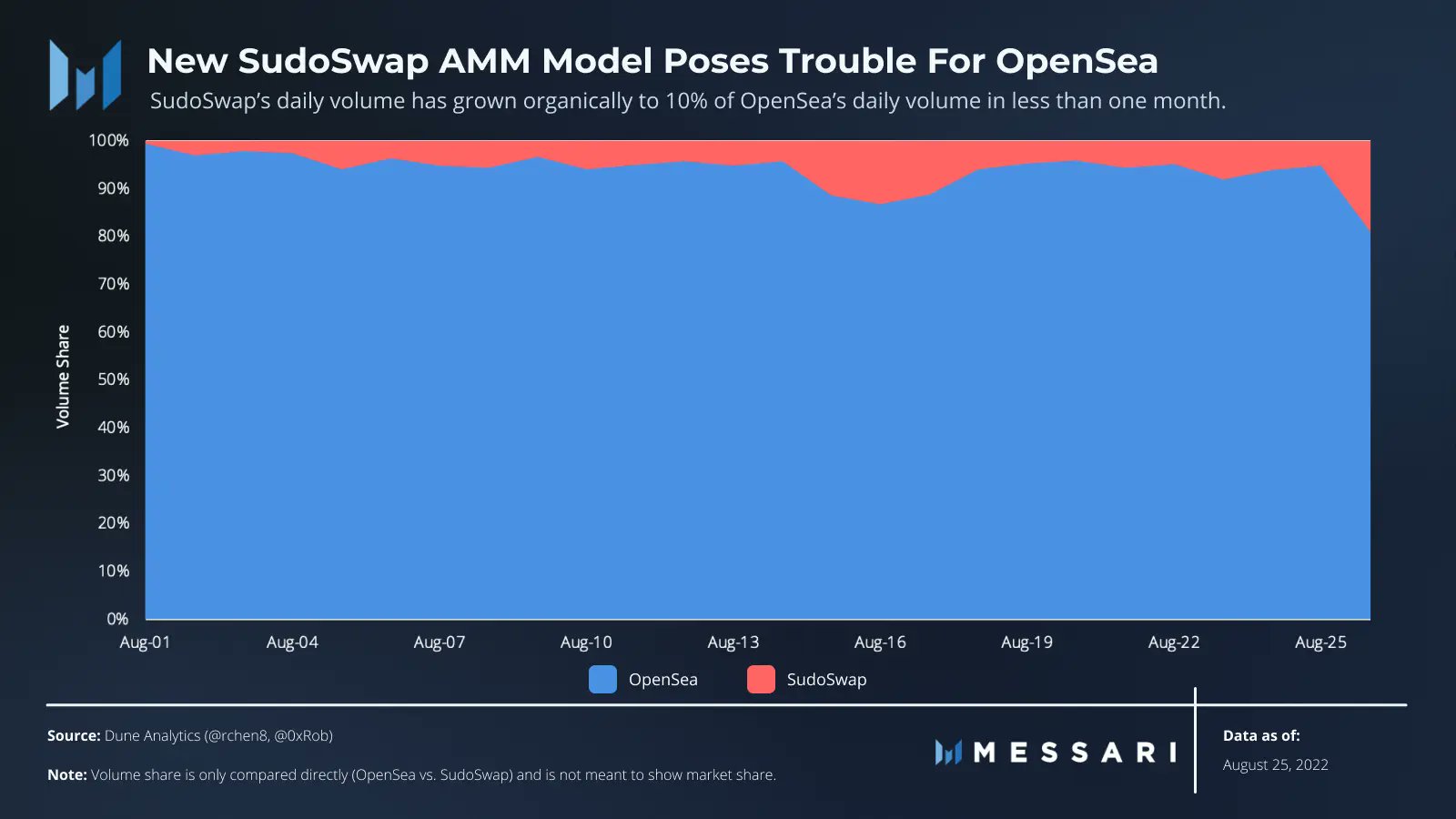

New Competitor Carves Away at OpenSea’s Non-Fungible Token (NFT) Marketplace Supremacy

A new non-fungible token (NFT) marketplace competitor is ripping away a small percentage of market share from OpenSea, the dominant company in the space.

Crypto insights firm Messari notes that the decentralized NFT marketplace SudoSwap “has started to cut into OpenSea’s stranglehold on the NFT space,” with its daily trading volume reaching 10% of OpenSea’s in less than a month.

Source: Messari

The decentralized NFT marketplace launched in early July, billing itself as “highly flexible, gas-efficient and fully on-chain.”

Claims the project,

“Currently, the NFT market relies on centralized orderbooks that are subject to downtime and centralization risk. sudoAMM changes that by being fully on-chain. Anyone can source the same liquidity used by the sudoswap marketplace in their applications using just Ethereum.

The market structure for NFTs has been inefficient due to fees. Buyers often need a price increase of 10% to just break even. Trading on SudoSwap means you only pay a 0.5% fee versus the usual 7.5% (2.5% + 5% royalty) fee on other platforms, enabling better price discovery.

SudoAMM is written from the ground up to be gas-efficient for traders. Trading single NFTs is just as cheap as the most highly-optimized NFT swapping contracts, and when trading NFTs in bulk, sudoAMM can be up to 40% cheaper!”

SudoSwap’s total value locked (TVL) currently hovers above $3 million, up more than 900% from $298,000 at the beginning of August, according to data tracker DeFi Llama.

The TVL of a blockchain represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren