Why Extreme Fear Is Back In Crypto In A Big Way

Data shows the crypto market has once again sunk back down into a state of extreme fear after showing some signs of improvement during the last couple of months.

Crypto Fear And Greed Index Says Market Is Extremely Fearful Right Now

As per the latest weekly report from Arcane Research, the market has now observed fearful sentiment for five months without a break.

The “fear and greed index” is an indicator that tells us about the general sentiment among investors in the crypto market.

The metric uses a numeric scale that runs from zero to hundred for displaying this sentiment. All values above 50 signify that investors are greedy right now, while those below the threshold suggest a fearful market.

End range values of more than 75 and less than 25 represent sentiments of “extreme greed” and “extreme fear,” respectively.

Historically, tops in coins like Bitcoin have formed while the investors have gone through extreme greed, while bottoms have taken place in periods with extreme fear.

Related Reading: Bitcoin Diamond Hands: Long-Term Holder Supply Surges Up To Near ATH

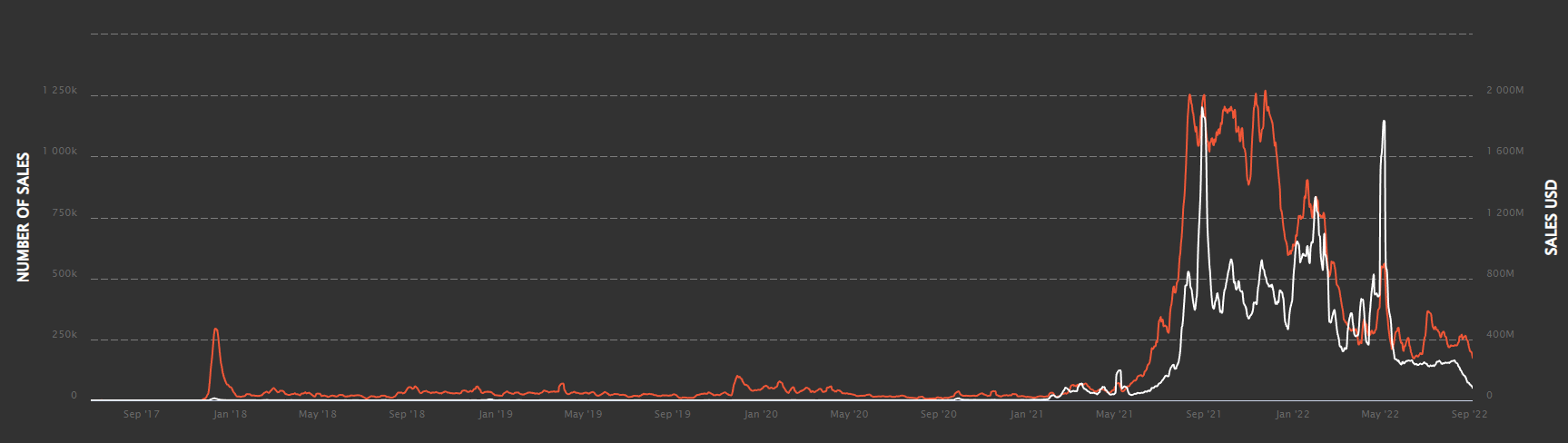

Now, here is a chart that shows the trend in the crypto fear and greed index over the past year:

Looks like the value of the metric has gone down in recent days | Source: Arcane Research’s The Weekly Update — Week 35, 2022

As you can see in the above graph, the crypto fear and greed index had been recovering during July and August, after the market had earlier been under a long spell of extreme fear.

The indicator almost reached greed values during this optimism buildup, but as the latest rally in Bitcoin died down, so did the investor mentality.

Related Reading: Bitcoin And Ethereum Are Web3 Market Innovators, Could GryffinDAO Be Taking DAO To An Unnoticed & Undervalued Market?

The sentiment quickly fell back deep into fear, and the decline has continued now, taking the value of the index to just 22. This means that the sector is now once again experiencing extreme fear.

The report notes that the sentiment has remained in the fearful region since April now, making it a run of five straight months of fear. Since the fear and greed index was conceived back in February 2018, this stretch of fear has been the longest such run.

BTC Price

At the time of writing, Bitcoin’s price floats around $18.7k, down 8% in the last seven days. Over the past month, the crypto has lost 18% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have plunged down below the $19k mark for the first time in more than two months | Source: BTCUSD on TradingView

Featured image from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, Arcane Research

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Decred

Decred  Dash

Dash  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur