Bloomberg Analysts Say Polkadot (DOT) and One More Blockchain Leading Ethereum (ETH) in Critical Metric

Commodity strategists from Bloomberg say that two altcoins are outshining Ethereum (ETH) when looking at one particular metric.

In the latest Bloomberg Intelligence: Crypto Outlook report, analysts Mike McGlone and Jamie Douglas Coutts say that in terms of its fee structure and issuance system, Ethereum enjoys a strong dominance over much of the market.

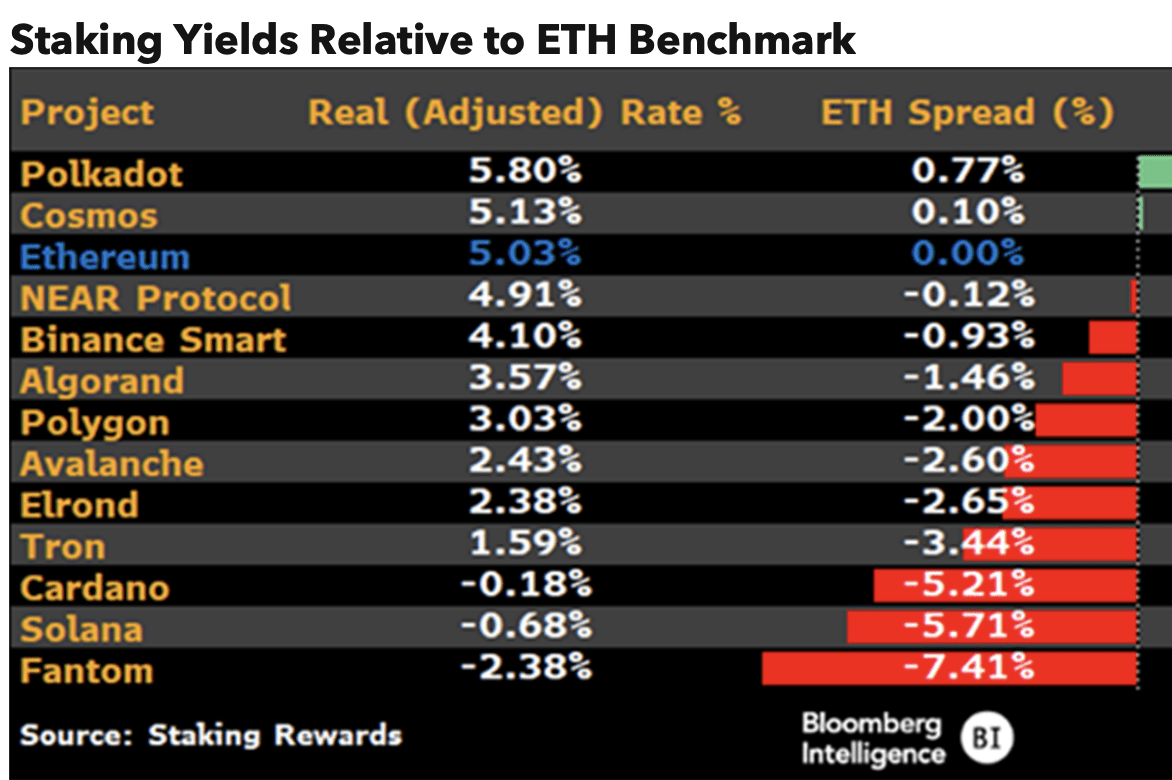

However, the analysts say there are two blockchains that outperform Ethereum as far as staking yield. These altcoins include interoperable blockchain Polkadot (DOT) and Cosmos (ATOM), an ecosystem of blockchains designed to scale and communicate with each other.

“As a result of Ethereum’s dominant market share in fee income and sound monetary (issuance) policy, capital deployment in the crypto economy is likely to start pricing risk relative to Ethereum’s real/adjusted rate (yield). On Bloomberg’s list of layer-1 crypto assets, only two networks have real yields that trade with a positive spread to Ethereum’s benchmark rate of 5.03%. Polkadot trades at a 0.77% premium while Cosmos is at a 0.10% premium. The assets which trade at negative spreads may be victims of mispricing. Inflation/issuance for these assets may need to undergo a radical reduction, similar to Ethereum, in order to attract more capital.”

Source: Bloomberg Intelligence: Crypto Outlook

The Bloomberg analysts say that staking has brought a new dimension to investing in crypto, and they compare it to investing in corporate bonds.

“The emergence of crypto as an asset class in conjunction with a yield component presents a new set of considerations for investors when assessing the risk/reward opportunities in this space. Given the volatility and newness of the demand for smart contract use, staking assets could be considered as equivalent to junk bonds. Yields for proof-of-stake are similar to corporate bonds in that they’re tied to the fees/cash flows

of the network/company.”

According to the analysts, a rise in staking yields is to be expected potentially as early as the first half of 2023, when they speculate that central bank liquidity could improve.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Monero

Monero  Dai

Dai  OKB

OKB  Ethereum Classic

Ethereum Classic  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Gate

Gate  KuCoin

KuCoin  Tether Gold

Tether Gold  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Qtum

Qtum  Synthetix Network

Synthetix Network  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Waves

Waves  Ontology

Ontology  Huobi

Huobi  Status

Status  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  NEM

NEM  Ren

Ren  Bitcoin Gold

Bitcoin Gold  Augur

Augur