When Will Crypto Winter Thaw Out? Total Crypto Market Cap (TOTAL) September 20, 2022

In this episode of NewsBTC’s daily technical analysis videos, we examine the total cryptocurrency market cap (TOTAL) following Ethereum Merge-related disappointments and sideways Bitcoin price action, and attempt to understand how long crypto winter might last.

Take a look at the video below:

VIDEO: Total Crypto Market Cap Analysis (TOTAL): September 20, 2022

Bitcoin price action continues to go mostly nowhere and Ethereum has pulled back due to Merge-related sell the news profit-taking, so in the video below we take look at these factors combined via the Total Crypto Market Cap chart.

Related Reading: WATCH: Bitcoin Bloody Monday Leads To Reversal Hammer | BTCUSD September 19, 2022

When Will The Cryptocurrency Market Bottom And What Next?

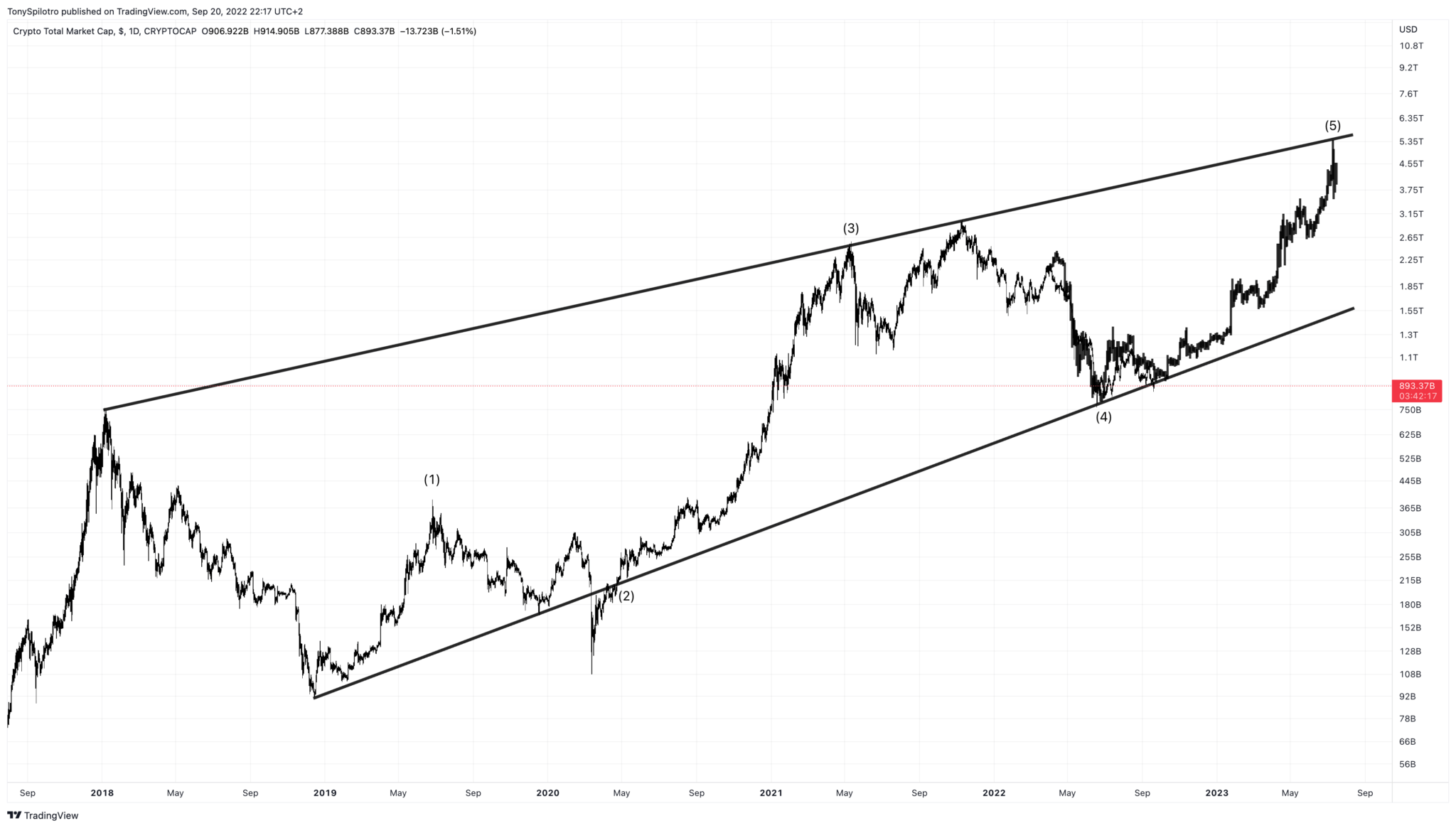

Sentiment, price action, and technical indicators all are behaving similarly to the 2018 bear market bottom. If no new lows are made, taking a bars pattern fractal from the bear market bottom and fitting it over the current price action could give some clues into what to expect.

Fitting the fractal perfectly involves increasing its size slightly, which results in a higher high if the similarities were to continue. The higher high would also occur at around the same trend line where the last double top formed.

Connecting resistance levels and support levels could create the structure of a rising wedge or in Elliott Wave terms, an ending diagonal. Ending diagonals form when an asset’s price has climbed far too much too fast.

Here is access to a FREE 1-hour course on how to spot an Elliott wave pattern on a price chart and develop a solid trading plan around it.

Get The Elliott Wave Principle Applied right (normally a $99 value) right here: https://t.co/7a7sDe3SM3 pic.twitter.com/NKzIcwiuWy

— Tony «The Bull» Spilotro (@tonyspilotroBTC) September 19, 2022

The fractal would provide the final wave 5 before a larger bear market in crypto. In Elliott Wave Theory, wave 5 can often match the magnitude of wave 1, which makes price and technicals behaving similarly as wave 1 that much more notable here.

Although wave 3 is typically the longest in Elliott Wave Theory, there is evidence that in commodities, wave 5 is the strongest due to supply and demand. In the past, cryptocurrencies have shown impressive performance during a wave 5.

Could a wave 5 in crypto still be left in the bull market? | Source: TOTAL on TradingView.com

Total Market Cap More Bullish Than Bitcoin

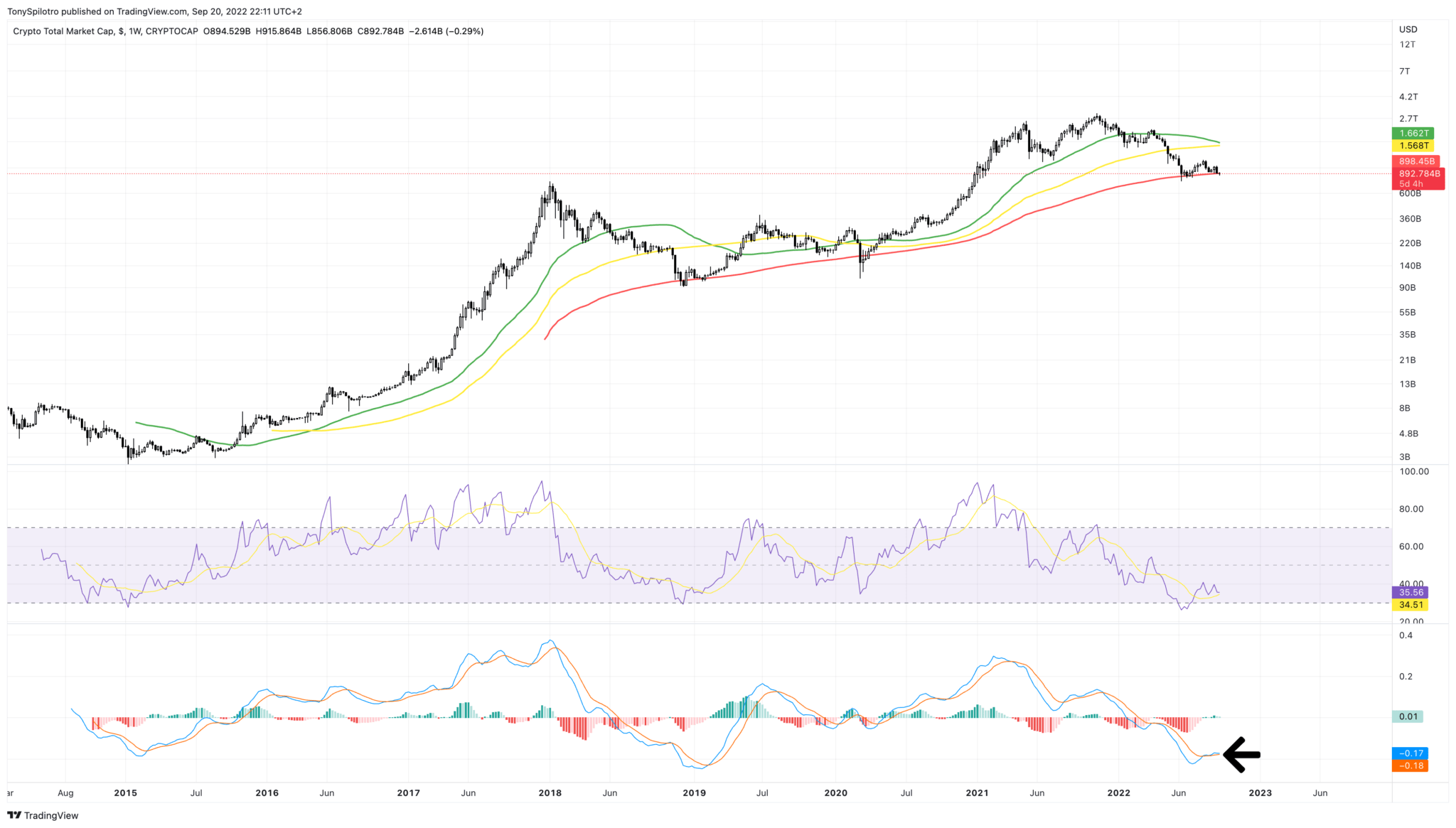

On weekly timeframes, the Total Crypto Market Cap is much more bullish than Bitcoin, having crossed bullish on the LMACD long ago, while Bitcoin waits for the signal to confirm with a weekly close.

The Relative Strength Index also reached oversold conditions, which in the past has been enough to put in a bottom in crypto. Unlike BTC, the Total Crypto Market cap is clinging onto the 200-week Moving average, which in the past has also signaled the end of crypto winter.

Several signals from the last crypto winter have appeared | Source: TOTAL on TradingView.com

Related Reading: WATCH: Bitcoin Barely Holds Onto $20,000 Support | BTCUSD September 16, 2022

Why Crypto Winter Could Last Another Several Months

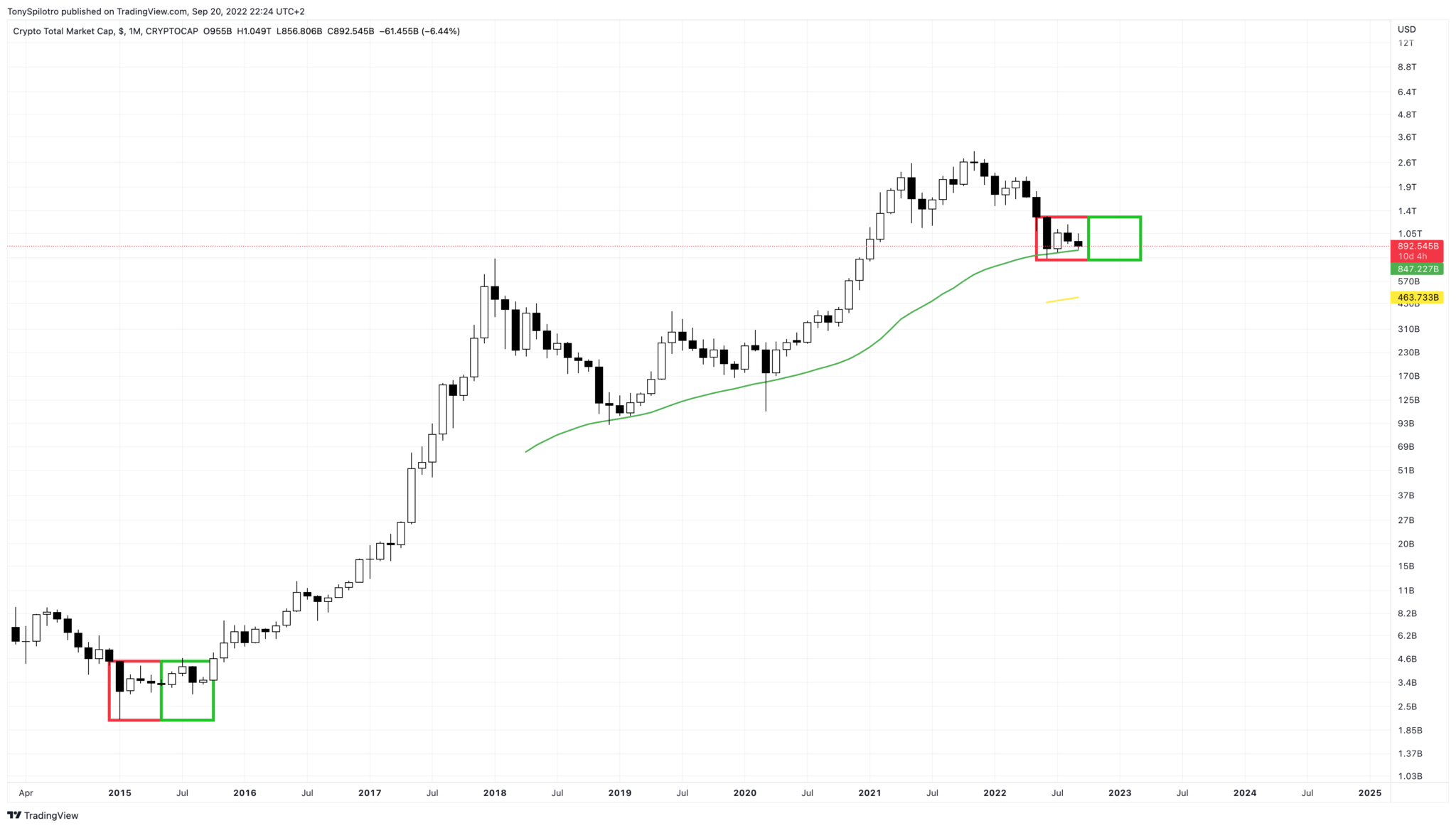

Flipping to monthly timeframes, also shows that the 50-month moving average is also doing its best to keep crypto afloat.

Although daily and weekly timeframes show several key similarities with the 2018 bear market bottom, the monthly timeframe’s current candlestick structure better resembles the 2014 bear market bottom, which when compared, could suggest that the crypto winter has several more months to go before prices begin to thaw out.

How much longer will crypto winter last? | Source: TOTAL on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading Course. Click here to access the free educational program.

Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur