Polygon’s MATIC Has Lost a Vital Support Level

Polygon has dropped below a vital area of support after a series of on-chain transactions sparked a furore within the cryptocurrency community.

Polygon’s MATIC Faces Potential Selloff

Polygon has become the talk of the crypto community after 14% of the total MATIC supply was transferred from its vesting contract.

A sense of commotion struck the cryptocurrency market after on-chain data revealed that 1.4 billion MATIC tokens had been transferred from Polygon’s vesting contract. In response, Polygon co-founder Sandeep Nailwal confirmed that the token release was part of a “planned movement” and urged the community to check Polygon’s vesting schedule.

Polygon’s team detailed the allocation for the 1.4 billion MATIC tokens vested in an announcement following the unlock. According to the team, the goal is to distribute these tokens across different segments of the project. 546.6 million MATIC will go to the foundation’s treasury, 200 million MATIC will be used for staking rewards, and 640 million MATIC will be allocated to the team.

MATIC dipped below a crucial support area following the token unlock, increasing the risk of a sell-0ff.

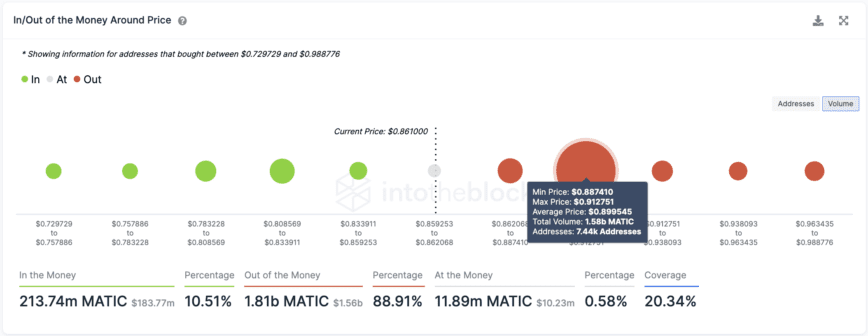

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) shows that more than 7,400 addresses have previously purchased nearly 1.6 billion MATIC between $0.89 and $0.92. If prices stay below this interest zone, the likelihood of some market participants exiting their positions to prevent losses increases.

MATIC’s In/Out of the Money Around Price (Source: IntoTheBlock)

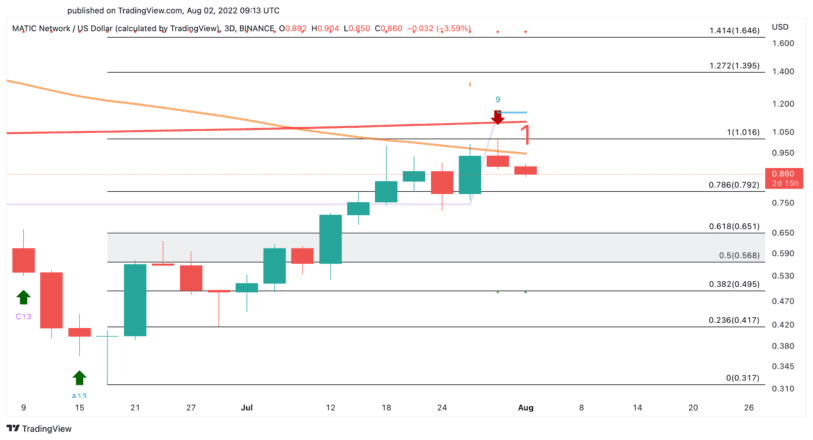

The pessimistic outlook coincides with a sell signal that the Tom DeMark (TD) Sequential indicator has presented on MATIC’s three-day chart. The bearish formation developed after MATIC was rejected by the 50-day moving average. If validated, Polygon could enter a one to four three-day candlestick correction that pushes prices to $0.60.

MATIC/USD three-day chart (Source: TradingView)

Given the importance of the 50-day moving average, MATIC would likely need to print a three-day candlestick close above it to invalidate the bearish thesis. Still, the 200-day moving average is sitting just above this resistance level, suggesting that Polygon will need to rise above $1.20 to advance higher. If it breaks through resistance, it could surge to $1.65.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Dash

Dash  Zcash

Zcash  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur