Is Filecoin Network’s Incentive Plan Sustainable? Crypto Analysts Want to Know

How long can it last?

That’s what crypto analysts are wondering about the Filecoin incentive program, the driver behind the bulk of the blockchain project’s growth.

Filecoin was launched in 2020 to decentralize the data storage business, providing an alternative to industry giants like Amazon (AMZN) at nearly a thousandth of the cost.

At its core, the network connects storage providers with clients looking to stow their data. By offering storage space – ranging from extra capacity on desktop computers to large racks – and then running mathematical proofs to show that clients’ data is unaltered, providers can earn the network’s native FIL token as a blockchain reward.

Recently, activity has been picked up the pace. According to a Messari report, active Filecoin storage deals between providers and clients surged 128% from the first quarter to the second quarter of 2022.

That has crypto analysts calling attention to the incentive program linked to 99.7% of that growth – Filecoin Plus (Fil+) – and wondering whether it’s sustainable.

Under Fil+, storage providers can earn 10 times the block reward, or amount of FIL tokens, of a typical deal by working with “trustworthy clients” such as universities and research facilities. These clients apply to notaries, or community-elected trustees, to verify the data they are storing.

Fil+’s approval system weeds out storage providers who may negotiate deals with clients storing fake data just to reap block rewards.

Analysts say that Fil+ block rewards act as a subsidy for providers, making it feasible for them to slash storage fees (averaging $0.0000026 per gigabyte per year). Still, they wonder what might happen to Filecoin’s growth and activity once the incentive program tapers off.

“Over time, storage miners will have to start charging,” said Messari enterprise research analyst Sami Kassib. “What I think is going to be the most important thing to watch there is if the storage demand can still keep up when storing data is no longer free.”

New revenue streams

Filecoin project leaders say the network is set to roll out new functions to create additional revenue streams for>

Jonathon Victor, product lead for Protocol Labs, the open-source research and development lab that developed Filecoin, outlined five revenue sources for storage providers: block rewards, storage fees, retrieval fees, transaction fees and additional services.

Storage fees are what clients pay storage providers for the initial storage deal. Retrieval fees are what clients pay providers to fetch stored data. Transaction fees are what crypto brokers charge traders for buying and selling FIL.

While revenue from block rewards will eventually decrease, Victor argues that storage fees will remain low as long as providers can make up the lost revenue through retrieval fees, transaction fees and additional services.

According to Filecoin’s 2022 roadmap, the storage network plans to add a retrieval market during the third quarter that would increase the speed of blockchain data retrieval and allow storage providers to charge clients for retrieving the data they are storing.

Filecoin also launched the Filecoin Virtual Machine (FVM) in July 2022, which let clients run smart contracts from other networks and unlocked the potential for decentralized finance (DeFi).

In the fourth quarter of this year, Filecoin plans to implement a programmable storage market, which would allow clients to create customized smart contracts to meet their needs.

“Things like the FVM are going to drive transaction fees,” said Victor. “It will drive demand for Filecoin block space.”

FIL token price

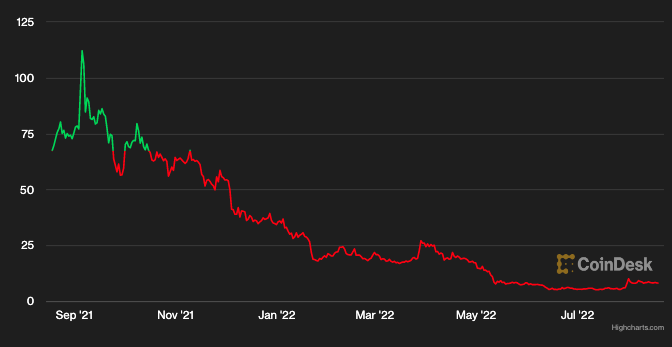

Filecoin’s FIL token price is well off its highs over the past year. (CoinDesk)

Additional services that will generate revenue for storage providers include on-chain and off-chain computing functions, which Filecoin plans to add to allow clients to use their stored data for calculations. On-chain computing is done through smart contracts on the blockchain while off-chain computing temporarily takes data off of the blockchain.

One key question for digital-asset traders is what these changes all mean for the project’s FIL token, which has more than doubled in price from a low point in June to a two-month high around $11.37 on Aug. 1.

The token is now trading at around $8.21, which is still about 96% down from its all-time high.

“What Protocol Labs’ main goal is, is to maintain and to increase block space demand,” Kassib said. “As long as you’re doing that, then the FIL token continues to accrue value, which continues to incentivize the storage providers and all the other supply-side participants in the network.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Zcash

Zcash  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur