Top 3 Metaverse Tokens To Buy In The Dip Before 2023- Apecoin, Decentraland, The Sandbox

Cryptocurrency prices were slightly up at the time of reporting as the price of major cryptocurrencies rose marginally during the early morning trading hours on Tuesday (13 December 2022). The global crypto market cap is $848.03B, a 0.83% increase over the last day. Meanwhile, Bitcoin and Ethereum are up 1.45% and 2.10%, respectively.

The price of some of the leading Metaverse tokens, namely ApeCoin, Decentraland and The Sandbox, traded in the red today. In this article, we will discuss three metaverse tokens that are trading lower but worth buying the dip. The trio can likely give you attractive returns in 2023. The critical factors we have considered while picking these coins include their utility, robust financial backing, and data on token transfers by date. However, since one shoe doesn’t fit all sizes, other factors have also been kept in mind while doing this analysis.

Apecoin (APE)

The live ApeCoin price today is USD$4.03 with a 24-hour trading volume of usd$269,824,043. ApeCoin is down 6.52% in the last 24 hours. The current CoinMarketCap ranking of Apecoin is 30, with a live market cap of USD$1,455,674,698. It has a maximum supply of 1,000,000,000 APE coins.

Apecoin price has gained nearly 5.95% in the last one week, while its last one month’s performance is +51.31%. Apecoin is a buy at the moment because the announcement of ApeCoin’s [APE] staking rewards have grown the hype around the token.

Many crypto communities have tried to profit from staking rewards. Users can get their hands on the rewards by becoming a part of any of the four staking pools. One such way is to buy APE and commit it to the pool.

Since the staking of ApeCoin has gone live, the demand for the APE coin has increased, increasing its price. Staking can increase or reduce the price of your coins because it is affected by the market forces of supply & demand.

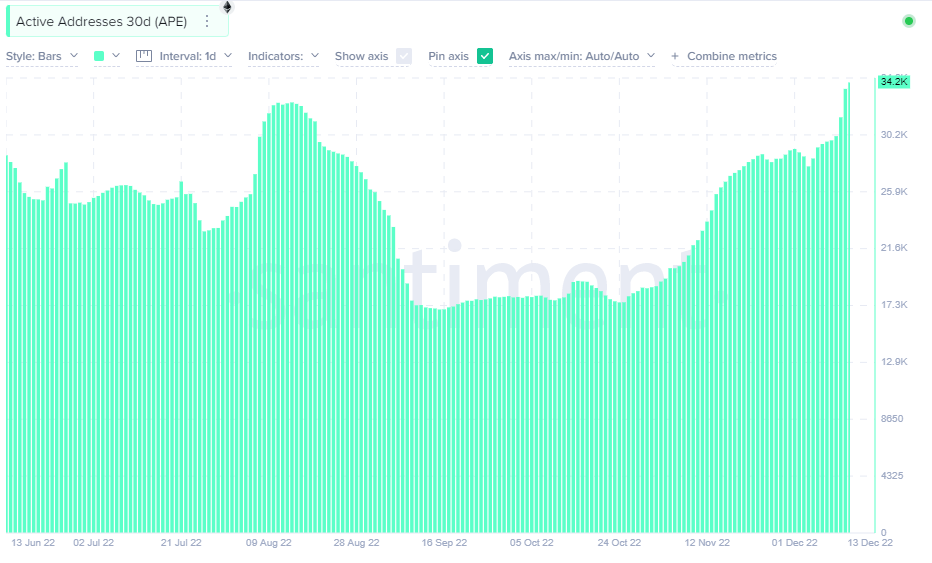

- Chart on 30-day active addresses for ApeCoin

As can be seen in the above shared image, it is observed that daily active addresses for ApeCoin saw a tremendous spike over the last few weeks. Subsequently, ApeCoin’s network growth has also increased. This indicates that the number of wallets transferring APE for the very first time had gone up.

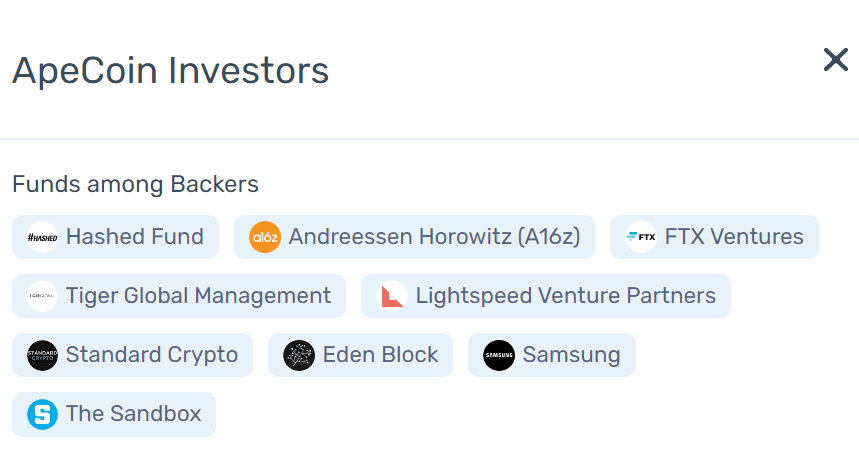

- ApeCoin Investors’ list

Decentraland

The current Decentraland price is USD$0.377683, down 0.18% in the last 24 hours. It has a 24-hour trading volume of USD$26,615,920. With a live market cap of USD$700,634,261, the current CoinMarketCap ranking of the metaverse token is 56. The maximum supply of MANA coins is not available. In the last one week, MANA’s price has fallen by 6.74%. The past one month and six months’ performance of the metaverse token stands at -15.14% and -54.42%.

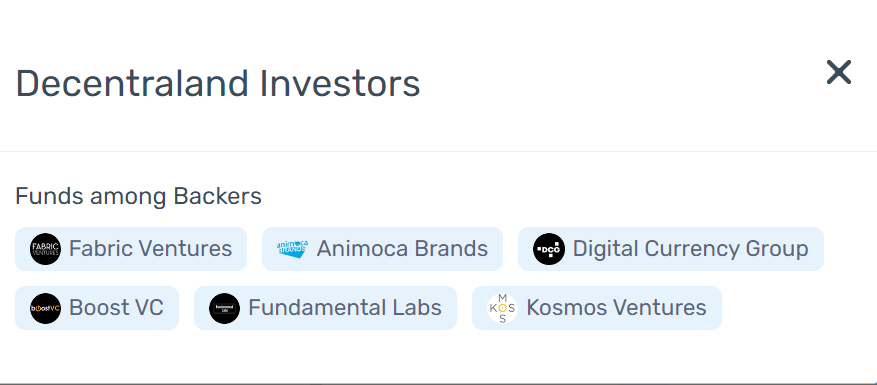

Companies that have invested in Decentraland include Republic Realm, Samsung 837X, and Sotheby. Formed in 2017, Decentraland is one of the older projects. As of October 24, it was the third-largest metaverse token in terms of market capitalization.

Decentraland Investors’ list

Token Transfers by data chart:

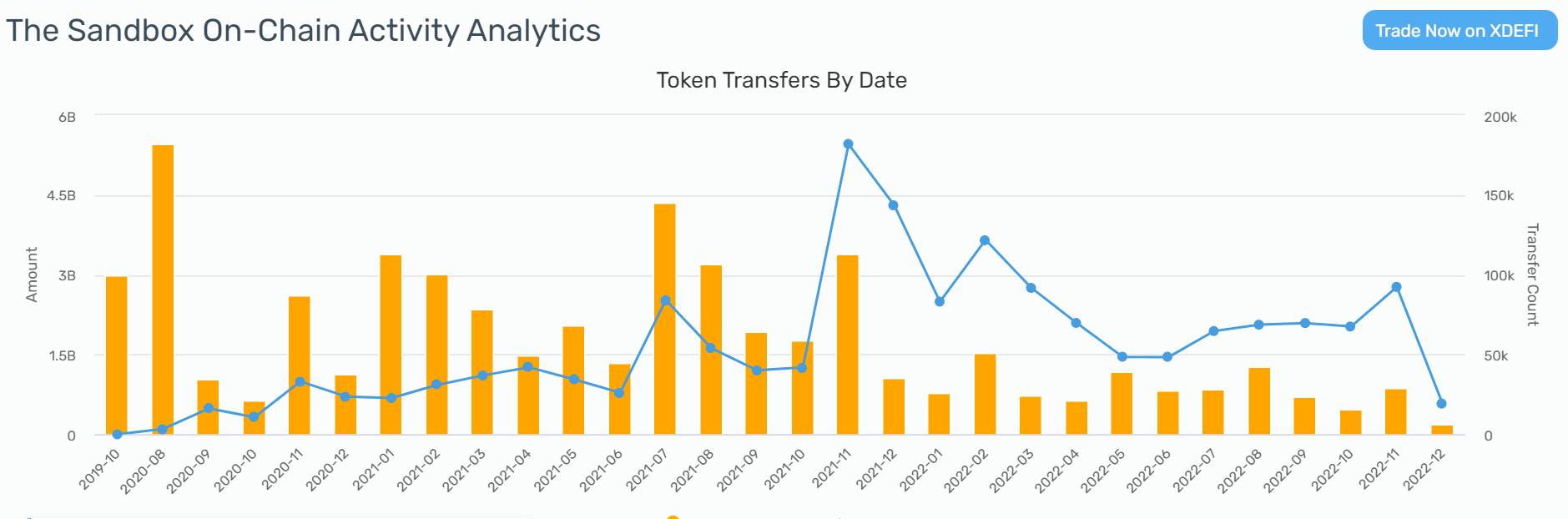

The Sandbox

The Sandbox price today is USD$0.551138 with a 24-hour trading volume of USD$75,106,148. The Sandbox price is down 0.43% in the last 24 hours. With a live market cap of USD$826,415,252, the current CoinMarketCap ranking of Sandbox is 49. It has a maximum supply of 3,000,000,000 SAND coins. In the last one week, The Sandbox price has fallen nearly 8.92%; it has dropped 35.75% in the last six months.

With the virtual reality (VR) aspect, this project is discovering the vision of the metaverse. The Sandbox is basically a game, and it has the support of gaming brands such as Atari, which could help it navigate unfavorable market conditions.

Another promising factor about this project is its limited coin supply of 3 billion tokens, of which 1.5 billion are in use. Seeing the increasing popularity of “The Sandbox,” several projects have bought land on the platform by entering into partnerships. These include British multinational universal bank HSBC, Standard Chartered Bank (Hong Kong), and PricewaterhouseCoopers (PwC).

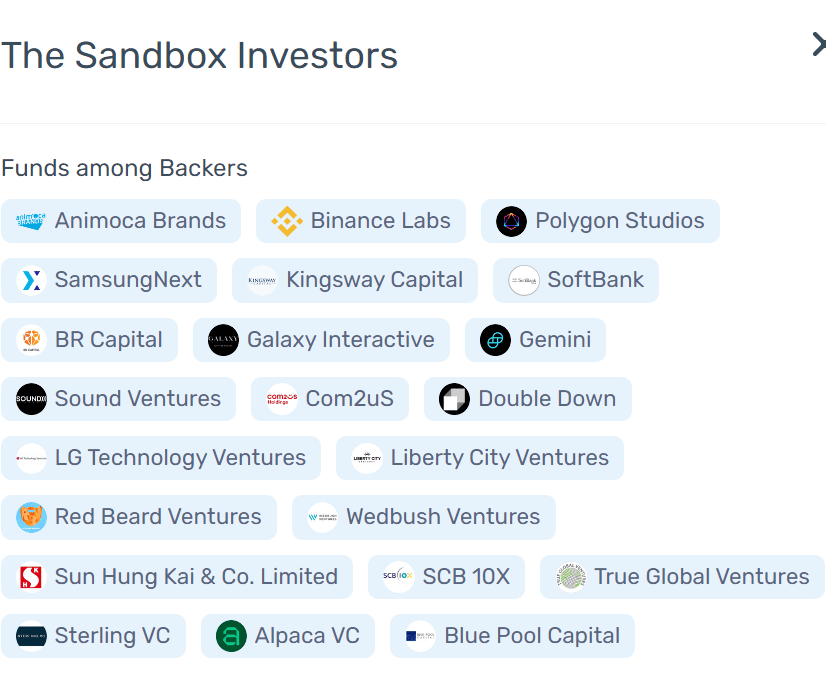

The Sandbox’s Investors’ list

Token Transfers by data chart:

Conclusion

The term “metaverse” has become a sizzling topic these days. The world’s biggest tech companies are investing heavily to build the metaverse for the future. These include Facebook, Microsoft, Google, Epic games, and the list goes on. Although the technology is yet to enter the mainstream, it is quickly gathering the attention of tech as well as crypto investors. It can thus be said that metaverse coins present an untapped opportunity for 2023.

The positive news is that since metaverse projects are comparatively new, coin prices are relatively low — below $1 in some cases. This opens the investment opportunity for almost everyone. However, this doesn’t mean that all projects are worth your money.

Disclaimer:

It is to be noted that the crypto market is highly volatile, and the metaverse concept is deeply rooted in cryptocurrency and blockchain. There is always a probability that what seems to perform well in the future plunges down for several reasons. Our article is not investment advice but a short analysis and personal opinion. It is always recommended to do your research before making any investment decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD