Solana’s Recent Activity Overshadows Both Ethereum and Binance

While address activity on leading altcoin networks Ethereum and Binance Chain declined, Solana witnessed a spike. The Solana network bucked the trend as the network’s users increased their activity.

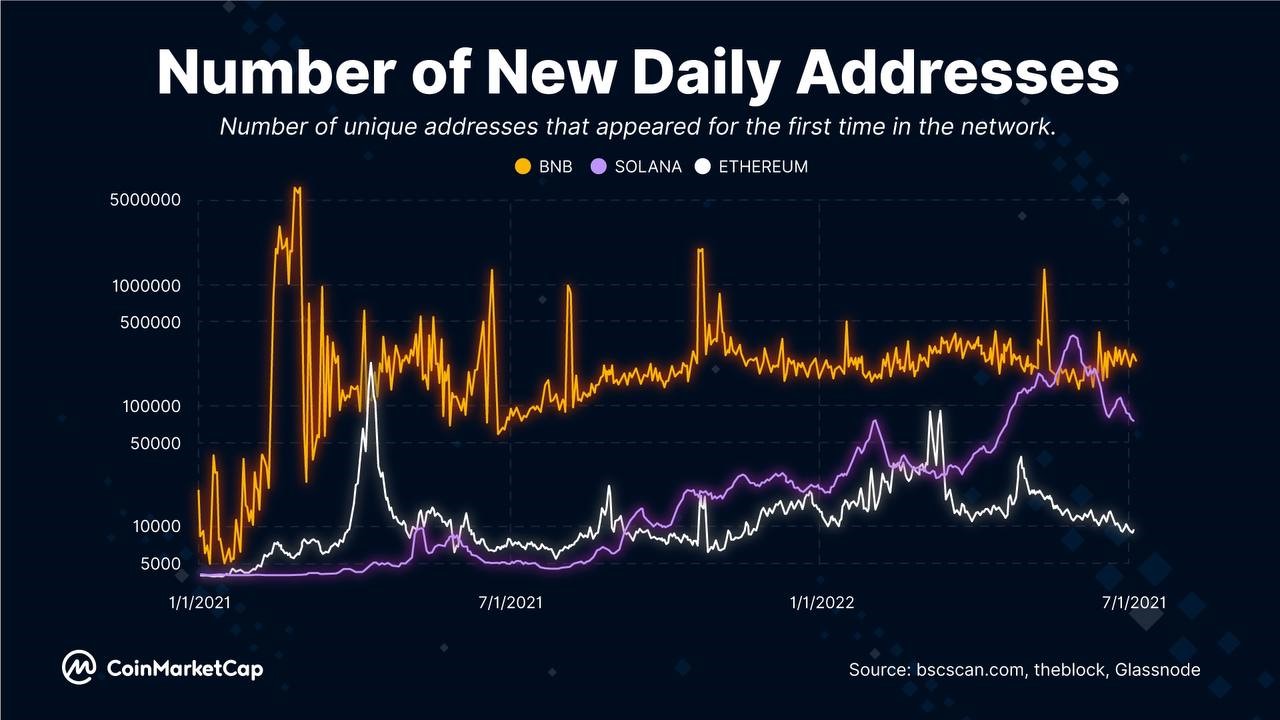

Data revealed that active addresses on the Solana network have grown by 58% since the beginning of 2022. Solana has therefore outperformed competitors Ethereum and Binance Chain in terms of active address growth.

Active addresses on a network is a metric considered an indicator of user growth in a cryptocurrency. Solana’s active address count increased during the bear market, a sign of increasing interest in SOL and participation from the wider crypto community.

Number of New Daily Addresses on Solana (Source: CoinMarketCap)

It is interesting to note that while Solana witnessed a 58% growth in active addresses, the BNB chain registered a fall of 17.9% and Ethereum suffered a worse decline, at 51.8%.

Solana has emerged as the only major layer-1 cryptocurrency with high participation and activity in terms of addresses on the network. Solana suffered a series of outages and downtime throughout the past year, due to technical glitches and high NFT trade volume on its blockchain.

Despite the struggle, the Solana network has witnessed tremendous growth, leaving peers like BNB Chain and Ethereum behind.

The Total Value Locked (TVL) on the Solana network failed to reflect the momentum of its address activity, and dropped close to $2.9 billion, against May 2022’s $6 billion. This insight reveals that the address activity has failed to increase the inflows to the Solana network, and there is room for further growth in the altcoin’s TVL with the spike in the number of participants.

Solana’s price remains at risk of collapse with the divergence between the address activity and TVL of the altcoin’s network. On observation, Solana’s price chart looks ready for a trend reversal.

Solana price could follow suit if Bitcoin price drops below the 200-week SMA at $22,559. This remains a key level for the asset. A decline below this level could trigger Solana’s price drop to $38, $31, and $25 weekly support floor. The 40% downswing is likely in Solana’s price in the event of a BTC price drop to the $22,559 level.

SOL-USDT Perpetual Contracts (Source: TradingView)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Decred

Decred  Zcash

Zcash  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur