Darknet hackers are selling crypto accounts for as low as $30 a pop

Cybercriminals from the darkest parts of the internet are reportedly selling hacked, verified crypto accounts on the darknet for as low as just $30 apiece.

According to an April 24 research paper by online data security provider Privacy Affairs — titled The Dark Web Price Index, cybercriminals have been selling all manner of fraudulently obtained financial account information on the dark web.

Our newest Dark Web Price Index yearly research is ready.

This one is the biggest so far.

Covers many new and interesting trends.

Check it out here: https://t.co/H2tnM4Uuxf#darkweb #hackers #cybersecurity #privacy #cybersecuritytips

— Privacy Affairs (@Privacy_Affairs) April 23, 2023

The prices of some of the ill-gotten verified cryptocurrency accounts include:

- Kraken verified account: $1,170

- Binance verified account: $410

- Crypto.com verified account: $300

- Coinbase verified account: $250

- U.S.-verified Bitrex account: $30

These figures mark a significant increase in the prices paid for the same account details in 2022, according to data from last year’s edition of the Dark Web Price Index. In 2022, hackers were paying just $260 and $250 for verified Kraken and Binance accounts respectively.

Hacked accounts can be used to illegally evade know-your-customer (KYC) measures on popular cryptocurrency exchanges.

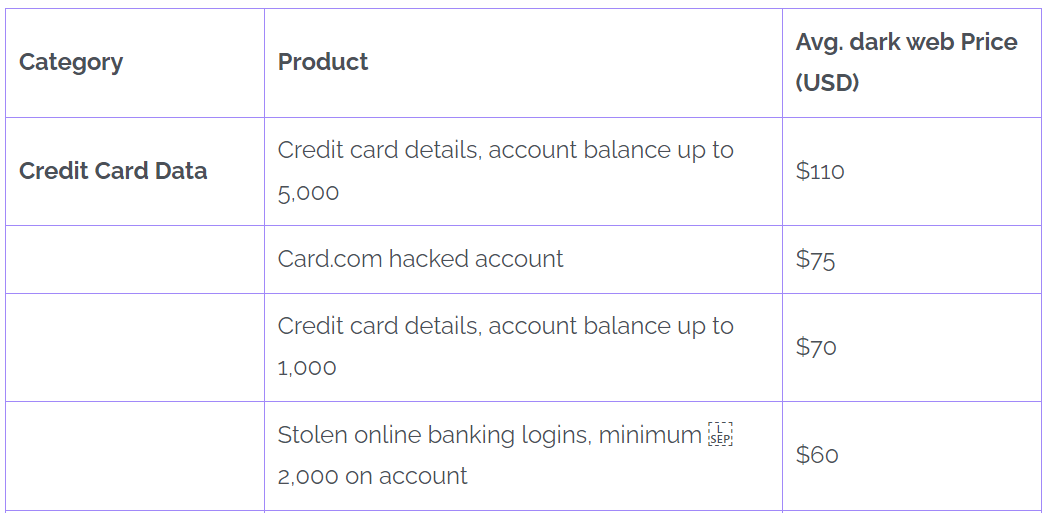

Cryptocurrency accounts aren’t the only items on the list. Account information for credit cards with balances of up to $5,000 are sold for just $110 while login credentials for online bank accounts with balances of up to $2,000 are sold for $60.

Average prices for certain credit card and online login data. Source: Privacy Affairs

Login details for all manner of social media accounts are also up for grabs, including hacked Facebook, Airbnb and Gmail accounts, starting as low as $25 a pop.

In a statement concerning these shocking new figures, Privacy Affairs security researcher Miklos Zoltan said that internet users must be more cautious with their personal information than ever before.

“If someone gets their hands on your financial details or social media credentials, the prices mentioned above are basically what it’s worth to them.,” Zoltan explained.

There’s a good chance that you value these things much more than they do, as to them you’re just another mark for a quick buck.

Related: YouTube helps recover hacked channel that attempted XRP crypto scams

The hacking of accounts at popular crypto exchanges has been a growing problem in the industry.

Recently, a customer of U.S.-based cryptocurrency exchange Coinbase filed a lawsuit against the company following an attack on his account.

He claimed to have lost “90% of his life savings” after he fell victim to a nefarious hack known as a “SIM swap” — where scammers gain control of a phone number by tricking the telecommunications provider into linking the number to their own SIM card.

Magazine: Whatever happened to EOS? Community shoots for unlikely comeback

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Monero

Monero  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond