Here Is Where Tether Might Be Holding Their Money

Following the unpleasant story with UST stablecoin developed by Luna, traders and investors around the world are worried about the safety of their funds in stablecoin solutions like Tether that took a significant hit with millions of outflows appearing momentarily.

Thanks to the most recent research, blockchain sleuths found an enormous quantity of real USD that matches Tether «shockingly well.» By funding Tether’s stash, we can determine who is behind the project.

There are two key U.S. banks that service the digital economy and connect cryptocurrencies with the fiat world, Silvergate and Signature. In the last two years, Signature saw massive inflows of funds with total deposits reaching $260 billion in the 2020-2022 date range.

The same story applies to Silvergate, which states in its own documents that it is active in the cryptocurrency space and does not have much of an activity in the retail sector, which means deposits to the bank should come from one source only.

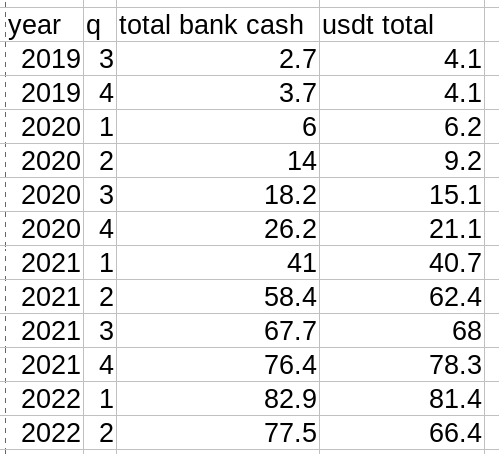

The most interesting part is the comparison between total deposits and the history of the market capitalization of Tether. In the provided table, the analyst notes that the stablecoin provided market capitalization matches one-to-one with the total deposits in the two banks combined.

Such a correlation cannot be accidental considering the variety of deposits other banks are having. The same number of deposits and Tether market cap could have been reached in one quarter or even a year, but 10 consecutive quarters is a pattern we cannot ignore.

The analyst notes that this fact does not mean that Tether is fully baked and secure to use, but it shows what the project is really about and what kind of banks are behind it.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Decred

Decred  Zcash

Zcash  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur