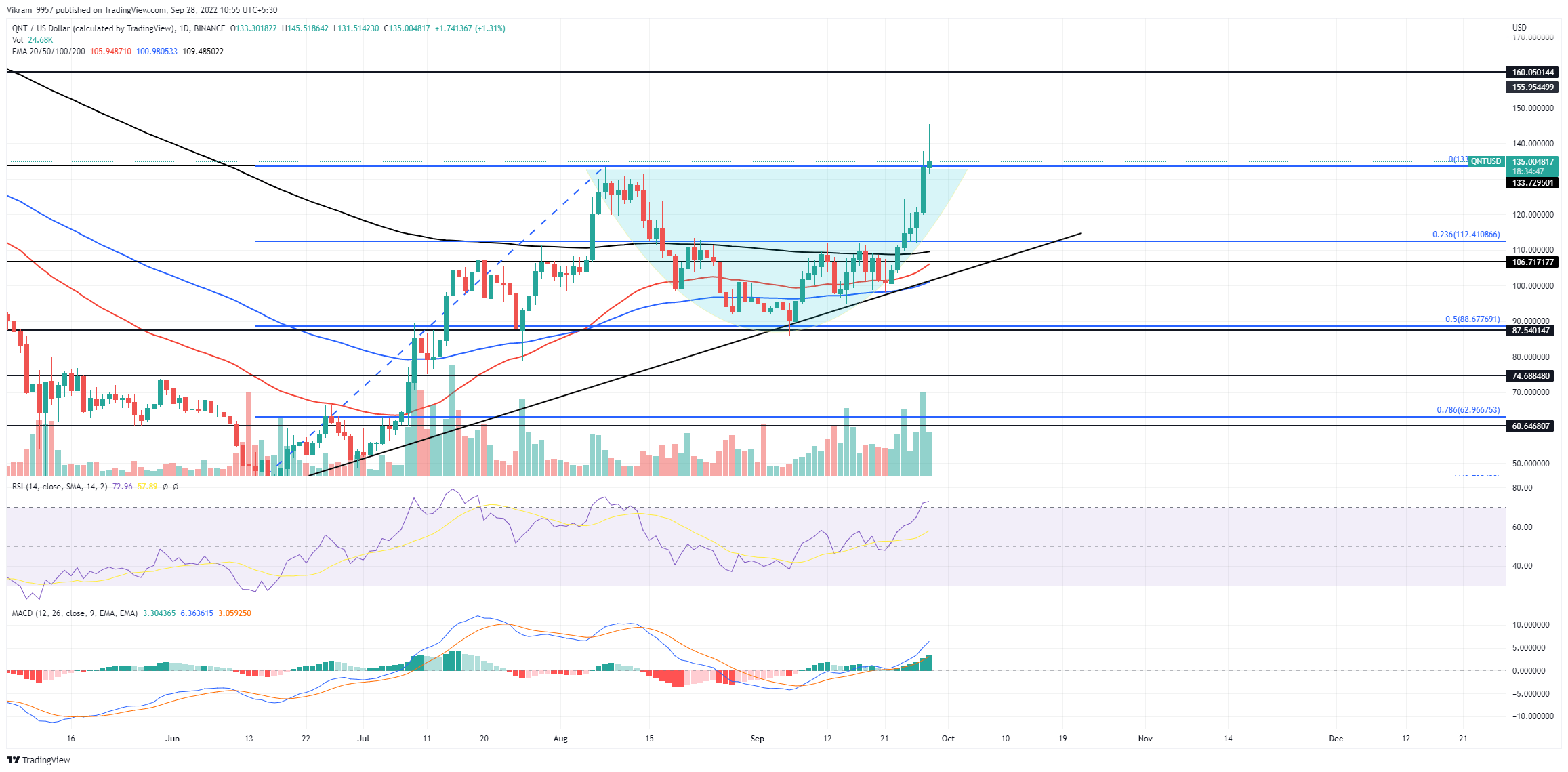

QNT Technical Analysis: Will This Golden Crossover Boost Quant Prices?

The QNT Technical Analysis shows a rounding bottom reversal from the support trendline giving a bullish breakout of $133. The QNT price action shows a bullish reversal from the ascending trendline, crossing the previous swing high at $133. Moreover, the price action offers a breakout entry opportunity for Quant buyers as the bulls break a rounding bottom pattern. However, the higher price rejection in the daily chart questions the uptrend sustenance.

Key Points:

- The Quant price action shows the $133 breakout.

- The higher price rejection candle warns of a reversal.

- The intraday trading volume in Quant is $205 million.

Source — TradingView

QNT Technical Analysis

As mentioned in our previous analysis, the QNT price action avoids a head and shoulder pattern displaying the buyers beating the bearish pressure. The market value breaks the $110 mark, nullifying the bearish pattern. The breakout rally propels the QNT price by 21% in the last five days, creating a streak of bullish candles. Moreover, the Quant price action displays a rounding bottom pattern breakout as the uptrend exceeds the $133 neckline. Additionally, the high momentum uptrend increases bullish influence over the crucial daily EMAs resulting in a positive uptrend. Hence, the possibility of a golden crossover increases in the daily chart. This prominent reversal rally comes after a sharp increase in buying pressure at the support trendline. Hence, any future correction to the support trendline can signal a buying opportunity for sideline traders. Coming back to the present times, the lack of bullish follow-through in the daily candle results in higher price rejection, questioning the breakout credibility. If the candle fails to close above the neckline ($133), the Quant price may drop back to the $112 mark. Optimistically, if the buying pressure sustains, the QNT market price will cross the psychological mark of $150 to test sellers at $160.

Technical Indicators

The RSI slope shows a rising trend above the overbought boundary with the support of the 14 days average line. Moreover, the MACD and signal lines display an increasing bullish spread, fueling the positive trend in histograms. Therefore, the technical indicators reflect a rising trend in buying pressure. As a result, the QNT technical analysis takes an optimistic standpoint and offers a buying opportunity upon breakout. Resistance Levels — $150 and $160 Support Levels — $133 and $112

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur