Here’s how much the world’s biggest celebrities paid for their NFTs

The idea of buying and selling crypto art via non-fungible tokens (NFTs) has sparked a craze on the internet that even A-list celebrities cannot ignore.

The encrypted art stored on the blockchain represents individual pieces of digital material purchased using cryptocurrencies. According to data analyzed by Finbold, the combined value of the five separate purchases made by celebrities came to a total of $9,873,500, as per statistics from blockchaincenter.

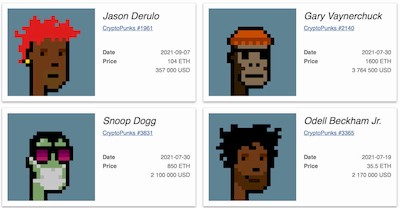

The five purchases are from just two NFT collections, The Bored Ape Yacht Club and CryptoPunks. The most expensive NFT was a CryptoPunk bought by Gary Vaynerchuck, also known as Gary Vee, who spent $3,764,500. NFL player Odell Beckham Jr followed in second, paying $2.17 million, while American rap star Snoop Dogg spent $2.1 million in third.

Justin Bieber’s purchase of Bored Ape Yacht Club #3001 ranks fourth at $1.3 million, while Neymar rounds out the top five with his $539,000 BAYC purchase.

Some celebrities such as Gary Vee and Bieber have bought more than one NFT each, meaning that if it went on the top 5 purchases alone, the figure would be more than $10 million.

NFTs see a decline in interest

Furthermore, there has been further headway into the world of NFTs, with a New York City real estate developer buying the first-ever real-life office building as an NFT and the European Union planning to combat counterfeiting with NFTs by 2023, interest in them has begun to wane in 2022.

Notably, Finbold reported in August non-fungible token Q2 trading volume dropped 40% as interest in digital collectibles began to decline wane.

“In mid-May, the crypto market faced considerable challenges and the NFT market cooled off. NFT trading volume dropped from $19.02 billion in Q1 to $11.26 billion in Q2.”

A June industry study revealed that most users, namely 64.3% of those polled, only purchased NFTs “to make money.” Considering that more than half of investors purchase NFTs only for financial gain, it is maybe not unexpected that Q2 trading volume decreased as the crypto market encountered downward pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond