NEAR Technical Analysis: Within Wedge, Buyers Prepare Escape Plan

According to the technical analysis, NEAR prices show a bullish reversal within the bearish wedge pattern teasing an uptrend continuation and leading to a breakout rally. The bearish retracement in the NEAR prices forms a bearish wedge pattern accounting for a drop of 25% over the last two weeks. However, the recent bullish reversal within the bearish pattern projects the possibility of a bullish breakout. So, should you consider buying NEAR tokens before the bullish breakout?

Key Points:

- The NEAR price action forms a bearish wedge pattern in the daily chart.

- The RSI slope shows a remarkable reversal in the nearly oversold boundary.

- With a market cap of $3.17 billion, the intraday trading volume of Near Protocol has increased by 8% to reach $227 million.

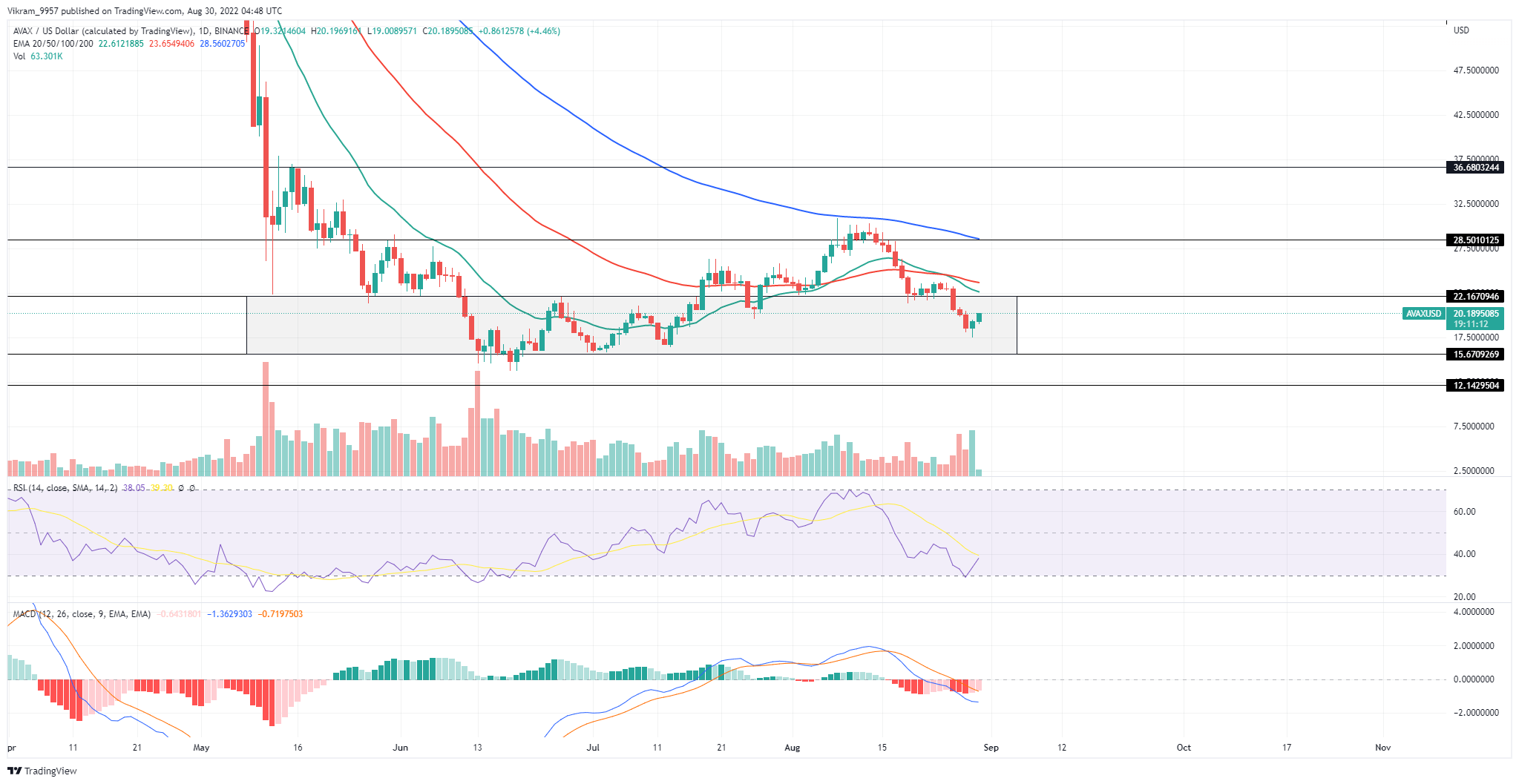

Source — Tradingview

NEAR Technical Analysis

The NEAR prices display a falling trend in the daily chart after facing rejection from the overhead resistance of $6.5. The correction phase drops below the 100 and 50-day EMA, sabotaging the possibility of a bullish crossover. However, the recent increase in buying pressure fuels the bull cycle within the falling wedge, increasing the possibility of a bullish breakout. Furthermore, the hike in the intraday trading volume supports the bullish engulfing candle. If the buying pressure propels the market value above the resistance trendline, the breakout rally can reach the $6 mark. Moreover, the 100-day SMA breakout can jump to the $8 mark. Conversely, reversing from the resistance trendline can result in a price drop to the $3.5 support level.

Technical Indicators

The RSI slope reverses within the nearly oversold zone to cross above the 14-day average line, reflecting an increase in the underlying bullishness. The MACD indicator shows a positive turnaround in the fast line, reflecting the possibility of a crossover event. Furthermore, the declining trend of the negative histograms reflects weakness in the selling pressure. Hence, the technical indicators maintain a positive outlook for the upcoming trend in the NEAR prices. Resistance Levels: $5 and $6 Support Levels: $3.5 and $3

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Decred

Decred  Zcash

Zcash  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur