SEC Chair Gary Gensler Blames Crypto For Banking Crisis

The year 2023 started with U.S. banking regulators the OCC, the Federal Reserve Board, and the FDIC joint statement highlighting risks posed by crypto to the banking sector. The regulators stated to take a cautious approach related to crypto asset-related activities and exposures at each banking organization.

The positive sentiment led by favorable on-chain and technical indicators drove Bitcoin price to rally 40% in January. The shares of banks including Silvergate, Silicon Valley Bank, and Signature traded normally and regulators didn’t take any action against these banks. However, the Federal Reserve Board rejected Custodia Bank‘s application for Federal Reserve System membership and release a statement to reduce banks’ exposure to crypto.

“The Board has not identified any authority permitting national banks to hold most crypto-assets […] As principal in any amount, and there is no federal statute or rule expressly permitting state banks to hold crypto-assets as principal. Therefore, the Board would presumptively prohibit state member banks from engaging in such activity under section 9(13) of the [Federal Reserve] Act.”

In February, crypto leaders with connections in the U.S. government agencies and Washington, D.C. warned of a widespread crackdown against the crypto market planned by the Biden Administration. Crypto-friendly banks such as Silvergate, Signature, and Metropolitan Commercial Bank were predicted to be the first target of regulators.

Operation Choke Point 2.0

Venture capitalist Nic Carter termed “Operation Choke Point 2.0” coordinated by the SEC, Treasury Dept, Federal Reserve Board, and other regulators to strangle the crypto industry by cutting its ties with the banking sector. Coinbase CEO Brian Armstrong revealed that the U.S. Securities and Exchange Commission (SEC) is likely looking to ban crypto staking.

A regulatory crackdown against crypto led by U.S. SEC started a series of problems for the crypto market. The SEC took action against crypto staking offered by Kraken, regulators took action against Binance and BUSD, and other crypto exchanges such as Coinbase and Bittrex.

In March, the regulators-led crackdown surprisingly caused the closure of crypto-friendly banks Silvergate, Silicon Valley Bank, and Signature in a week. Regulators blamed crypto for the banking crisis, but the turmoil happened due to continued rate hikes by Federal Reserve and wrong management decisions.

Brian Armstrong, CZ, Elon Musk, Nic Carter, Arthur Hayes, and Cathie Wood blasted regulators for blaming crypto. Congressman Tom Emmer wrote a letter to the FDIC chairman Gruenberg blaming him for instability in the banking sector to choke crypto activity in the U.S.

The U.S. House Financial Services Committee is finally looking into potential coordinated efforts by the U.S. regulators to de-bank the crypto market.

Who Will SEC Chair Gensler Blame For Collapse of Non-Crypto First Republic Bank?

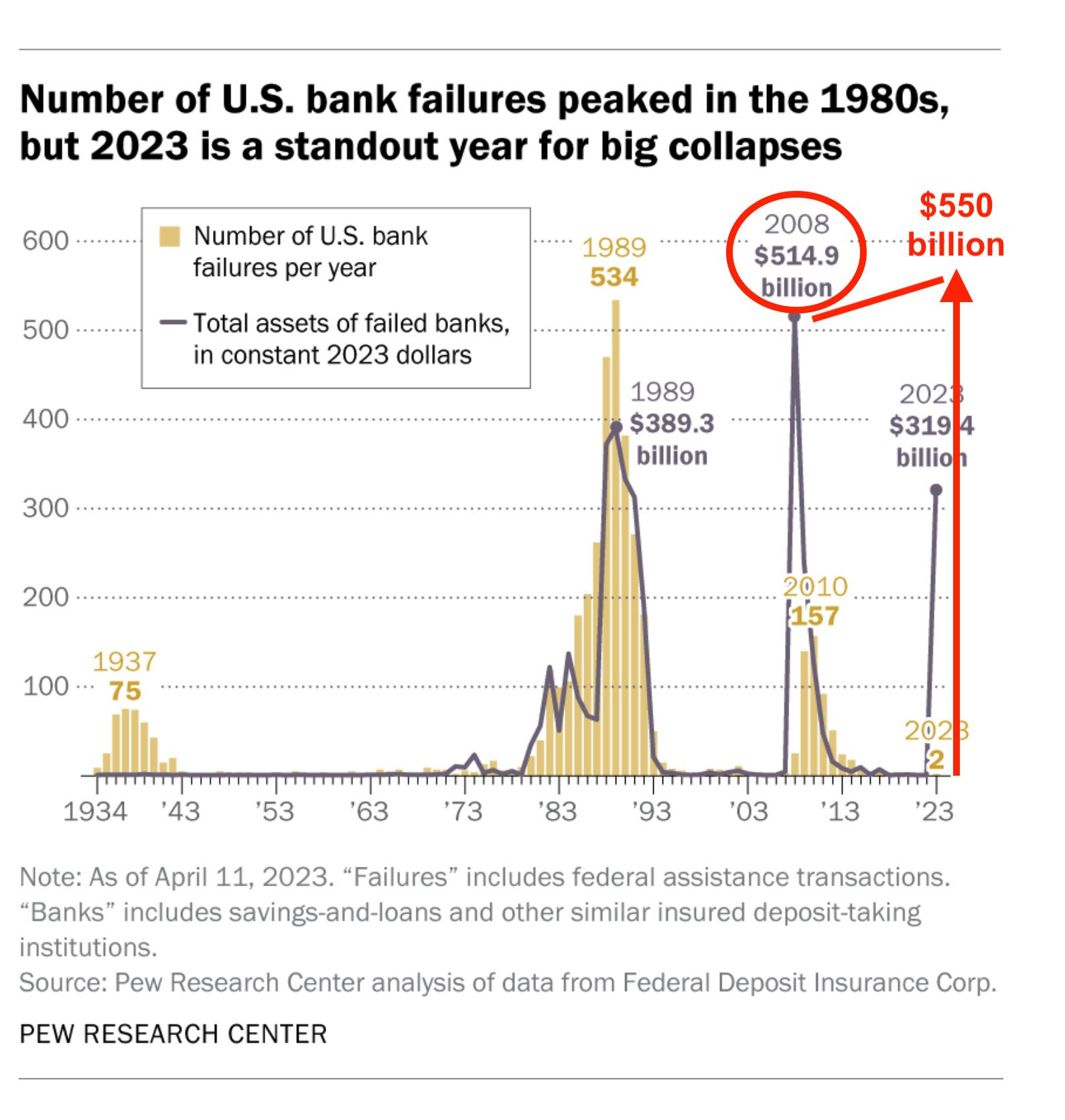

SEC Chair Gary Gensler blamed crypto for the collapse of banks when he was asked by House Republicans over the agency’s treatment of digital assets, including the lack of clarity. This week, JPMorgan absorbed First Republic Bank after the new problems started with the bank despite a $30 billion deposit in March by Big banks including JPMorgan and PNC. With the collapse of First Republic Bank, the year it’s tuning out to be the worst for banks in terms of asset losses as compared to the 2008 Global Financial Crisis.

With another wave of banking crisis starting, who will SEC Chair Gary Gensler blame for the collapse of non-crypto First Republic Bank? The regulators need to admit that their policies and decisions caused the banking crisis. 3 out of 5 largest banks have collapsed this year, hinting at more bank collapses.

Despite the banking crisis and looming debt crisis, the Fed plans raised interest rates by another 25 bps on May 3. It is likely to trigger a collapse of banks such as PacWest Bancorp and Western Alliance Bancorp. In fact, former Federal Reserve Bank of Dallas President Robert Kaplan said the banking crisis is just getting started.

Also Read: Bitcoin (BTC) Price To Hit $30K Or $26K? US Fed, Wall Street Predictions

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom