XRP Price Plummets 25% – Will Stellar (XLM) Follow Suit?

Both XRP (XRP) and Stellar (XLM) have been falling since Sept. 23. While the bullish structure for the former is still intact, the latter is more decisively bearish, suggesting new lows will eventually occur.

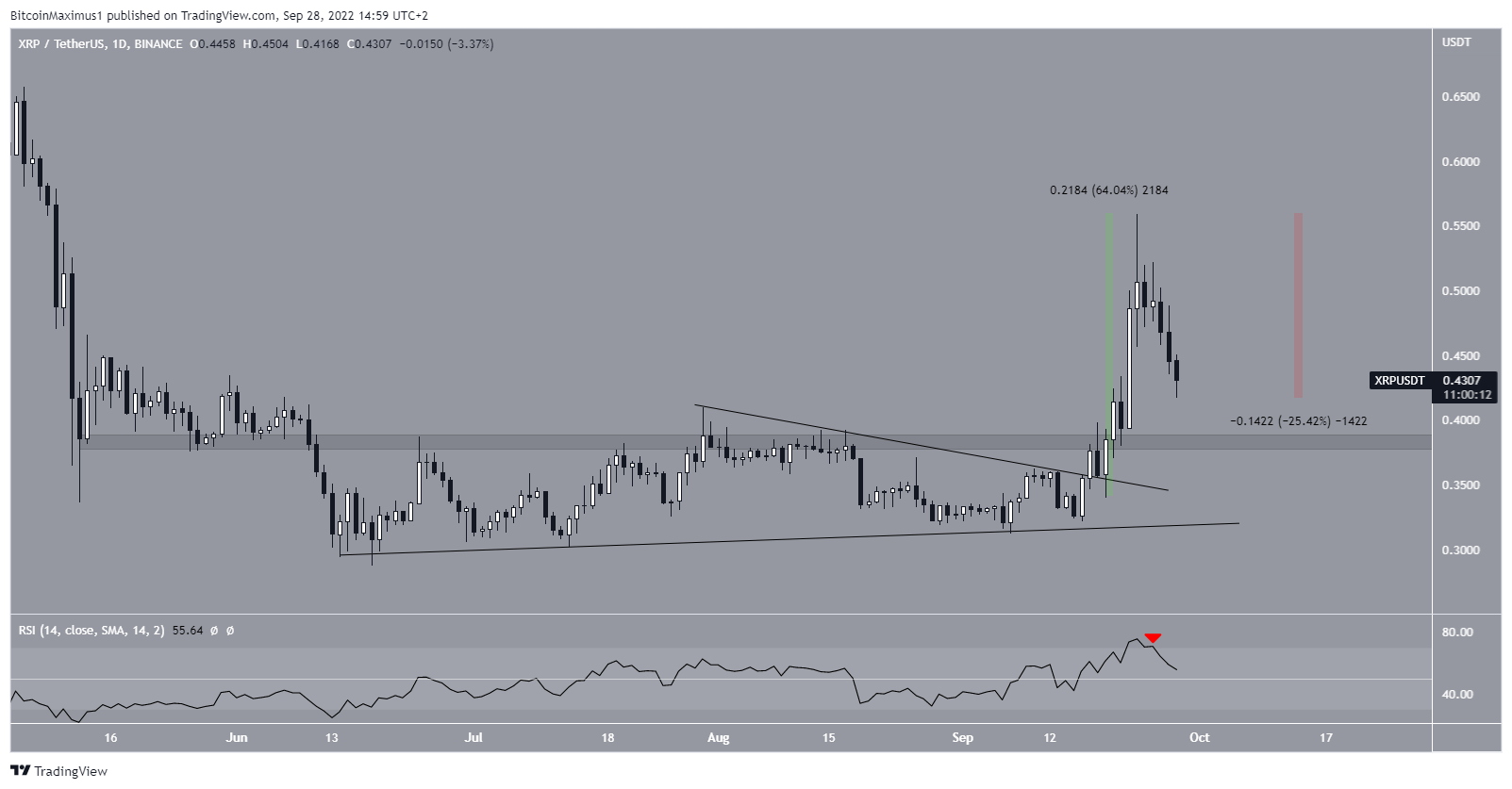

On Sept. 17, XRP broke out from a descending triangle pattern which had been in place since June 14. The breakout led to a high of $0.559 six days later, an increase of 64%. It is possible that the increase was fueled by speculation about a positive settlement in the ongoing Ripple vs SEC case.

However, the price has been falling since, leading to a low of $0.416 on Wednesday, a decrease of 25% measuring from the high. The decrease occurred despite partnership announcements with both I-Remit and Armada Music.

Throughout this downward movement, the daily RSI has also fallen below 70 (red icon), a sign of a bearish trend.

If the downward movement continues, the closest support area would be at $0.384. The area had previously acted as resistance since June and is now expected to provide support.

XRP/USDT Chart By TradingView

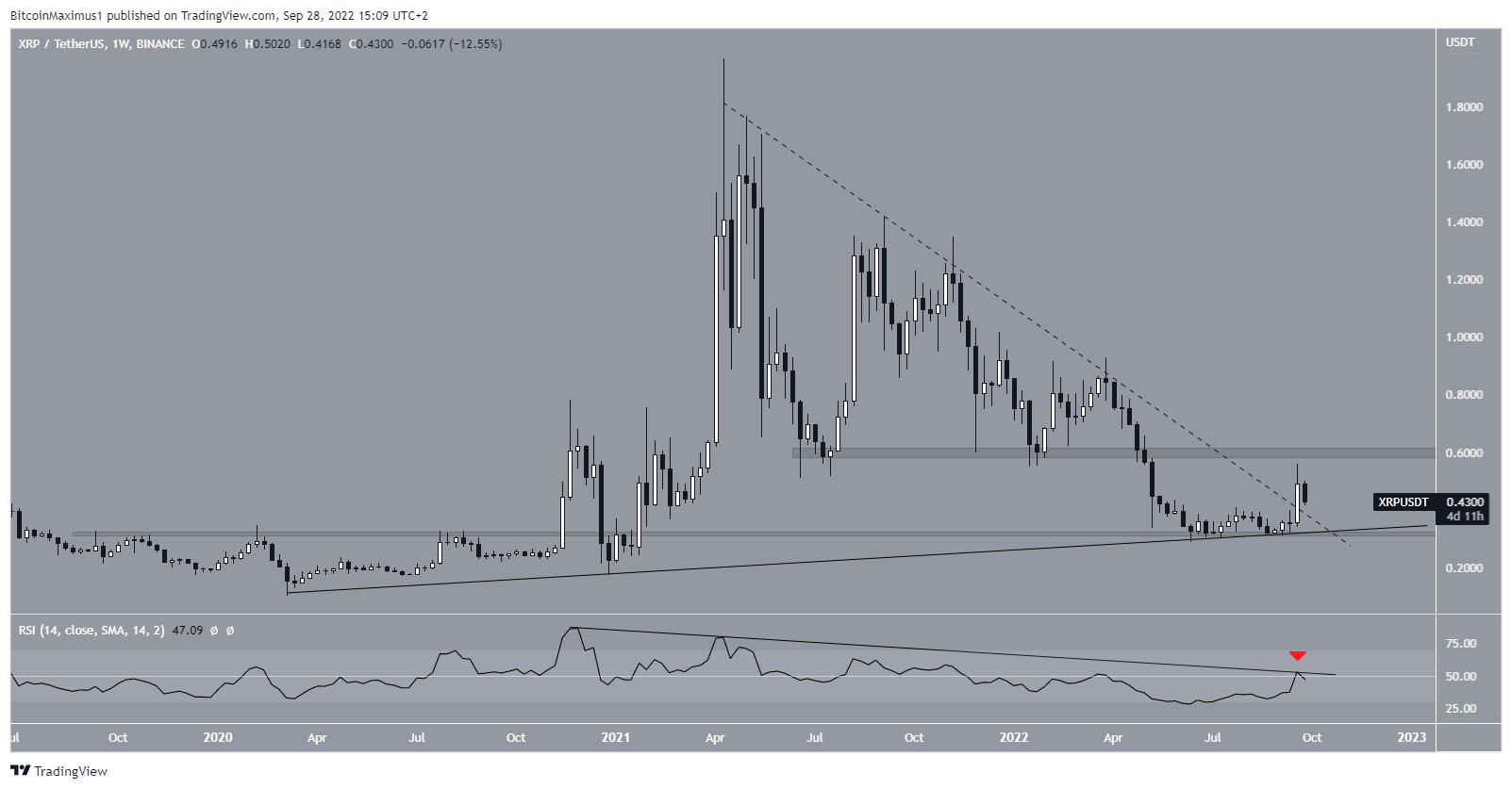

Future still looking bullish for XRP

Despite this ongoing fall in the daily time frame, the outlook from the weekly chart is still bullish. The main reason for this is that the price has broken out a long-term descending resistance line (dashed) and now seems to be validating it as support.

So, a re-test of the $0.384 support area would also cause a validation of the line as support.

However, in order for the bullish reversal to be confirmed, the weekly RSI has to move above 50 and break out from its own descending resistance line (black). Until that occurs, the bullish reversal cannot be confirmed despite it being likely.

XRP/USDT Chart By TradingView

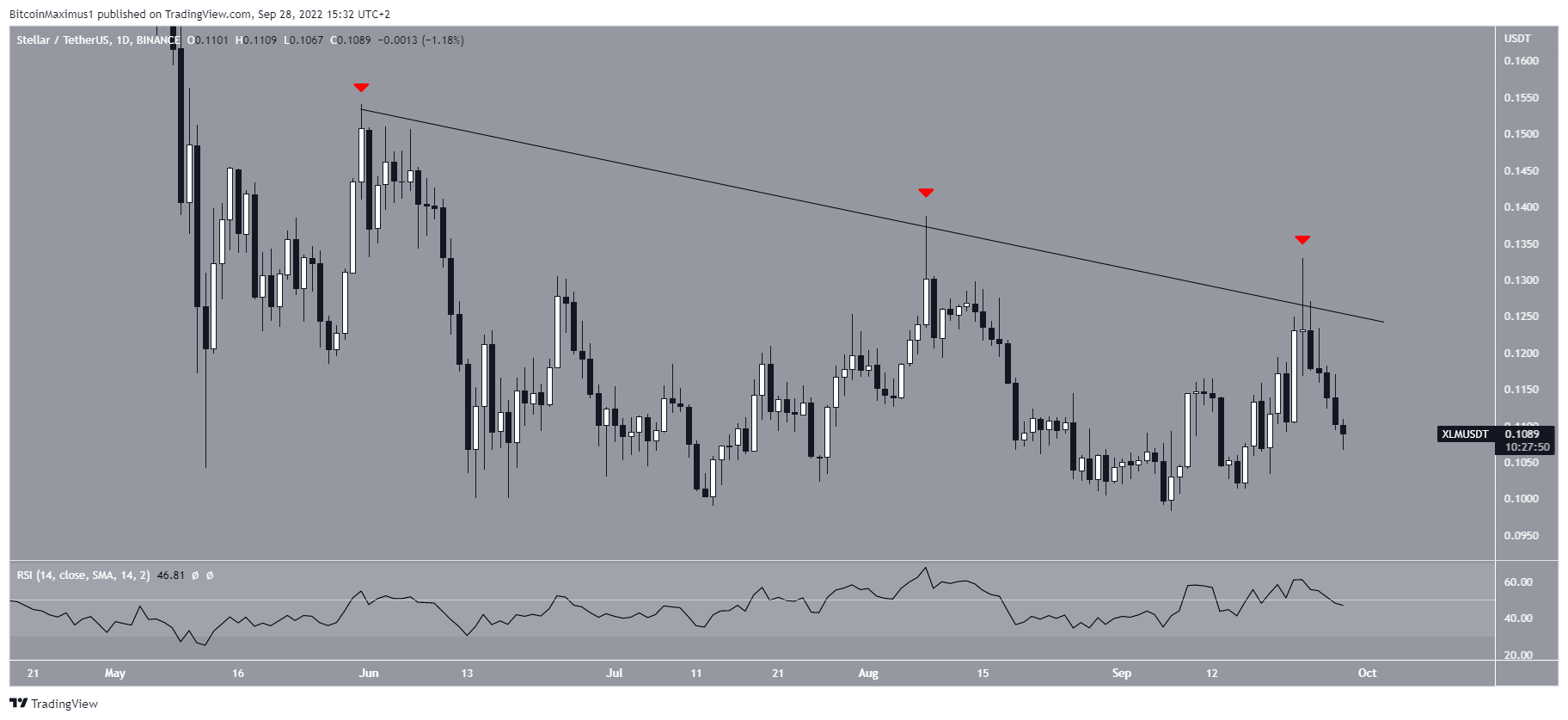

XLM future less positive

The price movement for XLM is more bearish than that of XRP. The price has been decreasing underneath a descending resistance line since the beginning of June. More recently, the line caused a rejection on Sept. 23 (red icon).

The ensuing decrease also caused the RSI to fall below 50, in what is considered a sign of a bearish trend. As a result, the outlook from the daily time frame is decisively bearish.

XLM/USDT Chart By TradingView

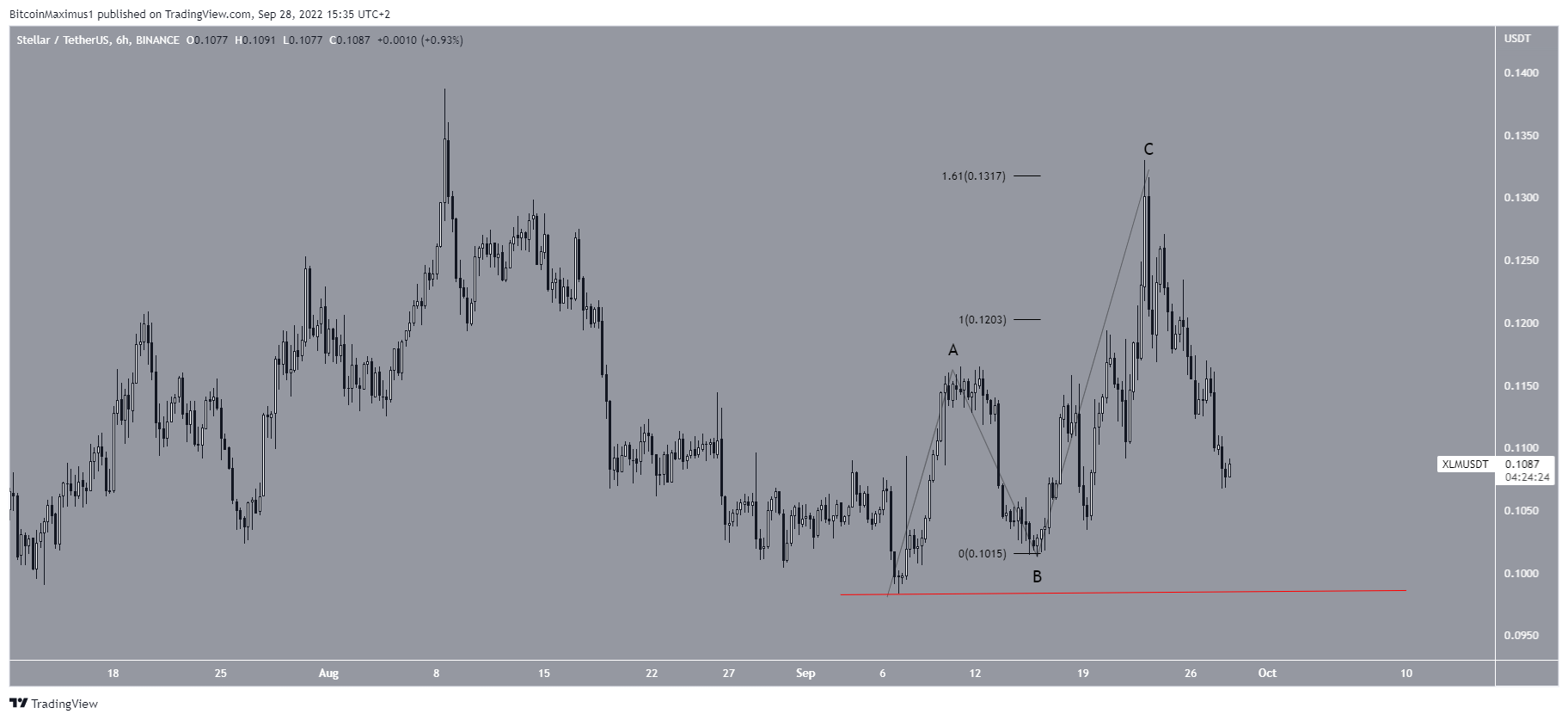

Furthermore, it seems that the price has completed an A-B-C corrective structure, in which waves A:C have had a 1:1.61 ratio. This is a common ratio in such structures.

Since the correction is moving upward, this means that the trend is still bearish. A decrease below the $0.098 lows (red line) would be expected to accelerate the rate of decrease due to the lack of support below it.

XLM/USDT Chart By TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  Enjin Coin

Enjin Coin  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Ontology

Ontology  Dash

Dash  Zcash

Zcash  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur