Solana ($SOL) Protocol TVL Dominance Rises Nearly 50% as Developer Activity Grows: Report | Cryptoglobe

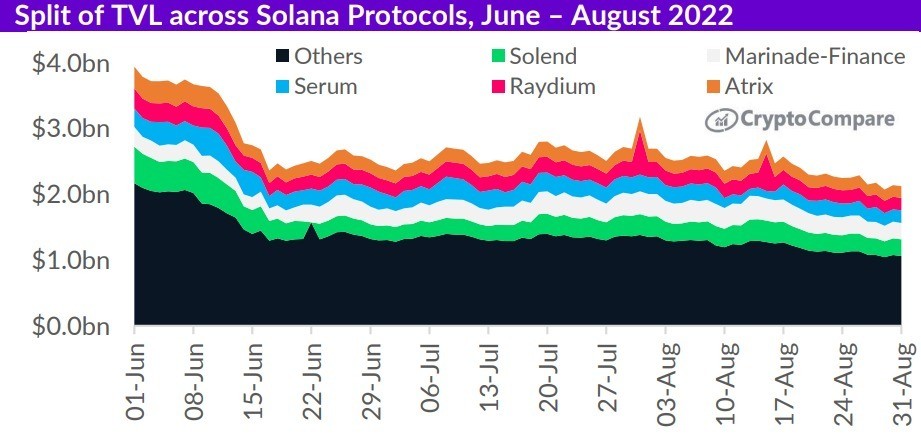

The total value locked (TVL) on the Solana blockchain’s decentralized finance (DeFi) space has trended downwards in U.S. dollar terms over the past three months, dropping a total of 45.9% from $3.94 billion to $2.13 billion.

According to CryptoCompare’s latest Asset Report, the dominance of the five largest protocols on the network has nevertheless risen over the same period, hitting a 51.6% peak on August 9. Solana, the report adds, benefits from a “well-diversified set of DeFi applications ranging from DEXes to lending, liquid staking, and yield services.”

Source: CryptoCompare

CryptoCompare’s report adds that developer activity on the Solana network has kept on increasing this year, with the “total number of GitHub contributors rising by 40.9%, while total commits have risen by 14.8%.”

Meanwhile, the cryptocurrency has seen its volatility steadily decrease since May, reaching a yearly low 30-day volatility of 77.2% on August 27. Per the report, this is the “lowest volatility figure for the cryptocurrency in the last two years, illustrating the lack of activity in markets.”

The firm adds that lower volatility isn’t necessarily a good thing for cryptocurrencies. Solana, for example, has lost over 80% of its value this year and has been underperforming against other major cryptocurrencies including $BTC, $ETH, and $ADA.

As CryptoGlobe reported, the total number of transactions conducted on the Solana network is nearing the 100 million mark, at a time in which institutional investors keep betting on products offering them exposure to the cryptocurrency, despite the ongoing bear market.

Institutional investors have earlier this month largely reduced their bets on both Bitcoin and Ethereum-based investment products, while increasing their exposure to several altcoins, including Solana.

Products offering exposure to Solana saw $500,000 in inflows, while products offering exposure to XRP saw $200,000 in inflows. Cardano-based investment products saw $100,000 in inflows, while multi-asset products saw $3.3 million in inflows.

Image Credit

Featured Image via Unsplash

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Maker

Maker  Hedera

Hedera  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  NEM

NEM  Waves

Waves  Ontology

Ontology  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur