Coinbase insiders sold $7.4M stocks in the last 30 days

Coinbase insiders — including its chief executive officer Brian Armstrong and other executives — have sold $7.4 million worth of the company’s stocks in the last 30 days, according to Dataroma data.

Coinbase CEO sold $5.8 million stocks

Brian Armstrong sold $5.8 million in COIN stocks during the period — almost 50% were sold in the last 24 hours. According to the data, Armstrong sold around 30,000 shares on March 21 for $2.24 million.

His other sales occurred on March 3 and 15, when he sold roughly 60,000 shares for $3.56 million. According to the data, Armstong sold his stocks when they traded between $51 and $76.

In October 2022, Armstrong pledged to sell 2% of his stake in the U.S.-based crypto exchange. He said the sales would fund scientific research and development through two startups NewLimit and Research Hub.

Meanwhile, other Coinbase executives — including its chief people officer Brock Lawrence, chief accounting officer Jones Jennifer, and chief legal officer Grewal Paul — cumulatively sold stocks worth $1.68 million.

Coinbase insiders have made over $5 billion from stock sales

Dataroma data showed that Coinbase insiders and early investors have cumulatively made $5.8 billion from their sales of the exchange’s stocks.

Per the data, $5 billion of these trades were made on Coinbase’s first day of going public. At the time, Armstrong sold 749,999 shares for $291.8 million and has not sold until after his October 2022 announcement.

Meanwhile, Coinbase insiders have only bought $86.9 million worth of the company stocks. The purchase was made by the exchange’s board member Tobias Lütke and its co-founder Fred Ehrsam.

Investment funds like Cathie Wood’s Ark Invest is one of the heavy traders of the company’s stock. For context, the company bought more than 350,000 shares for $22 million in early March. The firm sold some of its holdings — $13.5 million — for the first time in this year on March 21.

Coinbase stock price performance

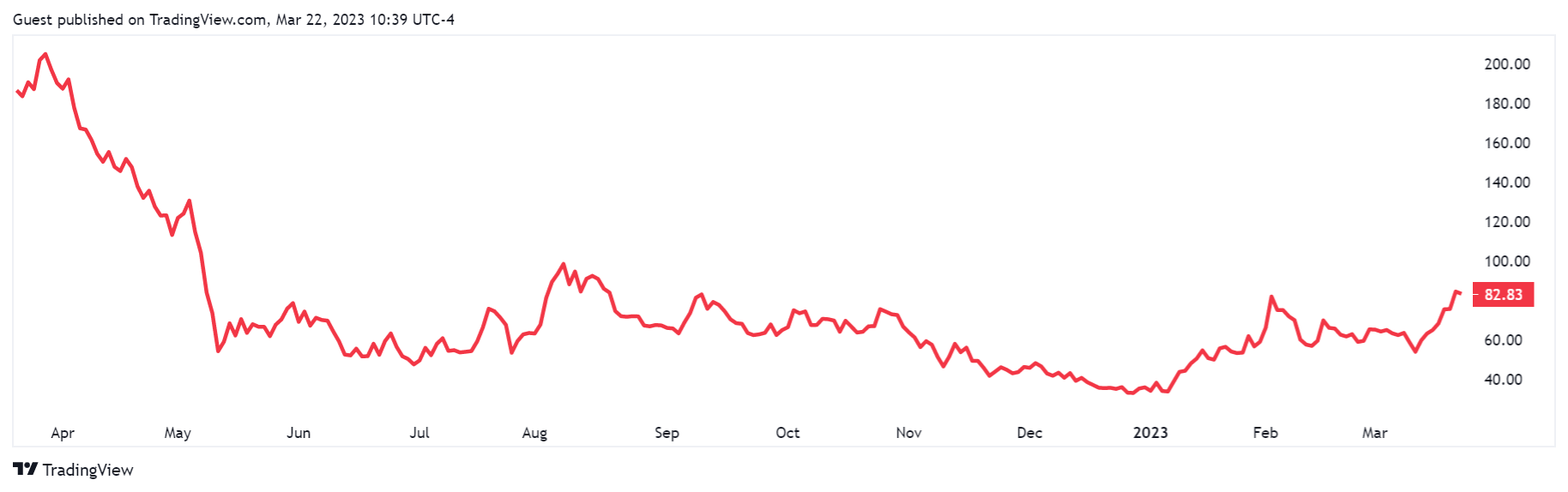

After peaking at around $350 when the company went public in 2021, COIN’s value declined by more than 86% in 2022 following the crypto winter that negatively affected the market.

However, with the crypto market recovering in the current year, COIN’s value has risen by nearly 150% on the year-to-date metric but is still down 54% over the past 12 months, according to TradingView data.

Coinbase stock today is down 0.57% to $83.51. The cryptocurrency exchange announced its expansion to Brazil and also revealed that it tested OpenAI’s ChatGPT tool for its blockchain security process.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  Zcash

Zcash  LEO Token

LEO Token  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD