Investor interest in selling Bitcoin plunges to yearly low, as Ethereum and XRP climb

Despite the broader cryptocurrency market undergoing significant corrections, investor interest in disposing of some assets continues to vary. Notably, the interest partly reflects the belief that certain crypto assets will likely rally in the future.

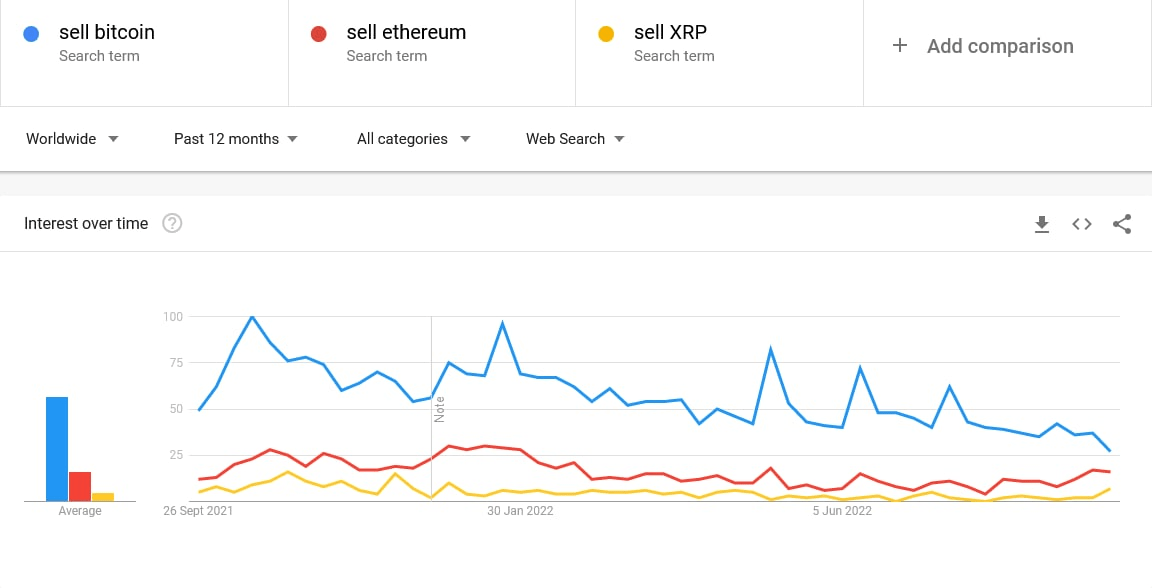

In particular, according to data acquired by Finbold, Google search interest in the keyword ‘sell Bitcoin’ has hit a 12-month low, recording a popularity score of 29 by the week ending September 24. The interest peaked by the week ending October 23, 2021, with a popularity score of 100.

Additionally, interest in ‘Sell Ethereum’ has recorded minor gains over the past 12 months, registering a growth of 16%. By the week ending September 24, the term recorded a score of 14. Similarly, interest in Sell XRP is also rising, recording a popularity score of 5. It is worth noting that the values stood at 0 by the week ending September 10.

Anticipation of Bitcoin’s future rally

The falling interest in selling Bitcoin (BTC) comes as the cryptocurrency continues to make attempts to regain its value above the crucial $20,000 level. However, the reduced interest in selling can be interpreted as a good sign for the market since investors might be expressing their optimism on the asset to rally again.

Elsewhere, the data compliments a Finbold report on September 22 indicating that the amount of Bitcoin HODLed in addresses has hit a new five-year high. Overall, investors are not eager to sell their Bitcoin with the hope that the asset will rally in the future, as supported by analysts.

Ethereum and XRP recording increased activity

Interestingly, compared to Ethereum (ETH) and XRP, Bitcoin has not registered any interesting developments around the network. In particular, the eagerness to sell Ethereum follows the Merge upgrade that transitioned the network to a Proof-of-Stake (PoS) protocol.

Before the event, there was a wide-scale bullish sentiment that the asset would rally. However, it turned out that the upgrade was a ‘buy the rumor, sell the news’ event. Therefore, it can be assumed that investors who acquired the asset in anticipation of a rally intend to sell to recoup their investments.

It’s worth noting that since the Merge, Ethereum has recorded significant losses over Bitcoin. By September 20, the value of Ether was down about 15%, just five days after the historic upgrade, while Bitcoin only registered losses of 3%.

At the same time, Ethereum continues to correct trading at $1,317 by press time, with almost 10% losses in the last seven days.

XRP records positive gains

Furthermore, investors interested in selling XRP are potentially attempting to profit from the token’s short-term price gains. Notably, as of September 223, XRP had recorded gains of almost 60% in a week, while the broader market experienced a bloodbath.

The uptick follows positive developments for Ripple from its case with the Securities Exchange Commission (SEC). The Ripple team has exuded confidence in winning the case, as highlighted by the company’s attorney, Stuart Alderoty.

According to the lawyer, SEC had failed to satisfy the Supreme Court’s Howey test.” The Howey Test is how regulators determine whether or not an asset is a security.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur