Shiba Inu (SHIB) Retraces After 40% Daily Increase

Shiba Inu (SHIB) has made four attempts at breaking out from a descending resistance line. While all of them have been unsuccessful, the price is gearing up for yet another one.

SHIB has been decreasing underneath a descending resistance line since Dec 24. This movement led to a low of $0.00000714 on June 18. So far, the price has made four unsuccessful breakout attempts, the most recent on Aug 14 (red arrow).

This also coincided with a rejection from the $0.00001780 horizontal resistance area. So far, the resistance line has been in place for 233 days.

During the short-term upward movement, the daily RSI has moved above 50. This is considered a sign of bullish trends. While the indicator is currently oversold, it has not yet generated any sort of bearish divergence, allowing for the possibility that the price will break out.

SHIB/USDT Chart By TradingView

Short-term movement

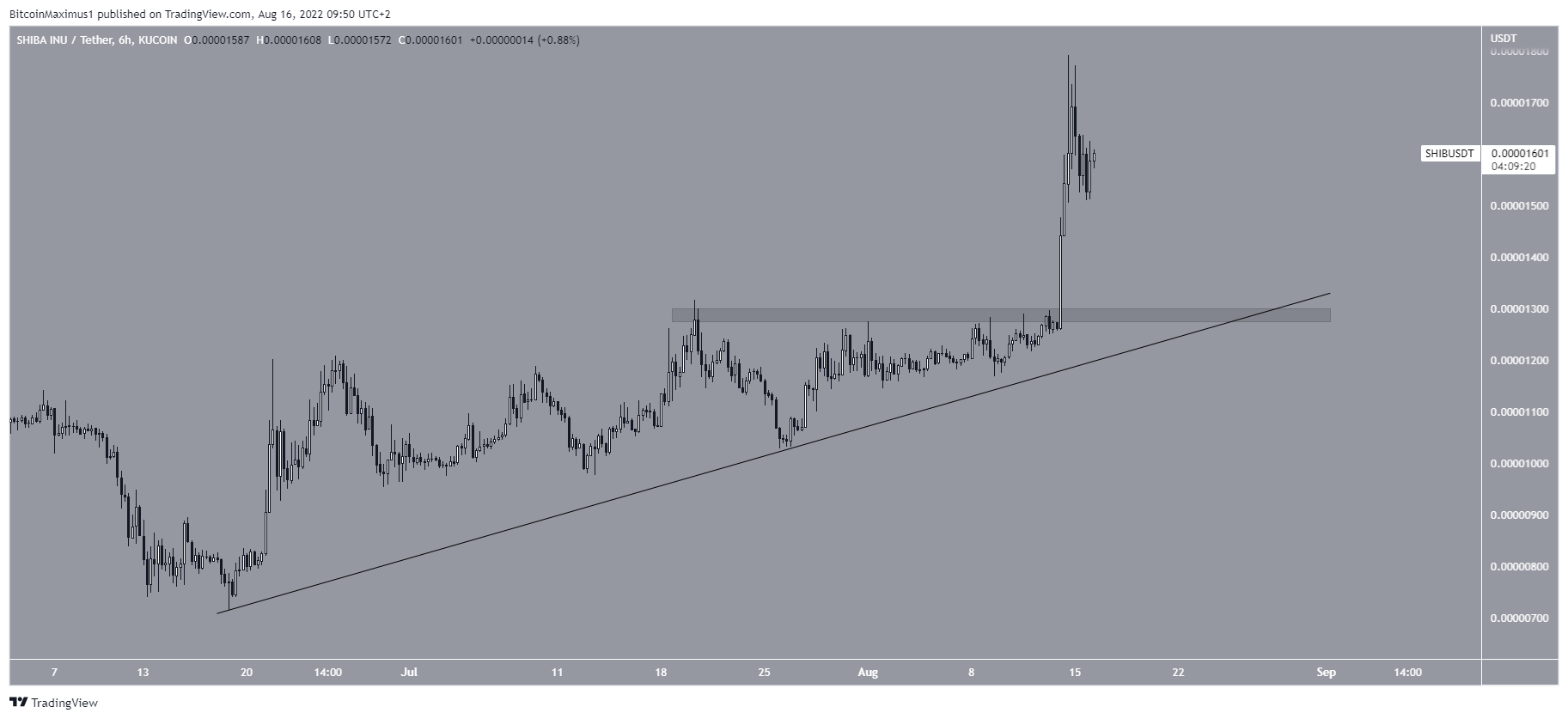

The six-hour chart does not show a clear pattern. While it is possible that the price is following an ascending support line, the line has only been validated twice.

There seems to have been a resistance area at $0.0000128, which is likely to provide support if a retracement occurs.

SHIB/USDT Chart By TradingView

SHIB wave count analysis

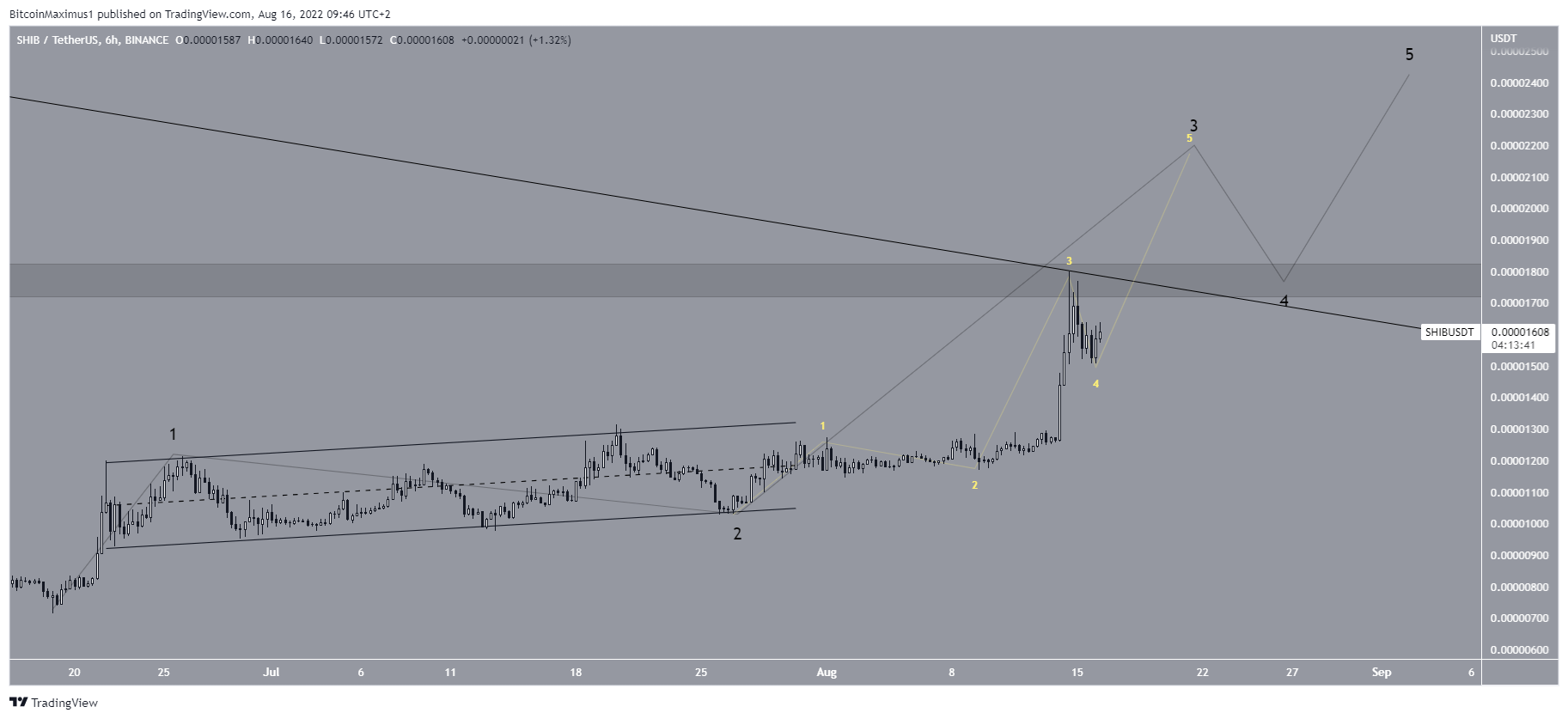

Cryptocurrency trader @Altstreetbet tweeted a chart of SHIB, stating that the price is in the process of completing wave four.

Source: Twitter

The most likely wave count does indicate that SHIB is in wave three of a five-wave upward movement. The sub-wave count is given in yellow.

If the count is correct, it would suggest that the price will break out from the aforementioned resistance line during wave three. Afterward, it will validate it as support during wave four prior to resuming its upward movement.

SHIB/USDT Chart By TradingView

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur