How Bitcoin NFTs Might Accidentally Fix Bitcoin’s Security Budget

Casey Rodarmor tweeted that “Inscriptions are finally ready for Bitcoin mainnet” on Jan. 20, and the use of inscriptions the last two weeks sparked a big hullabaloo on Twitter between some of Bitcoin’s partisan factions.

The hullabaloo included a number of different claims:

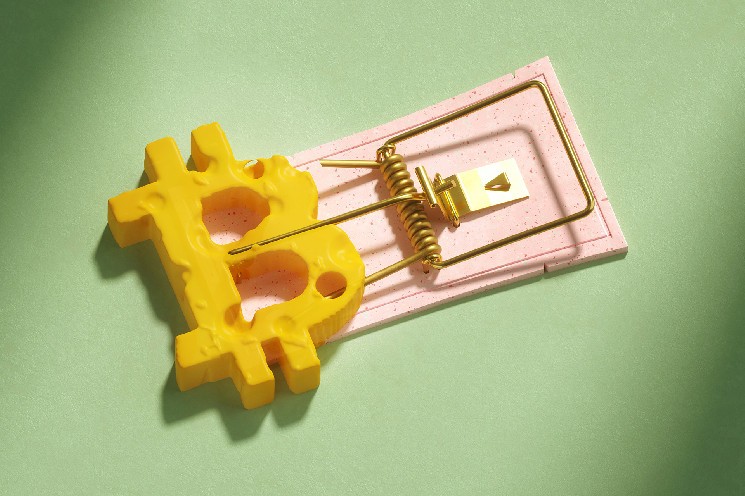

- That Bitcoin’s security budget problem was accidently solved. So we wouldn’t have to worry that there would be no financial incentive to mine bitcoin in the future once the fixed supply runs out. Maybe transaction fees will be enough to incentivize miners?

- Inscriptions would lead to blockchain spam and graffiti so uncontrollable that we are eventually engulfed by gray goo.

- All these non-fungible tokens (NFT) and such on Bitcoin is just another silly fad, like colored coins.

This article is excerpted from The Node, CoinDesk’s daily roundup of the most pivotal stories in blockchain and crypto news. You can subscribe to get the full newsletter here.

Rodarmor’s flint rock tweet referred to the Ordinal protocol, which introduced inscriptions to Bitcoin. The Ordinal protocol assigns each satoshi, or sat (the smallest unit of bitcoin), a sequential number. It’s a little bit more complicated than that, but only a little. Once these sats are numbered and identified, users can inscribe the sat with arbitrary data, as long as the transaction doesn’t exceed the 4-megabyte (MB) block size limit. That arbitrary data can be anything!

A fully playable version of the first-person shooter DOOM? Sure.

A picture of a Bored Ape cross-pollinated with a CryptoPunk? Fine.

A bald, sunglasses-donning Taproot Wizard re-creation of the famous MSPaint-spawned Magic Internet Money Wizard that once served as an advertisement for the /r/Bitcoin subreddit that takes up almost the entirety of a Bitcoin block? Sure. Fine. But why?

Why not?

If you’re thinking: “That sounds a lot like NFTs” you’re right. They do sound a lot like NFTs. Ordinal NFTs is a good term – and it’s the term I’ll stick with – but out of respect for the sensitivities of hardline bitcoiners and in the interest of being as technically correct as possible, these are probably better characterized as “artifacts.” To be sure, external links to arbitrary data have been shared in the data field of Bitcoin transactions many times. Inscriptions take it a step further so that the linked data actually exists on the blockchain.

Bitcoin NFTs: Initial reactions and potential consequences

For those lucky enough to be unfamiliar with the politics of Crypto Twitter, you should know this has stirred up a fiery controversy. There are many Bitcoin influencer types who have staked a meaningful part of their reputations on hating NFTs – as they’re a distraction and technologically unsound – so Ordinal NFTs haven’t been a hit with them. To their credit, no matter how much crypto pluralists have bashed Bitcoin for being a pet rock project that only does peer-to-peer, borderless, censorship-resistant transactions in a decentralized manner, being very good at that is, in fact, very good.

Expanding too far afield from that use case, which Ordinal NFTs certainly should be characterized as, could be detrimental to that use case. But that argument’s central point is more philosophical than practical.

Practically, the strictest interpretation of the Bitcoin ethos would be that it doesn’t matter what someone does with their bitcoin so long as it abides by the rules of Bitcoin’s software. If I want to waste my bitcoin on coffee then some other user is free to waste it on an Ordinal NFT. The conversation should end almost immediately thereafter.

That said, there are at least two small areas of potential concern: 1) illegal data and 2) chain bloat.

On the first, inscriptions could allow illegal data to become a part of the Bitcoin blockchain – like the links to illegal pornography that already exist on the blockchain, but in a more permanent way. This is an obviously terrible potential consequence of Ordinal NFTs, but there is some comfort in that there’s a technical requirement requiring a special off-chain agreement with a miner to inscribe data in excess of 1 MB. Furthermore, the Bitcoin blockchain is transparent, so the inclusion of this type of media would be met with swift investigation and punishment.

On the second, inscriptions have led to almost completely full 4-MB Bitcoin blocks. This is abnormal. Most Bitcoin blocks have not been close to the size limit. Some worry that the influx of large blocks will make it more difficult for new node participants to start up due to the immense amount of data that will accumulate over time and bloat the chain with superfluous data. This was the central battle in 2017 during the Blocksize Wars that led to the creation of Bitcoin Cash (which has higher blocksize limits than Bitcoin) and consequently Segregated Witness (SegWit) on Bitcoin, which, in combination with 2021’s Taproot upgrade, made inscriptions possible.

Along with separating signatures from transactions – in a witness data field that can include other arbitrary data if desired – SegWit introduced the block weight, which allows more transactions to be included in the 4-MB block by theoretically discounting the size of witness data. And Taproot made it easier to include even more data in the witness.

Everything is delicately tied together – and this is one of the reasons I think the risk of chain bloat is overblown. Since inscription data is witness data, it can be pruned, in that it’s technically possible to run Bitcoin software without downloading all the historical witness data. In non-technical speak, this is good because users are putting a bigger proportion of new data into a Bitcoin transaction in a spot where it slows everyone down as little as possible.

The other is that hardware gets better and cheaper over time, so even though Bitcoin’s blockchain will continue to grow in size as long as it is used, the nodes will simply capture more processing power. Such is life as a transparent, decentralized ledger.

But where the discussion of Ordinal NFT’s consequences becomes far more interesting is how these now mostly full blocks might affect Bitcoin’s transaction fee market for blockspace.

Bitcoin has full blocks now? Did we fix the security budget?

Bitcoin miners make money by validating transactions in exchange for transaction fees and a block subsidy, which is the new bitcoin mined after each block is mined. Transaction fee rates are quoted in sat/vB, which means that the more data a transaction includes the larger the fee. There is interesting game theory at play as users are the ones who propose the fee rate to miners and blockspace is scarce due to the 4-MB size limit.

Some users opt to only propose transactions at 1 sat/vB, the lowest fee rate. For those users, it could take a while for their transactions to complete if there are lots of other users trying to do transactions. And they could theoretically never be completed since miners tend to validate transactions with higher fee rates.

With this mechanism in mind, and the fact that Bitcoin blocks weren’t really ever full until inscriptions came along, it’s probably unsurprising to read that making an Ordinal NFT is usually more expensive than a regular Bitcoin transaction. Pictures take up a lot of space especially compared to plain text.

Here’s how it could be good for Bitcoin and its security budget.

More transactions should mean more fees. Blocks full of transactions are better than blocks not full of transactions – not to mention the empty blocks (which does happen). It almost goes without saying, but a more robust transaction fee market is good for the Bitcoin network. It’s good for any financial network. Right now, miners make almost all of their money from the block subsidy, but the subsidy will go away eventually leaving only transaction fees. So for Bitcoin to survive in the long term, a robust transaction fee market needs to take hold.

To that, a potential best-case scenario for the longevity of Ordinal NFTs is that they act as a buyer of last resort for blockspace. Since Ordinal NFTs are unusually large transactions, they will almost always be more expensive than normal peer-to-peer Bitcoin transactions on a per-transaction basis even if they have low fee rates. As such, there’s a chance a user who wants an Ordinal NFT might be willing to wait longer to save money by paying a lower fee rate. Then these transactions will only be included in blocks when market fee rates are comparatively low and block space is abundant.

Where that may fall apart is the potential that users don’t actually start paying a higher fee rate for peer-to-peer bitcoin financial transactions than Ordinal NFT transactions. Maybe then almost all blocks will only include Ordinal NFTs and no other types of transactions forever. I think that’s unlikely but it could happen.

As for what that means for the direction of transaction fees, Luxor’s head of content, Colin Harper (a former CoinDesker), put it well in a recent article:

There’s a good chance that ordinal NFTs alone do not increase transaction fees. Well, they could increase fees, but not in the way you might think. After all, they benefit from the SegWit data discount, so theoretically a block full of digital artifacts would actually carry fewer fees than one filled entirely with ordinary Bitcoin transactions.

But if enough users start inscribing ordinal NFTs so that they seriously compete for blockspace with ordinary transactions, the users broadcasting ordinary transactions would need to increase their own fees for inclusion. In this case, miners would likely prioritize as many ordinary transactions as possible, because they have a higher fee per byte of data and they can fit more of them into a block, thus maximizing fees.

So if ordinal NFTs create transaction fee pressure, miners will likely optimize for higher fees by including as many ordinary, economic transactions as possible.

(Colin Harper/Luxor)

I think this is spot-on and it’s how I am thinking about this until we have more empirical evidence to consider.

Sure Ordinal NFTs are fun-ish, but at the risk of sounding pompous they are so much less consequential than bitcoin’s best use case of peer-to-peer, borderless, censorship-resistant money. In all, my take is that Ordinal NFTs will be at its very best a means to strengthen the Bitcoin transaction fee market and at worst a spectacular fad that fades away with no wider negative consequences for Bitcoin.

It will at the very least be interesting to see where this takes us.

Never a dull day.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Stacks

Stacks  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Maker

Maker  Hedera

Hedera  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Zcash

Zcash  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Lisk

Lisk  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur