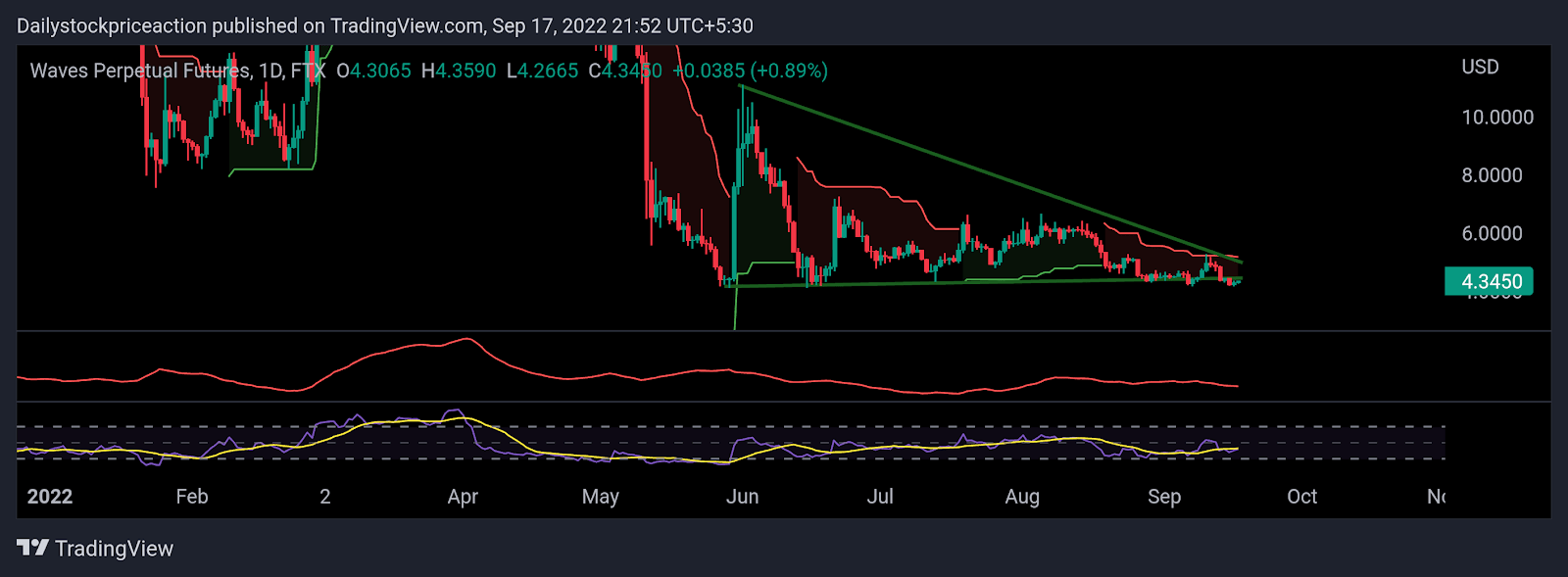

WAVES COIN PRICE ANALYSIS: WAVES coin is trading at the supply zone on a daily time frame, as it forms a bullish chart pattern, will it give a breakout?

- The WAVES coin price is trading at the supply zone on a daily time frame.

- The WAVES coin price is forming a falling wedge pattern on a daily time frame.

- The pair of WAVES/BTC is trading at the price level of 0.000216 with a decrease of -0.59% in the past 24 hours.

Source: WAVES/USDT by tradingview

The WAVES coin price as per the price action is trading near the supply zone after bouncing strongly off the demand zone. The WAVES coin price is forming higher high and higher low formation on an hourly time frame. While on a larger time frame the coin price is for its lower low and lower high price structure. The recent fall in the price of the WAVES coin price has led to it breaking the important demand zone. Recent gains in the price of WAVES coin price could just be a pullback of the bearish trend. Currently, the supply zone has been tested twice, making it weak. Therefore if the bulls overpower the bears, the coin price can be seen moving upwards rapidly. The WAVES coin price is trading below the 50 and 100 MAs. The recent fall in the price of WAVES coin price has led to coin prices falling below the important MAs. Moving upwards the coin price can be seen facing strong rejection from these MAs. At present, the WAVES coin price is trading at the upper band of the Bollinger band indicator. The range of Bollinger bands has narrowed indicating massive movement on either side. Volumes have increased as the coin price rose from the demand zone.

The WAVES coin price is forming a falling wedge pattern on a daily time frame

Source: WAVES/USDT by tradingview

Supertrend: The WAVES coin price has fallen rapidly in the past week following the bearish sentiments in the overall cryptocurrency market. As a result, the WAVES coin price has started trading in the long-term demand zone. Recent bearishness in the price of WAVES coin price resulted in the breakdown of the super trend by line. Previously, the super trend buys line was acting as a strong demand zone. The breakdown of the super trend buy line, was with a strong bearish candlestick pattern. As of now, the super trend indicator has triggered a sell signal. Moving upwards the coin price can face strong rejection of the super trend sell line.

Relative Strength Index: RSI curve is trading at the price of 44.12 as the coin fell to the demand zone. At present, the RSI curve has crossed the 20 SMA. The coin is forming lower low and lower high formation on a daily time frame as the coin shows bearishness in the higher time frame. The WAVES coin price can be seen moving if it sustains the recent gains and breaks the supply zone and if it does then the RSI curve can be seen moving even higher up supporting the trend, crossing the 50-halfway mark

Average Directional Movement Index: ADX curve has been falling for the past couple of days. This has come after the coin price failed to surpass the supply zone. At present, the ADX curve is transacting at 21.45. Recent bearishness has resulted in the ADX curve slipping below the 25 Mark. If the coin price fails to bounce off the demand zone, the ADX curb can be seen losing strength and falling further.

CONCLUSION: The WAVES coin price is trading at the demand zone, and as the price action suggests, is forming a bullish chart pattern. As per technical parameters, the coin price can continue in a bearish trend for a larger time frame. Although the coin price has formed a bullish candlestick pattern at the demand zone, it remains to see if the WAVES coin price successfully bounces off the demand zone or falls below it. An investor should remain cautious and wait for a proper signal and then act accordingly.

SUPPORT: $4.00 and $4.10

RESISTANCE: $6.0 and $6.7

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish any financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Hedera

Hedera  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Synthetix Network

Synthetix Network  Tezos

Tezos  Gate

Gate  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  Decred

Decred  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur