XRP Unexpectedly Drops to 50-Day Moving Average as 40% of Rally’s Gains Are Gone

The growth of the cryptocurrency market at the beginning of 2023 might be reaching a logical conclusion.

XRP’s complicated state

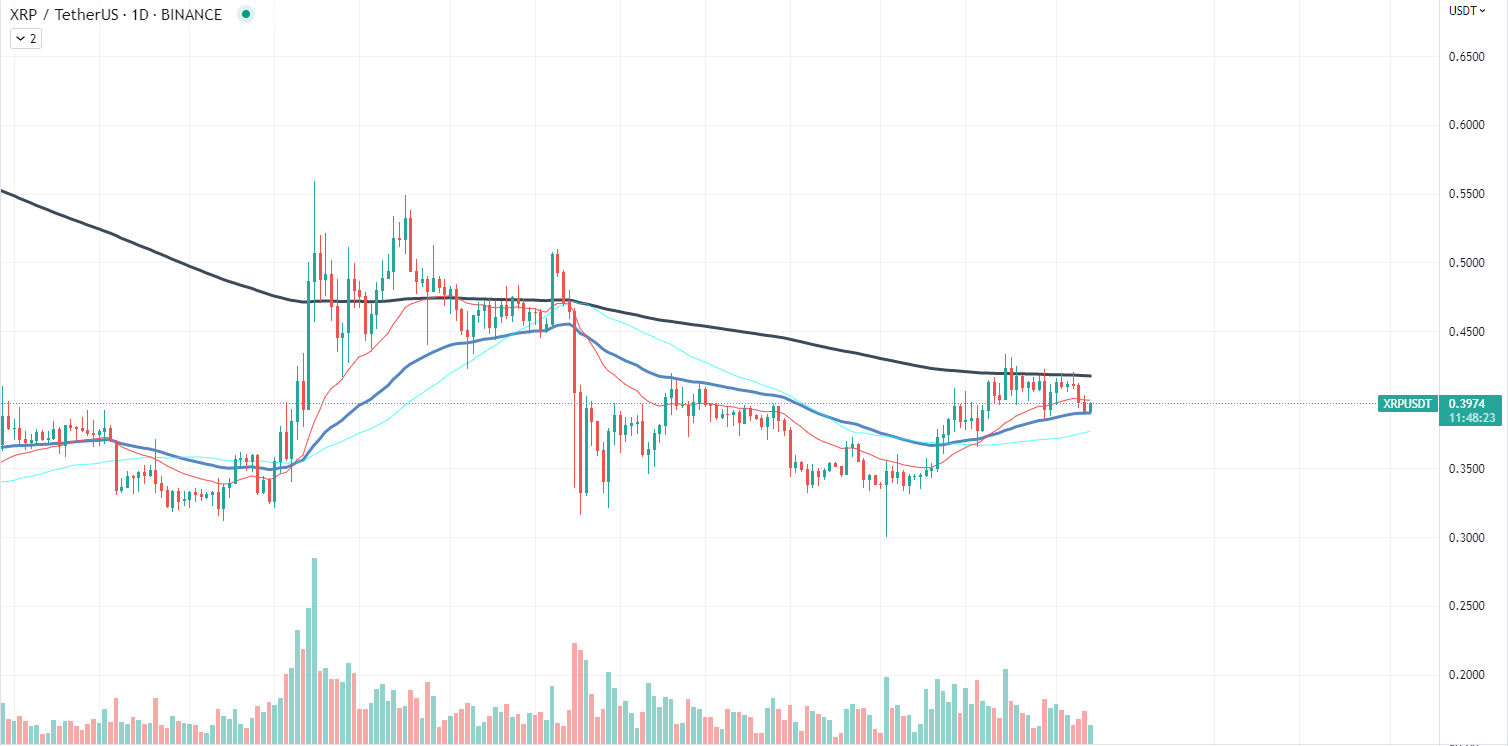

XRP has dropped to a local support level after experiencing a strong 20% price increase since the beginning of the recovery of the cryptocurrency market. The asset reached its 50-day moving average, which is commonly regarded as a main support level for assets moving in an uptrend. However, it should be noted that XRP has yet to enter a prolonged uptrend, as indicated by the placement of moving averages on the daily chart of the asset.

At the time of writing, XRP is trading at $0.39 and has gained less than 1% in value over the last 24 hours. Despite its recent strong performance, it is worth mentioning that approximately 40% of XRP’s gains during the recent rally have already been lost.

Lido making comeback

In the last two days, Lido Finance (LDO) has made a double-digit gain and has become one of the strongest performing assets on the whole cryptocurrency market. The rise in demand for staked Ethereum liquidity is the most likely reason for this unexpected performance.

Lido Finance aims to provide decentralized liquidity solutions for staked Ethereum. In the past 48 hours, LDO has gained more than 14% to its value, making it one of the most sought-after digital assets. The increase in staking volume on the Ethereum network is one of the factors that has contributed to LDO’s strong performance.

However, there are some risks for LDO holders, including the continuously rising competition on the market. At the time of the launch of Ethereum staking, Lido Finance was dominating the market, with almost all the existing staking volume going through only one provider. The situation has changed today, but Lido Finance remains the biggest and most commonly chosen solution for gaining liquidity while staking ETH.

DYDX stays in uptrend

The token has been successfully avoiding the recent selling pressure from big whales, including Justin Sun. Despite Sun’s continuous transfer of DYDX on Binance, which was most likely for selling purposes, DYDX has managed to hold its ground and even show signs of a potential rally continuation.

DYDX saw a 140% rally before dropping by over 20%. However, the asset has already reversed and gained 6% to its value, showing that it has the potential to continue the rally. This sudden turn of events can be attributed to the strength of the DYDX community, which has shown unwavering support for the asset even amid selling pressure from whales.

The strong performance of DYDX can also be seen as a positive sign for the overall cryptocurrency market, as it shows that even with selling pressure from big players, smaller assets can still hold their ground and potentially rally. This could attract more investors to the market and increase overall market confidence.

At press time, DYDX is trading at $2.89 and gaining less than 1% to its value in the last 24 hours. With the asset’s recent performance and the support of its community, DYDX could be one to watch in the coming days and weeks. However, it is important to remember that the cryptocurrency market is a highly volatile one, and investing in any asset comes with its own risks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  KuCoin

KuCoin  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur