Bitcoin (BTC)

$22,807

−251.1 ▼ 1.1%

Ethereum (ETH)

$1,620

−19.3 ▼ 1.2%

S&P 500

4,111.08

−25.4 ▼ 0.6%

Gold

$1,883

+20.1 ▲ 1.1%

Nikkei 225

27,693.65

+184.2 ▲ 0.7%

BTC/ETH prices per CoinDesk Indices, as of 7 a.m. ET (11 a.m. UTC)

Crypto Traders are Waiting on a Signal from the Fed

Major digital assets are trading flat as the Asia business day begins, with bitcoin down 1% on-day to $22,829 and ether also off 1% to $1,622.

Singapore-based crypto trading fund QCP Capital said in a recent note that the performance of equities today and U.S. central bank Chair Jerome Powell’s speech will be its guide to the next leg in crypto.

“Without a recession and >4% unemployment this year, it is extremely unlikely the Fed will cut rates, which means our view that the market’s pricing of cuts this year is too dovish still holds,” the fund wrote.

QCP said its is looking to see Powell’s comments on whether he thinks the current market rally has “gotten out of hand.”

Despite talk of a recession, and frequent headlines mentioning layoffs, the last two job markets reports show that the U.S. labor market is still hot. December’s numbers show the U.S. added 223,000 jobs to payrolls, pushing the unemployment rate down to 3.5%, while recently released numbers from January show 517,000 jobs being added. Both numbers defied expectations.

“I think it’s still going to be very hard to get to 2%,” Edward Moya, senior market analyst with OANDA, recently said on CoinDesk TV. “The Fed acknowledged, for the first time in this cycle, they said that the disinflation process has begun.”

Moya highlighted the strong labor market in the U.S., and worldwide, as an obstacle to driving down inflation with increased wages supported by a fundamentally strong market.

“If we see further signs that some inflation abroad is becoming stickier than we thought, then there’s a risk of a decent sell-off across Wall Street that could drag down bitcoin,” he said.

Moya says he’s looking at Treasury Yields. There’s still a correlation between that and the price of bitcoin that remains intact – for now.

Biggest Gainers

There are no gainers in CoinDesk 20 today.

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Cardano | ADA | −4.3% | Smart Contract Platform |

| Gala | GALA | −4.2% | Entertainment |

| Solana | SOL | −4.0% | Smart Contract Platform |

Insights

SBI’s Metamask Competitor for Yen-Denominated NFT Trading

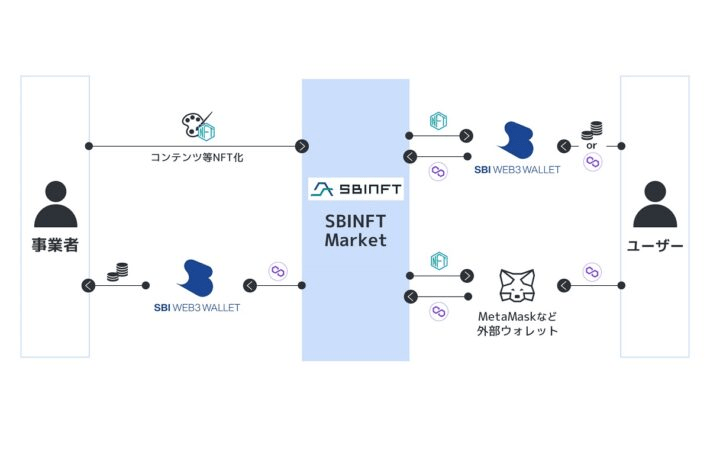

Japan’s SBI, a digital assets financial services firm, recently announced it’s launching a MetaMask-like wallet platform for non fungible tokens (NFTs) that’s only using the Japanese yen for trades on the SBINFT Market, CoinDesk Japan reports.

(Japan’s SBI)

Japan, with its world-renowned IP, and universally recognized styles of art, is an emerging hub for NFTs. But the majority of transactions are done in USD, not yen, which is something that SBI is looking to change.

In international trade dominated by fiat, the U.S. dollar, the world’s most liquid currency and the measure for most commodities’ pricing , ranks as the highest traded global currency with nearly 88% of global trade denominated in Greenbacks. This is predictable as the U.S. is the world’s largest economy and most of the globe’s trade has some sort of nexus to the country.

Crypto, however, is tied to no nation. There’s no centralized economy behind it. Yet at the same time, the majority of the world’s digital asset transactions are denominated in USD.

“Despite the shrinking US portion of the world’s GDP, the dollar increasingly dominates, notably in the digital ecosystem,” Bloomberg analyst Mike McGlone wrote in an April 2021 note. “There appears to be little to stop the most consistent trends in crypto assets: rising trading volume and the proliferation of stablecoins tracking the dollar.”

Case and point: data from CoinGecko shows that there’s only around $87 million in 24 hour volume for yen-denominated bitcoin trading pairs, and roughly $21.5 million for ether trading in yen. There have been a few attempts at developing a yen stablecoin, but they don’t seem to have gotten much traction.

But this comes as Japan fully embraces Web 3. As CoinDesk’s Emily Parker reported during a recent trip to the country, crypto there seems to exist in a near parallel universe. Post Mt. Gox rules have meant that FTX Japan assets are held in third-party custody; Lawmakers are working to propose a framework for DAOs and NFTs to the nation’s legislature, called the Diet.

The next step of this embrace will be more crypto trading in yen. SBI’s Web 3 wallet might be what instigates things.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  EOS

EOS  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur