Spice VC to make investor payout after selling Blockdaemon, Securitize stakes

Crypto-focused venture capital firm Spice VC has sold part of its holdings in two of its most successful companies — Blockdaemon and Securitize — in order to fund a payout to investors.

Spice VC will distribute a multi-million-dollar payment to more than 400 of its long-term investors, known as limited partners, with the payout expected to be executed in the fourth quarter of this year, according to a release on Thursday. It had made a similar payout in the second quarter. The firm didn’t respond to a request to share the exact amount to be distributed.

“We are excited to announce that we will be making our second distribution to Spice VC investors this year, with additional payouts expected in 2023,” founder and managing partner Tal Elyashiv said in the announcement. “It gives our team at Spice incredible satisfaction to achieve these kinds of successful returns for our investors who believed in our mission and vision from the very beginning. We look forward to adding significantly to those returns as we continue to make strategic moves to benefit our investors.”

Spice closed its first fund in 2018 and launched a second in May this year. Investors in VC funds can find their cash tied up for years as they wait for the fund’s portfolio of startups to reach an acquisition, stock market listing or other exit event. The average time for a startup to reach an exit can be more than eight years, according to a Venturebeat report.

Spice, however, has tokenized its funds in order to provide extra liquidity to its investors. It last paid out to investors in April 2022 of this year, which it claimed to be the first-ever investor payout completed by a fully tokenized VC firm.

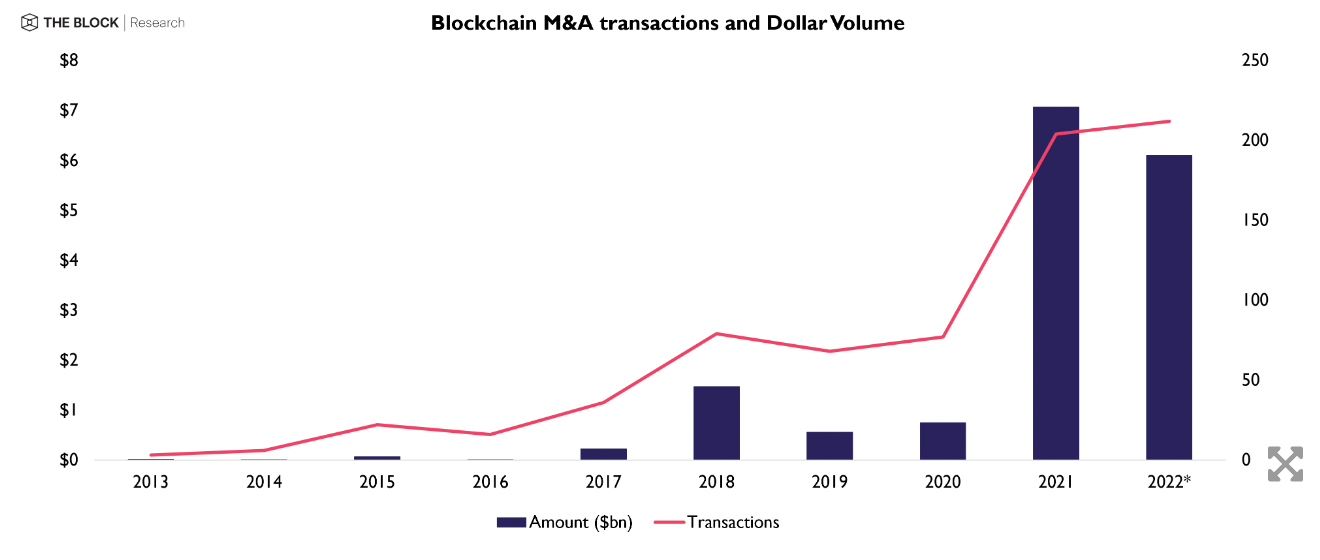

News of the payout comes as one possible exit route in crypto venture capital — mergers and acquisitions — are on pace for a record year, according to a report from The Block Research.

Blockchain M&A transactions and dollar volume by year

However, several high-profile deals have fallen apart in recent weeks, such as investment firm Galaxy Digital’s acquisition of crypto custodian BitGo and crypto miner Prime Blockchain’s merger with SPAC 10X Capital Venture Acquisition Corp II.

One-click checkout company Bolt also dashed out of its $1.5 billion dollar acquisition of crypto payment provider Wyre on Friday.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD