UNI Technical Analysis: Uniswap Prices Shoots Above $8

The UNI price action shows a bullish breakout rally challenging the 200-day SMA in hopes of reaching the psychological mark of $10.

Key Technical Points:

- The UNI prices jumped by 26% in the last 24 hours.

- The consolidation range breakout rally exceeds the $8 mark.

- The 24-hour trading volume of Uniswap is $490 million, indicating a drop of 94.68%.

Past Performance of UNI

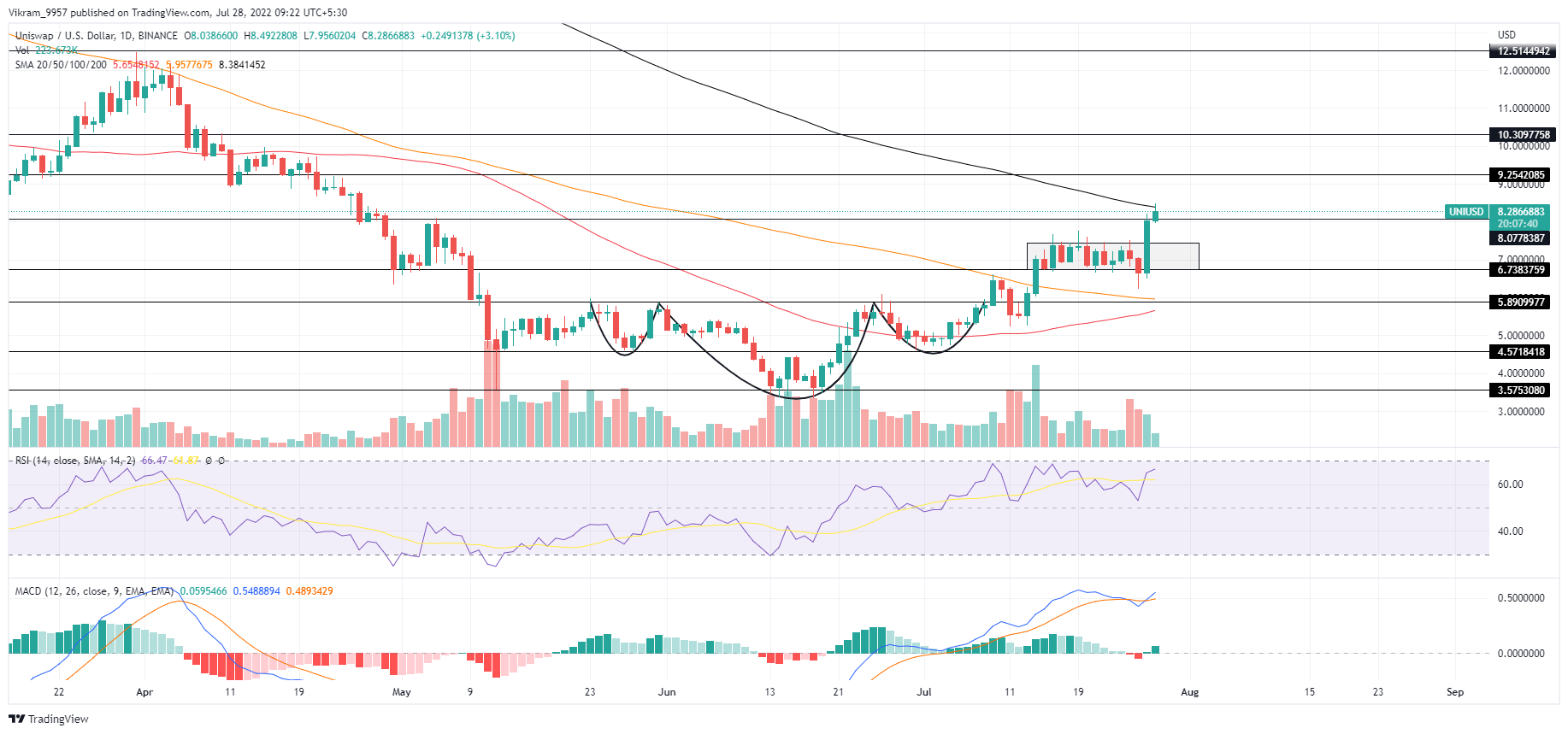

As teased in our previous article, the UNI prices broke the consolidation range to exceed the $8 mark and challenge the 200-day EMA. The bull run overnight comes despite the Fed’s interest rate increase as it meets the market expectations. Hence, the altcoins see a surge in buying pressure and tease a bullish trend continuation.

Source — Tradingview

UNI Technical Analysis

The bullish engulfing candles formed in the UNI/USD price chart display a significant increase in buying pressure with the support of volume spikes. Hence, the likelihood of an uptrend sustaining above the $8 mark increases. The 200-day SMA opposes the uptrend, but the increasing bullish influence on the 50 and 100-day SMAs tease a crossover to regain positive alignment. The crossover event will increase the buying pressure and improve the market sentiments. The bullish breakout undermines the bearish alignment of the MACD and signal lines with another positive crossover. The surge in underlying bullishness is evident by the spike in the daily-RSI slope reaching the overbought boundary. In a nutshell, the technical indicators project a bullish bias supporting the UNI technical analysis of an uptrend continuation.

Upcoming Trend

If the price trend exceeds the 200-day SMA, the UNI market value will shoot up to challenge the psychological mark of $10 to reach $12.5. Conversely, a reversal from the 200-day SMA will result in downfall to the $8 mark. Resistance Levels: $10 and $12.5 Support Levels: $8 and $6.75

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Hedera

Hedera  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Holo

Holo  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Ontology

Ontology  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur