NFT ecosystem attempts a bounce back amid bearish market sentiment

Over the past two years, nonfungible tokens (NFTs) gave the crypto ecosystem the boost it needed to grab mainstream attention — owing to the involvement of prominent artists and celebrities. However, despite the enormous losses suffered by NFT investors following the ongoing, 10-month-long bear market, the ecosystem showed sustainable signs of a comeback in the last two weeks.

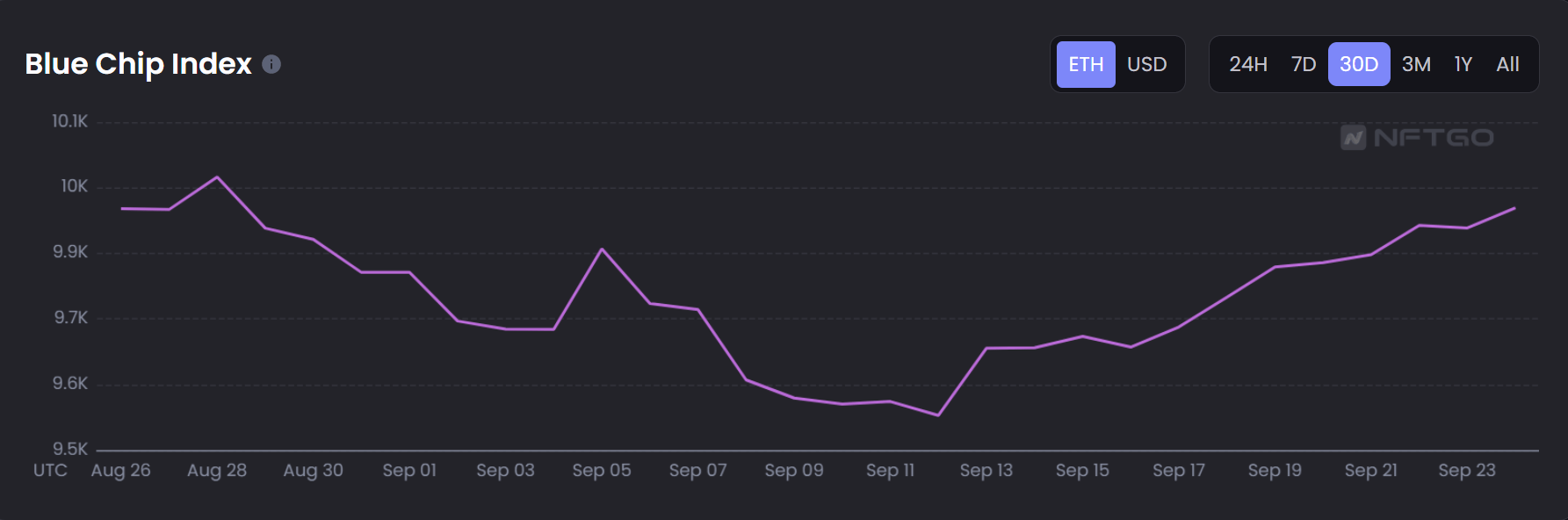

Since Sept. 12, the performance of blue-chip NFT collections witnessed a steady growth, inching back toward the 10,000 Ether (ETH) that was lost in mid-August 2022, according to data by NFTGo.

The performance of blue-chip NFT collections. Source: NFTGo

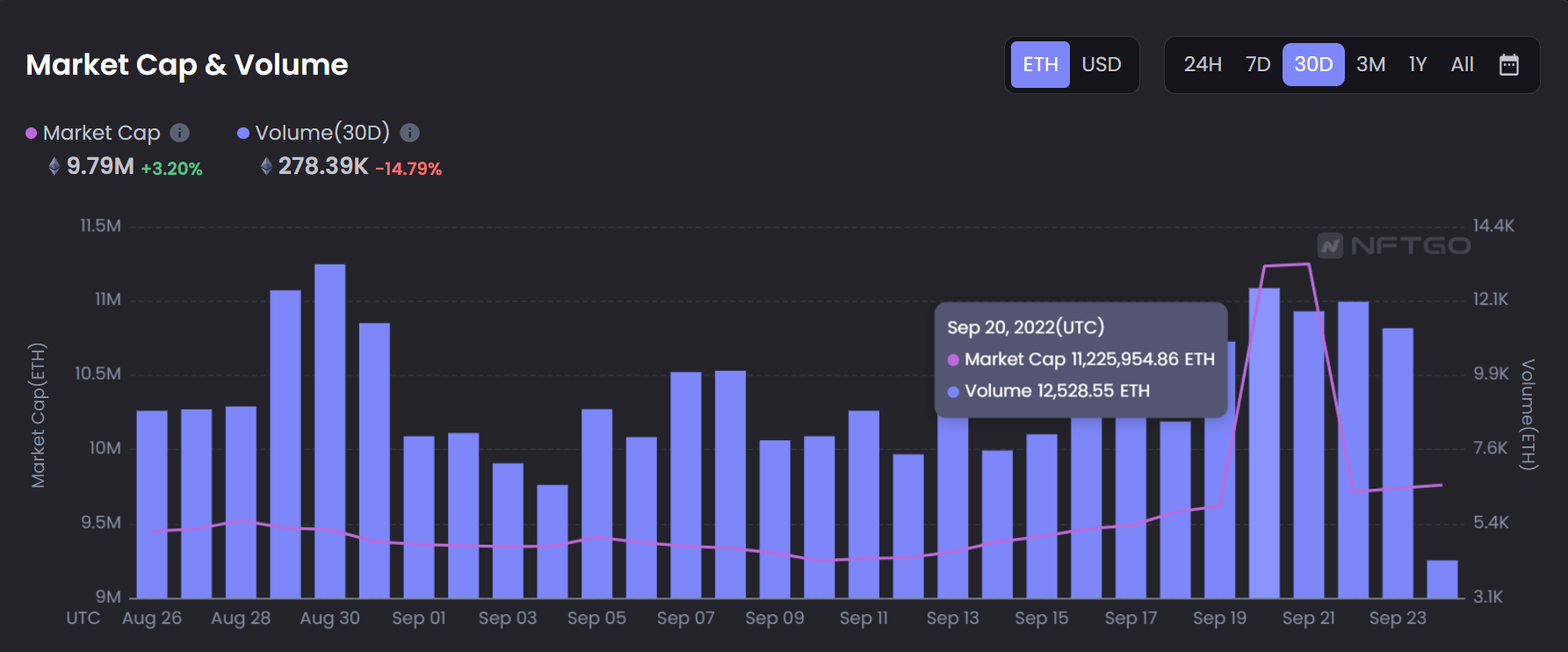

On Sept. 20, the market capitalization, which is derived from the floor price and the trading price of NFTs, spiked nearly 16.5% at roughly 11.25 million ETH.

Market capitalization of NFT collections. Source: NFTGo

Reciprocating the market cap breach of the 11 million ETH mark for the first time in three months, the number of NFT holders grew 32.24% along the same timeline, as shown above.

Ethereum Name Service (ENS) currently contributes the highest volume at 9.25%, which is followed by popular NFT collections such as Bored Ape Yacht Club and Otherdeed.

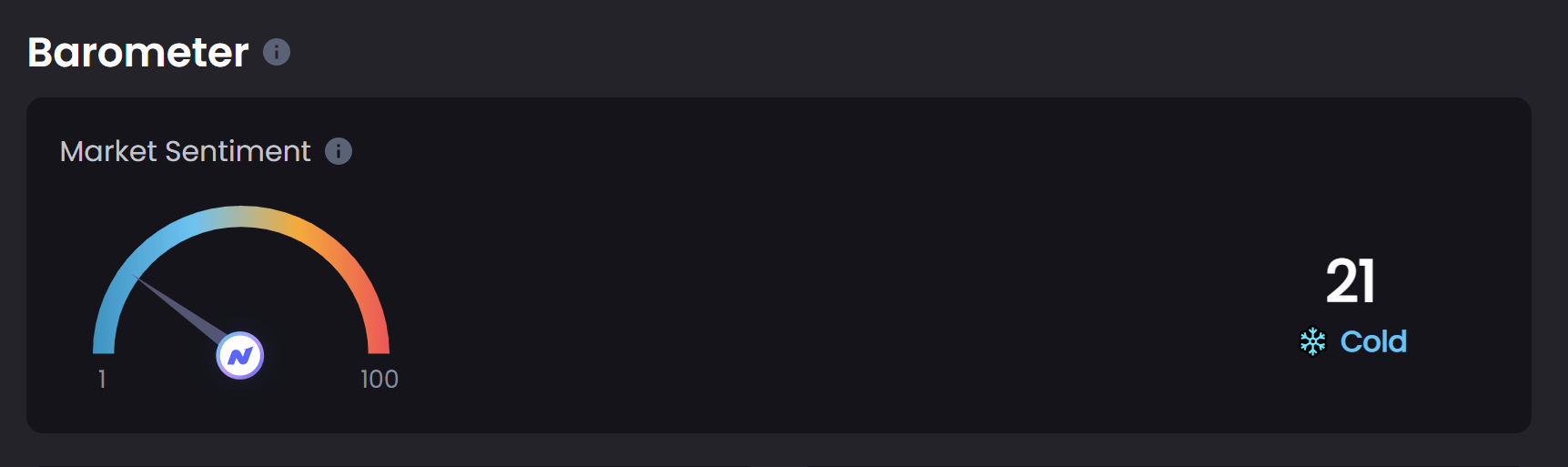

NFT market sentiment. Source: NFTGo

However, current market sentiment — calculated based on volatility, trading volume, social media and Google trends — remains cold as investors try to recoup their previous losses.

Related: Post offices adopting NFTs leads to a philately renaissance

NFT marketplace OpenSea launched the OpenRarity protocol to verify the rarity of NFTs within its platform.

The protocol aims to provide a reliable “rarity ranking” that would assist investors when considering purchasing NFTs.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur