Polkadot price analysis: Price levels down to $7.84 as bearish pressure still persists

The Polkadot price analysis reveals that a downward movement in DOT/USD price has been observed today, which has cast quite a negative impact on the overall coin value. The price has degraded up to $7.84 value after the bearish trend. Although a constant improvement in price has been recorded till 12 August 2022, the last week has been critical as the coin underwent continuous loss, and the trend is the same for today as the price is sinking downwards.

DOT/USD 1-day price chart: DOT loses 7.11 percent

The 24-hour Polkadot price analysis shows that the cryptocurrency has been facing loss for the past six days. The price is continuing the downtrend today, degrading the cryptocurrency value to $7.84. A loss of 7.11 percent has been recorded during the last 24 hours, and over the past week, a 14 percent loss has been observed in the cryptocurrency value as the trend has been towards the bearish side. The moving average (MA) might go lower than the SMA 50 level, i.e., $8.67, if the declining trend continues. The trading volume has also decreased by 15.15 percent, and the market dominance is 0.80 today.

DOT/USD 1-day price chart. Source: TradingView

The volatility was decreased previously, but it seems to be on the increasing side now as the Bollinger bands show signs of diverging. The upper value of the Bollinger bands indicator is now standing at $9.71 point, representing the strongest resistance, whereas the lower value is at $7.63 point representing the strongest support. The Relative Strength Index (RSI) score has reduced to an index of 42 as well as the selling activity is still on the rise.

Polkadot price analysis: Recent developments and further technical indications

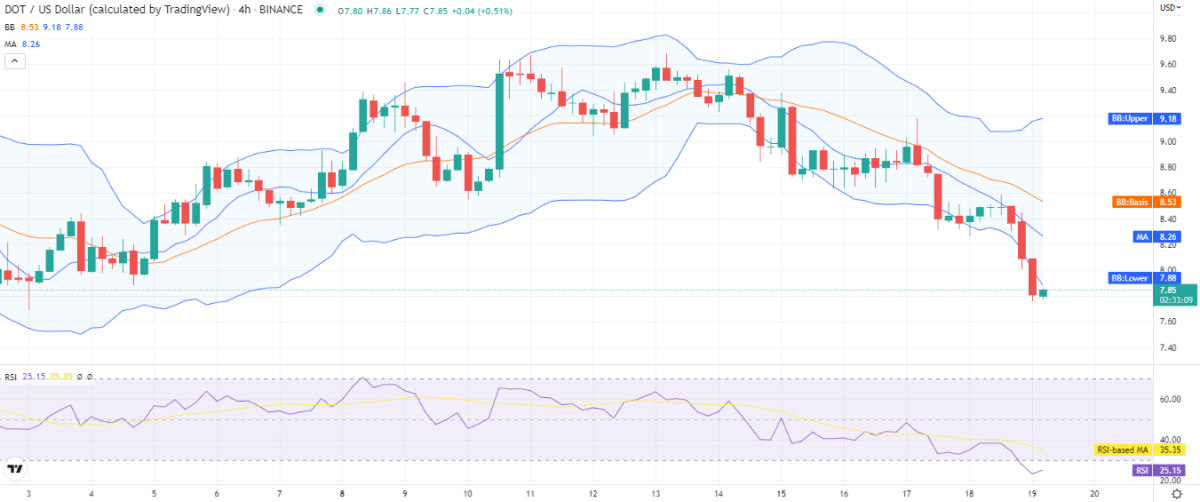

The 4-hour price chart for Polkadot price analysis shows the price has covered a steep downward movement in the starting four hours of today’s trading session as the bearish momentum has been trending over the market. The drop in price was quite drastic as the price levels decreased rapidly. However, a slight increase in price has been recorded in the last four hours, and the bulls have succeeded in taking the lead and slightly recovering the price to the $7.85 limit. The price is still below the lower limit of the volatility indicator.

DOT/USD 4-hours price chart. Source: TradingView

The volatility is increasing, and the increase in volatility means that the price might recover to a certain degree in the coming hours. As a consequence, the upper Bollinger band has now moved up to the $9.18 position, whereas the lower Bollinger band has moved down to $7.88. The RSI curve has entered the underbought region, but it has now taken a turn upwards, though the indicator is still trading in the underbought region at index 25, hinting at extreme bearish pressure.

The bulls have been leading the price charts for the past month, but the circumstances changed during the past week if we observe the situation from a general perspective. There is a strong bearish signal for the day as given by the DOT/USD technical indicators as a whole. We can see only two indicators giving out the buy signals, nine indicators on the neutral position, and 15s indicators giving sell signals.

Polkadot price analysis conclusion

The Polkadot price analysis suggests a bearish trend has been observed throughout the day as the price has been reduced to a $7.85 value. The one-day and four hours price charts are predicting a downward trend by giving a lead to the bears. Similar trends are expected in the coming hours as well, as the selling momentum has gotten sharper, but support has also arrived, as is visible on the 4-hour chart; the future trend will depend on the fact if the support can persist or not.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur