KuCoin Draws Ire for Sky-High Yields on Bitcoin Dual Investment Earn Products

There was a time when having sky-high annual percentage rates on crypto yield products felt like the best way to drive adoption. That time has passed.

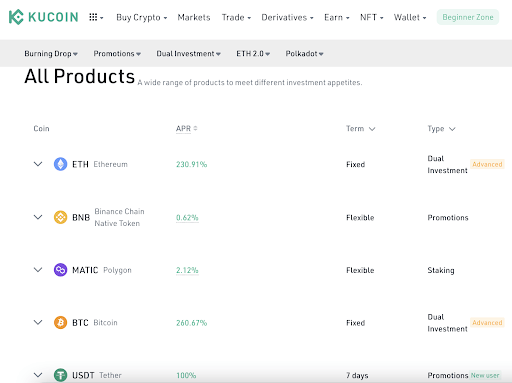

This week crypto exchange KuCoin is facing scrutiny because its KuCoin Earn page boasts APRs of 233.15% on Ethereum, 253.28% on Bitcoin, and 100% on Tether deposits. Although the company’s website says that the Tether (USDT) rates are part of a promotion, the ETH and BTC rates listed correspond with an advanced “dual investment” KuCoin Earn product.

All the attention has sent 24-hour volumes on the exchange, which was $640 million yesterday, up to $862 million today, making it the fifth largest centralized exchange by normalized volume, according to CoinGecko.

That has raised some eyebrows on Crypto Twitter, along with defenders who have dismissed the criticism as FUD (a crypto-native acronym for fear, uncertainty, and doubt).

emmm

what is happening on Kucoin?

USDT 100%? eth 186%?

is this a glitch or what is this? pic.twitter.com/NqNUdMDfKA

— Pentoshi ? (@Pentosh1) November 29, 2022

?1 / I’ve been seeing absurd #Kucoin FUD regarding the APR.

Dual Investment is a financial product that is non-principal-protected and has high yields. Same on Binance should you withdraw from Binance because of the enormous APR. No!

Is this a real concern? Absolutely not.? pic.twitter.com/me6UzRXRU8

— WIZΞ (@TraderWize) November 29, 2022

Dual investment products are derivatives that allow clients to deposit money in one currency, like BTC, and potentially make a profit by withdrawing it in another currency, like USDT, when the contract expires and needs to be settled.

Source: KuCoin Earn

They tend to offer high interest rates because they can be very risky. That’s because it’s a non-principal protected product. So rather than just earning a lousy or no return on the funds that were deposited, investors risk receiving less money than they put in. It’s the reason why critics of these products like DeFi Pulse co-founder Scott Lewis call these sorts of schemes «predatory.»

Kucoin’s “Dual Investment” product is just selling a straddle directly to Kucoin, but explained in a obfuscated way so it is less obvious to the noobs. pic.twitter.com/mIoN3yGDUC

— scott? (@scott_lew_is) November 29, 2022

But the timing of the product’s debut on Wednesday rattled users, who think it’s an attempt to get more deposits onto the exchange. At the start of the month, after problems started cropping up for now-bankrupt FTX, CEO Johnny Lyu said on Twitter, “Protecting user funds is the top priority at KuCoin. We will release Merkle tree proof-of-reserves or POF in about one month.”

KuCoin published the balances of some of its wallets, and their addresses, on November 11, the same day that FTX filed for bankruptcy, but hasn’t yet provided an audit from a third-party accounting firm. Meanwhile, DeFi Llama and Nansen list their reserves at $2.2 billion and $2.5 billion, respectively. However, there isn’t any way for the public to know, based on on-chain data or proof-of-reserves attestations, what an exchange’s liabilities are, or if the exchange has enough assets on hand to cover those liabilities.

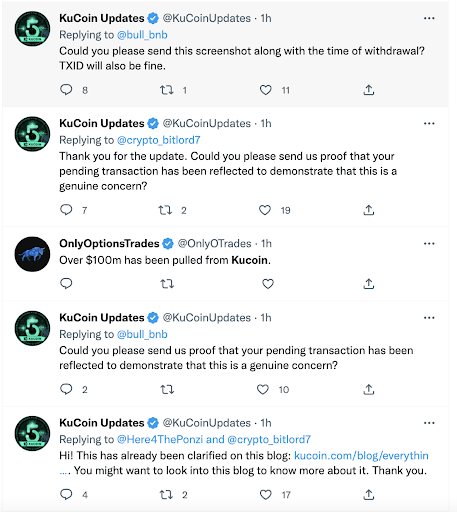

The main KuCoin Updates account spent the better part of the day fielding complaints from users who could not withdraw their funds and pointing people to a blog post about its dual investment product. Representatives for KuCoin did not respond to Decrypt’s request for comment.

Source: Twitter screenshot taken Wednesday, Nov. 30

Both the main KuCoin Twitter account and Lyu have been trying to dispel rumors that the exchange is insolvent, meaning that it doesn’t have enough assets to cover its debts.

“KuCoin’s Dual Investment Product has raised some real buzz,” Lyu wrote on Wednesday morning. “PLEASE note that it’s not a staking or guaranteed interest product and it can imply earning passive income with potential risk.”

KuCoin’s Dual Investment Product has raised some real buzz. PLEASE note that it’s not a staking or guaranteed interest product and it can imply earning passive income with potential risk. Think before you invest, make sure you know the projects or products well. https://t.co/Vdm9vc6CDL

— Johnny_KuCoin (@lyu_johnny) November 30, 2022

Incredibly high interest rates have been drawing scrutiny across the industry. They’re the reason detractors refer to any crypto project as a Ponzi scheme, where early investors are paid huge returns using money from more recent investors. The illusion continues for as long as the originator can keep bringing in new investors.

If a user clicks the icon to expand the ETH row on the KuCoin Earn website, they’ll see that the rates on staking ETH, 4.39%, and depositing it into a savings account, 2%, are less eye-catching.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Maker

Maker  Hedera

Hedera  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Holo

Holo  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Zcash

Zcash  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Lisk

Lisk  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur