Polkadot price analysis: DOT set to face yet another rejection below $1

Polkadot price analysis seems to be turning bearish, as price action over the past 24 hours saw DOT price lower down to $8.55. This change in trend came about after a significant uptrend over the past 3 days that saw Polkadot to rise up to $8.82 from $7.70, recording a 14 percent increment. An evening star pattern can be seen emerging on the daily chart for DOT, which suggests price changing trend. A daily close below support at $7.5 could signal the end of bullish spell for Polkadot and invite more sell offs into the market.

The larger cryptocurrency market showed signs of consolidation over the past 24 hours, as Bitcoin topped up to $23,000 and Ethereum rose past $1,700. Among leading Altcoins, Cardano rose up to $0.51 whereas Ripple jumped up to $0.37. Dogecoin also consolidated around current price at $0.06, whereas Solana moved past the $40 mark with a minor increment.

Polkadot price analysis: Cryptocurrency heat map. Source: Coin360

Polkadot price analysis: RSI shows dip in market valuation following 3-day ascent

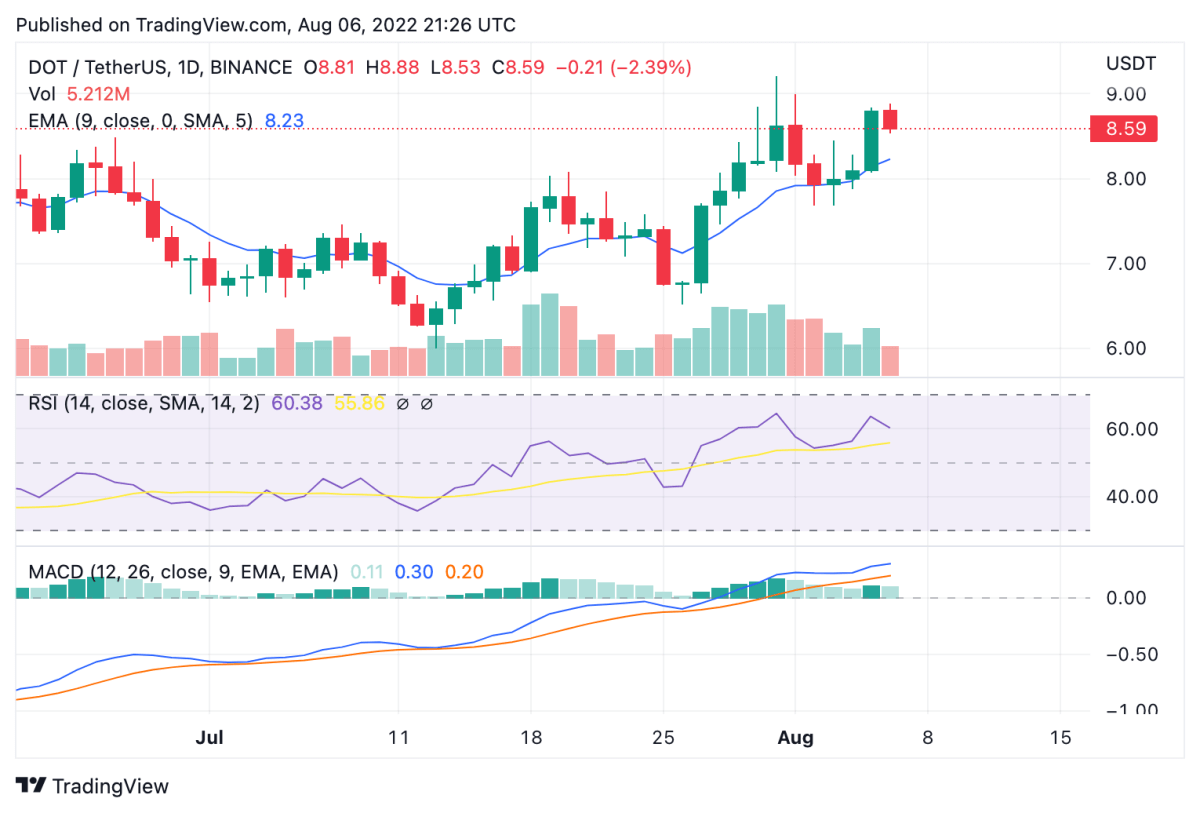

On the 24-hour candlestick chart for Polkadot price analysis, price can be seen forming an evening star pattern to turn bearish over the past 24 hours. DOT price rose up to $8.85 yesterday but faced yet another rejection below the $1 mark. A similar trend was observed at the end of July 2022, when DOT faced market rejection at $9.09. Price currently remains above the crucial 50-day exponential moving average (EMA) $8.22. However, any movement below support at $7.5 could trigger a further descent for Polkadot.

Polkadot price analysis: 24-hour chart. Source: Trading View

The 24-hour relative strength index (RSI) shows a dip in market valuation around the current trend around the 60 mark which also shows price exhaustion into the overbought zone. Trading volume also dropped 12 percent, indicating stagnancy in price creeping into the market. Meanwhile, the moving average convergence divergence (MACD) curve continues to stay above the neutral zone currently but is forming lower highs at current trend.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Hedera

Hedera  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Gate

Gate  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Holo

Holo  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Ontology

Ontology  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur