Sudoswap Erupts as NFT Traders Capitalize on Royalty-Free Sales

The NFT ecosystem has relied on centralized marketplaces, most prominently OpenSea, for practically its entire existence. Now, decentralized alternative Sudoswap is gaining traction — fast.

Sudoswap aims to shake up NFT trading with automated market making (AMM) algorithms and liquidity pools, echoing premiere Ethereum decentralized exchange (DEX) Uniswap.

Poor liquidity and slippage has long plagued NFT markets. A CryptoPunk might sell for $100,000 on one day but not garner similar offers for weeks or months — leaving investors confused over exactly how much it’s worth.

With its own brand of AMM, Sudoswap allows NFT traders to buy and sell without having to wait for an offer. Sellers contribute their crypto as liquidity to facilitate smoother automated trades, with orders settling with the pool rather than an individual, all on-chain.

“Each user who wants to sell an item deposits one or more NFTs into a pool which they control the pricing over, and the actual purchases happen across all of the pools,” Owen Shen, Sudoswap’s founder, explained on a podcast in May.

Shen added: “You can set a pool with a higher pricing, but it’s the same as listing an item at a higher price — users will buy elsewhere if there’s cheaper items on the market.”

NFT traders are into the idea

In essence, each NFT listing on Sudoswap is actually its own pool, and every seller is solely responsible for providing liquidity to those pools. Users can set NFT values and other parameters for their pools — such as selling NFTs on a bonding curve that slowly increases as pieces are bought.

With Sudoswap, traders can quickly buy and sell NFTs across all pools, allowing for more immediate price discovery and reducing the threat of being stuck with an illiquid asset.

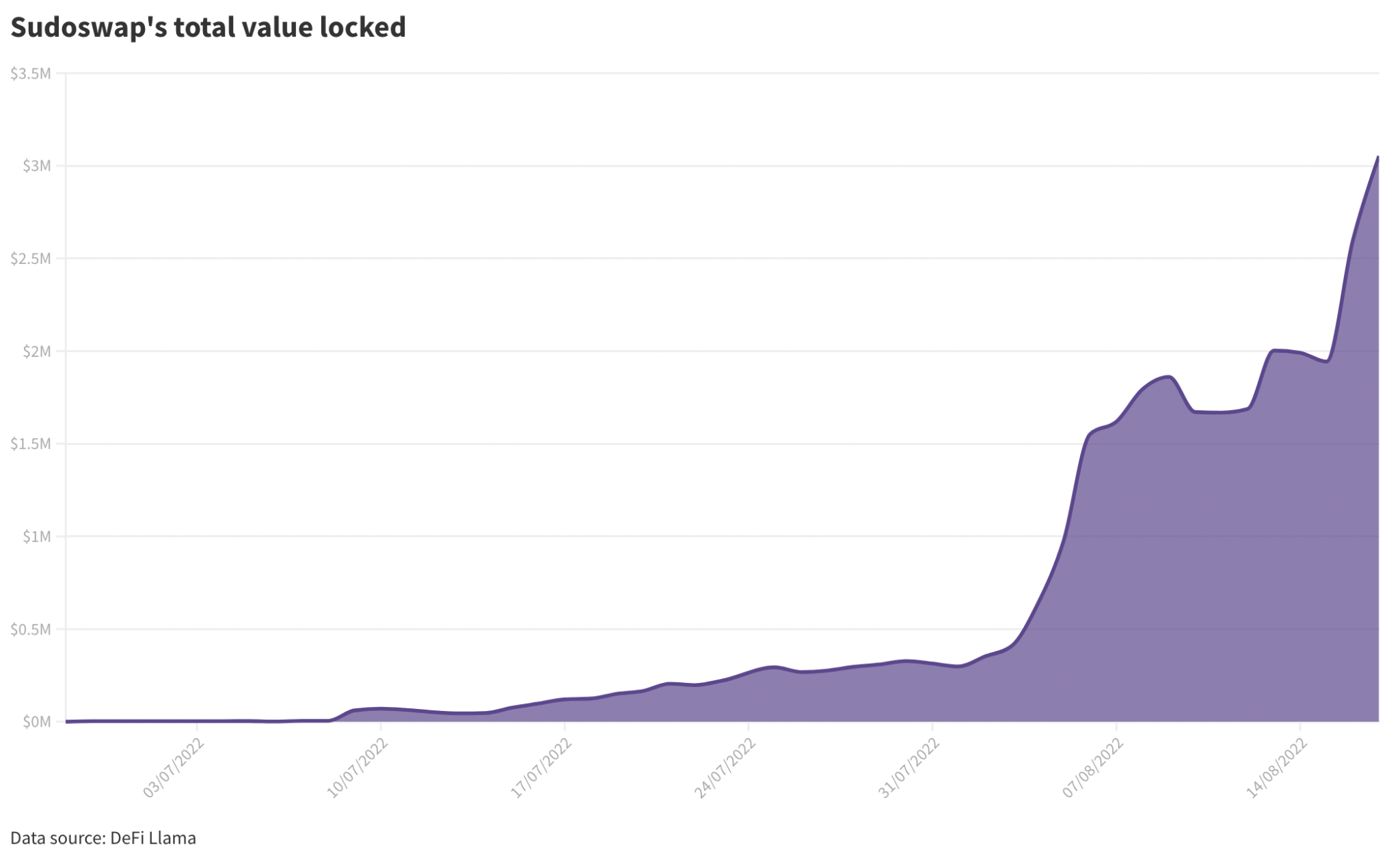

NFT traders seem onboard with the experiment; over the past month, Sudoswap’s total value locked inside its liquidity pools has skyrocketed 2,400%, from $120,000 to $3 million, DeFi Llama data shows.

Overall, the platform’s AMM has facilitated trades of more than 60,000 NFTs across nearly 29,000 transactions since early July, representing $16.5 million in trade volume, per a Dune Analytics dashboard.

For scale, OpenSea processed roughly $800 million in NFT trades over the same period. So, there are still ways to go for Sudoswap to catch up to the big dog.

But the power of Sudoswap is that it removes pesky intermediaries, for better or worse. Centralized NFT platforms frequently bow to copyright strikes, stopping auctions in their tracks.

In fact, OpenSea triggered debate over the line between art, freedom of expression and plagiarism when it banned “flipped” Bored Ape Yacht Club (BAYC) collections. It’s done the same with overtly offensive NFTs, as is its prerogative.

Sudoswap could do similar filtering via its front-end web app, echoing those of major DeFi protocols in the wake of the Tornado Cash sanctions.

Royalty-free NFT trading on Sudoswap could undermine artists

Sudoswap does not pay any royalties to creators on NFT trades. Unlike OpenSea which pays on average 5% to NFT issuers on secondary sales, while keeping an additional 2.5% for itself, Sudoswap charges just 0.5% fees on trades, funds it sends to its treasury, not creators.

The platform’s low fees, on top of its liquidity pool structure, has become attractive for traders, but whether NFT creators and artists feel the same way is another story.

The bulk of NFT revenues usually comes from initial sales, but royalty payments on secondary trades have long been one of the primary sales pitches of the NFT ecosystem.

And in the case of industry giants such as Yuga Labs, they definitely don’t hurt. The floor price for its BAYC tokens is currently 77 ETH ($145,000), and 2.5% royalties means it would net at minimum around $3,600 per trade.

Over the past 30 days, 368 BAYC trades have been recorded, according to CryptoSlam. So, the back-of-the-napkin math works out to be $1.3 million in BAYC royalties for Yuga Labs over the past month alone. (Yuga Labs declined to comment for the purposes of this article.)

I am 100% certain that «not paying royalties» is not a sustainable competitive advantage for Sudoswap.

If it «works» in any significant way it will be copied.

So people should state their views on royalties assuming every market evolves to a common approach

— 6529 (@punk6529) August 13, 2022

Prominent NFT figure @punk6529 weighs in on Sudoswap.

“I haven’t seen many individual artists or creators opt into Sudoswap yet,” Derek Edward Schloss, co-founder of FlamingoDAO, told Blockworks.

“I think most of the volume so far has been NFT owners creating their own pools, bypassing the artist and creator entirely,” he said.

One artist Blockworks spoke to said they wouldn’t be phased if the entire ecosystem adopted royalty-free trading, however. They’ve sold dozens of items on which they forgot to set royalties and aren’t terribly upset whenever one of them re-sells.

If Sudoswap and its royalty-free trading truly catches on, artists will likely need to adjust how they price their work — making mints more expensive or simply focusing on moving volume themselves, Jake Stott, CEO of Web3 creative agency Hype, told Blockworks.

“My inkling is that royalty-free marketplaces will prove to be better-suited for NFT collections by big brands, like the Coca-Colas and NBA Top Shots of the world,” Stott said. “Unlike artists, brands might be keener on forgoing royalties as NFTs can be more of a community and brand building tool for them — and not a direct stream of revenue.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Litecoin

Litecoin  Hedera

Hedera  Zcash

Zcash  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD