Axie Infinity Leads Metaverse, NFT Token Rally as Trade Volumes Surge

Metaverse and NFT-focused cryptocurrencies, including Axie Infinity (AXS),Flow (FLOW), Apecoin (APE), and Sandbox (SAND), have posted significant gains over the past 24 hours.

Play-to-earn (P2E) gaming platform Axie Infinity’s AXS governance token soared 25.6% in the last 24 hours, making it the largest gainer among the top 100 cryptocurrencies, per Coingecko.

As of this writing, AXS trades at around $8.54 and is the 46th-largest cryptocurrency boasting a market capitalization just north of $970 million.

Despite today’s heroics, AXS has had a rocky 2022. AXS lost nearly 94.8% of its value from its recorded all-time high of $164.90 in November 2021.

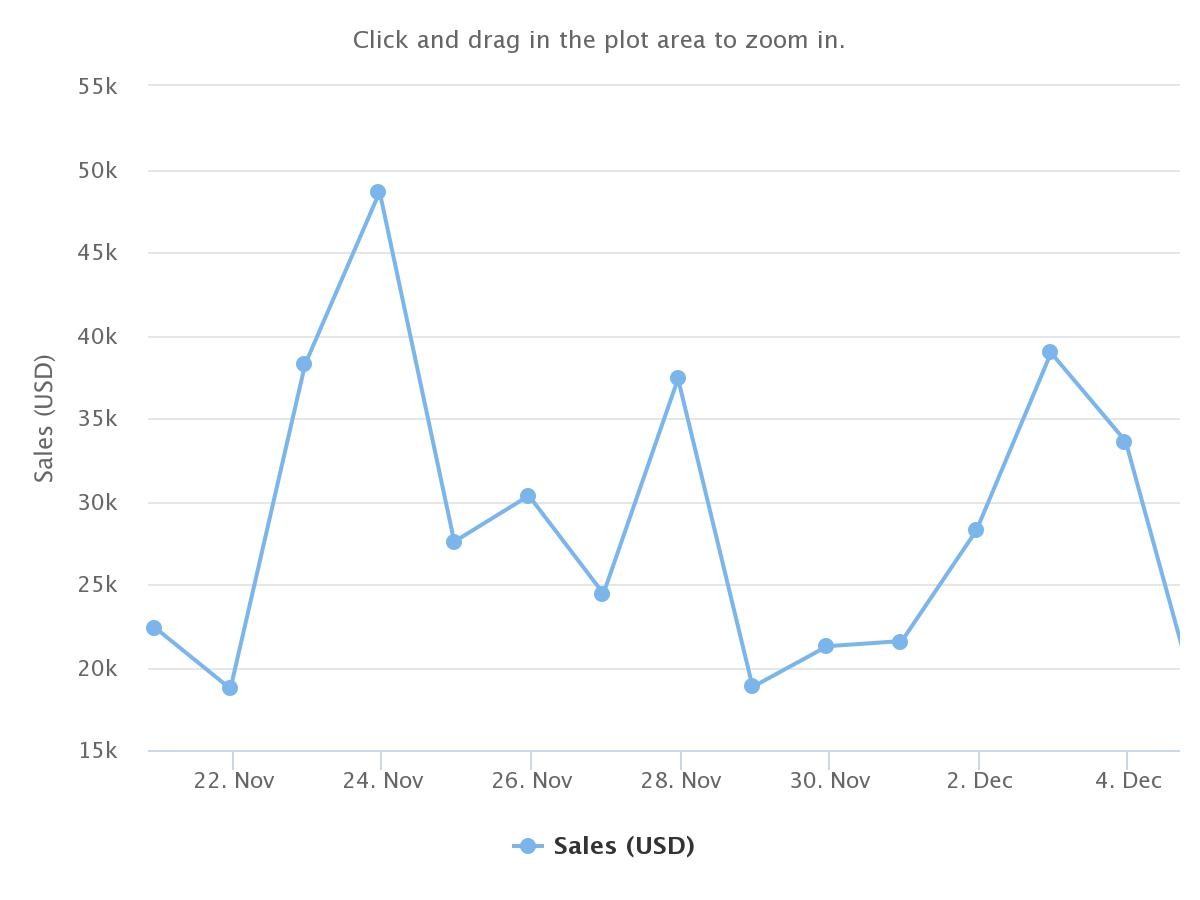

According to NFT data platform CryptoSlam, trading volume for Axie Infinity has fluctuated between roughly $18,000 and as high as $48,000 over the past few weeks.

Axie’s NFT sales from November 21 to December 4. Source: CryptoSlam.

Given today’s bullish price action, roughly $20,000 in AXS short trades were liquidated in the past 24 hours, according to Coinglass.

Meanwhile, the token powering the Flow blockchain has rallied more than 5.5% over the past 24 hours and trades at around $1.15, per data from Coingecko.

In August 2022, Instagram integrated Flow-based NFTs pumped the token’s price to $3. Since then, however, FLOW has been on a downtrend.

As of this writing, FLOW has lost 97.3% of its value since its all-time high of $42.40 in April 2021.

Apecoin (APE), the Ethereum-based token created for the Bored Ape Yacht Club (BAYC) ecosystem, has also gained nearly 4% over the past 24 hours and trades at around $4.12 per Coingecko.

The 34th-largest cryptocurrency APE’s daily trading volumes rose 66% to $192 million over the past day.

SAND, the token powering the virtual real estate project The Sandbox, is up 6.7% to $0.62 over the past 24 hours, participating in the widely driven NFT-based token rally.

According to Coingecko, SAND gained nearly 9% over the past week. But the bullish week hasn’t been strong enough to reverse its yearly losses. In November 2021, SAND rallied as high as $8.40.

What’s pumping the metaverse?

The primary reason driving the bullish price action of the metaverse and NFT-related tokens is the rising sales volume over the past 24 hours.

According to data from CryptoSlam, overall NFT sales volume rose 20.75% in the last 24 hours to just above $16.5 million.

Ethereum-based, in particular, NFTs saw a 31.36% spike in daily trading volumes, followed by Flow with 16.28%, likely contributing to the token’s latest rally.

Yuga Lab’s NFT collections Otherdeed, Bored Ape Yacht Club (BAYC), and Mutant Ape Yacht Club (MAYC) collectively made up roughly 40% of the Ethereum-based NFT’s trading volume, helping APE ride its fortunes.

Beyond NFT and metaverse tokens, leading cryptocurrencies in Bitcoin (BTC) and Ethereum (ETH) have also rallied 1.6% and 2.7% over the past 24 hours. The overall cryptocurrency market is also up 2%, amounting to more than $906 billion at press time.

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond