NFT Collections Will Be Regulated Like Cryptocurrencies Under EU’s MiCA Law, Official Says

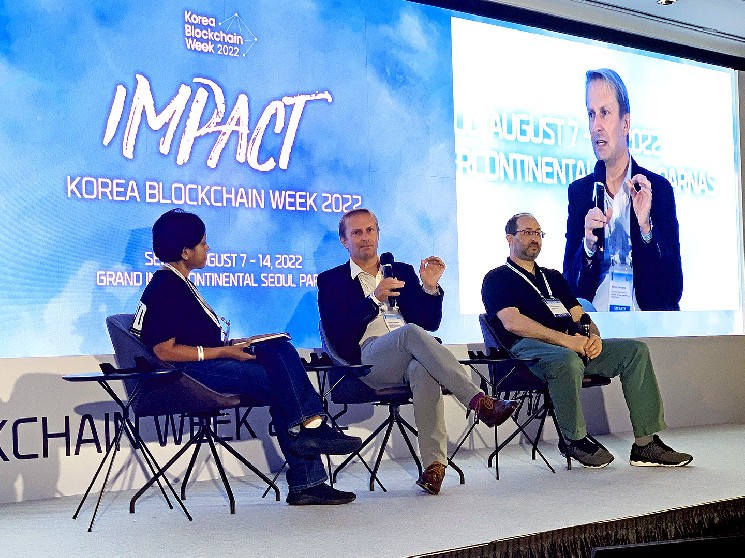

SEOUL, South Korea — Non-fungible tokens (NFTs) that are part of a collection will have to apply new European Union (EU) crypto rules intended to warn investors of risks, an official told attendees at Korea Blockchain Week on Tuesday.

The remarks come in spite of previous claims that the innovative ownership tokens would be excluded from the bloc’s newly agreed Markets in Crypto Assets (MiCA) law. The EU struck a political deal on MiCA at the end of June – and how to treat NFTs, which offer a tradable, digital way to prove ownership of assets such as artworks, was a major sticking point in talks until the last moment.

Though the deal settled the major political elements of the law, no text is yet available. In theory, according to official declarations, the final draft of the law exempts NFTs unless they constitute some other kind of crypto asset. In practice, remarks from the European Commission’s Peter Kerstens suggest that carveout might provide scant relief.

Read more: Crypto World Is Cautious of Finer Details In EU’s MiCA Law

EU legislators “take a very narrow view of what is an NFT,” said Kerstens, who is advisor for technological innovation at the commission’s financial-services arm, said, implying few assets will benefit from the exemption.

“If a token is issued as a collection, or as a series – even though the issuer may call it an NFT and even though each individual token in that series may be unique – it’s not considered to be an NFT, so the requirements will apply,” Kerstens said.

That would mean issuers of NFT collections have to publish a white paper setting out details of the protocol used by the NFTs, and would be forbidden from making outlandish promises about future value that could mislead people into buying, he added.

EU national governments felt that including NFTs in MiCA would be an unjustified extension of a bill originally designed to protect investors in stablecoins and initial coin offerings. But lawmakers from the European Parliament, who also had to sign off on the legislative deal, were more hawkish, arguing the NFT market is prone to securities-style price manipulation such as wash trading.

Kerstens himself had previously said it would be “silly” to require a white paper – a lengthy regulatory document broadly equivalent to the prospectus drafted for stocks – for every NFT. The idea that NFT platforms like OpenSea might have to seek regulatory authorization had provoked worries about crushing innovation in the nascent industry.

The European Commission, broadly the EU’s executive arm, proposed the first draft of MiCA back in 2020. Since then it has brokered talks in the EU’s Council and Parliament as they amended the law.

Read more: EU Agrees on Landmark Crypto Authorization Law, MiCA

Korean regulators are still hesitating over how to regulate the cryptoasset industry. The approach taken by the EU – and by the U.S., whose Congress currently has a number of crypto bills pending – may prove crucial in setting their direction.

Korean government officials told local media in June that work on the country’s upcoming digital asset framework, the Digital Asset Basic Act, would begin in earnest in October, after U.S. regulators publish the reports ordered by President Joe Biden’s executive order on crypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Litecoin

Litecoin  Hedera

Hedera  Zcash

Zcash  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD