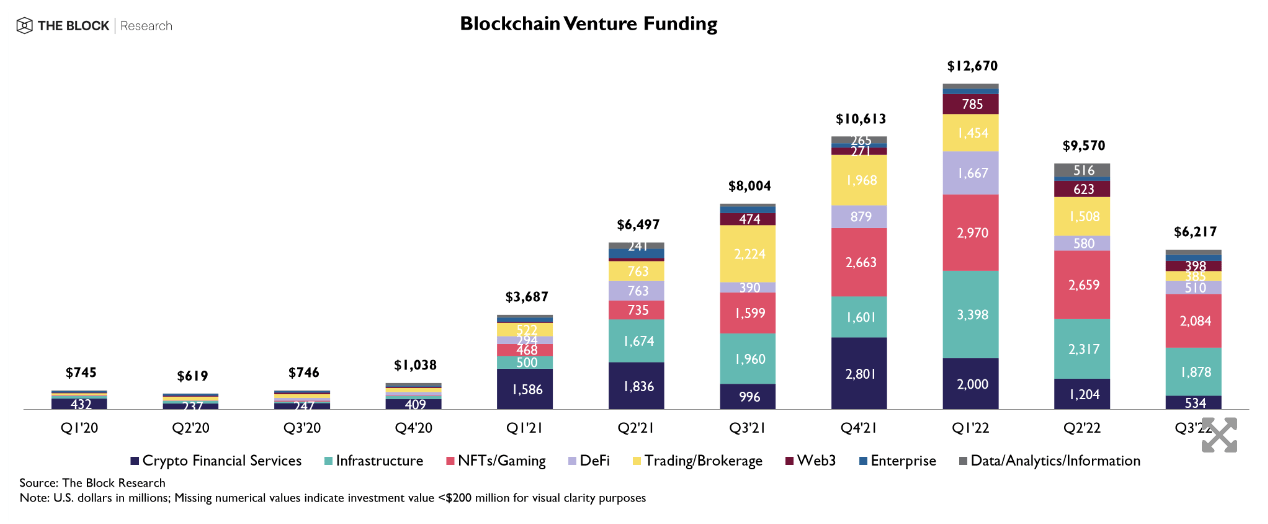

Blockchain venture funding falls for second consecutive quarter

For the first time since 2018, crypto venture funding has fallen for its second consecutive quarter.

This quarter, venture funding for crypto startups dropped by roughly 35% to $6.2 billion, following a 22% decline in Q2 — according to a new report released today by The Block Research.

Prior to this period, venture capitalists continued to heap cash on the sector — recording seven consecutive quarters of growth. This quarter-on-quarter drop in funding confirms that funding for the sector has receded, and investors weary of the downturn are no longer as loose with their pursestrings as in the heady bull market days of 2021.

The last time this type of drop happened was in the latter half of 2018, during a previous bear market when the price of BTC — a key metric of the healthiness of the crypto market as a whole — hit a low below $4,000 after reaching an all-time high of more than $19,000 at the end of 2017.

Along with the amount of funding, the number of VC deals also took a sharp turn — declining by 22% quarter-on-quarter. Previously, the number of deals in the sector had increased for three consecutive quarters.

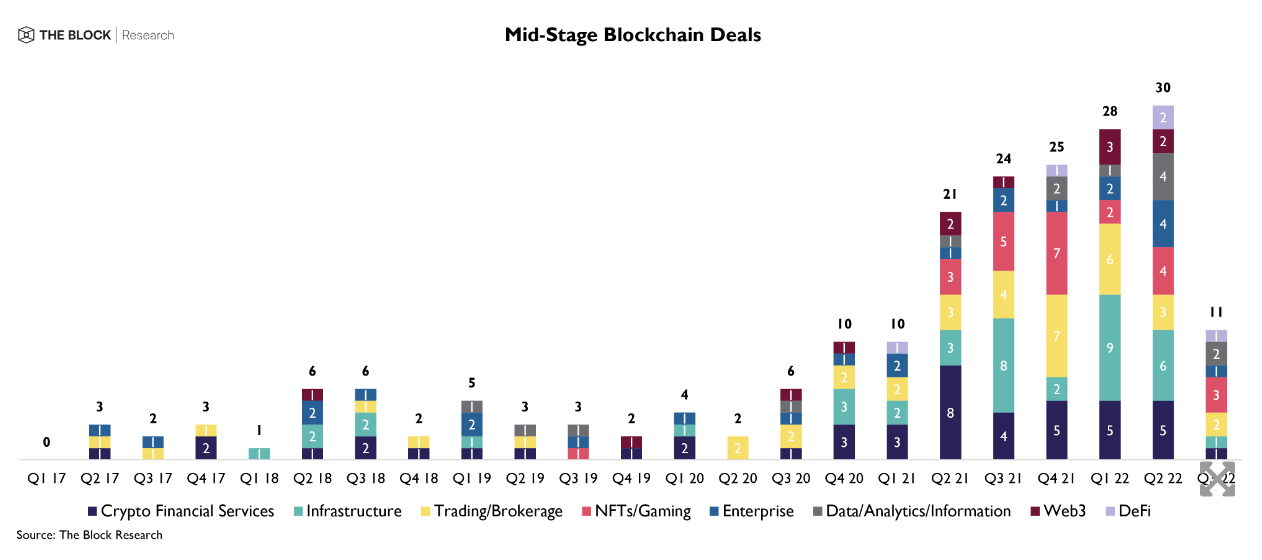

The mid to late-stage deal flow appears to be particularly hard hit by current market conditions. There was only one late-stage deal last quarter, compared to 13 in Q2 — a 92% drop. Startups granted mid-stage deals were also similarly hard to come by, with funding dropping by approximately 63%, and with only 11 deals compared to Q2’s 30.

Still, while every subsector saw seed-stage deals decline, infrastructure startups raising seed rounds increased by approximately 24%. Today, two infrastructure firms — SettleMint and Tatum — raised €16 million and $42 million rounds, respectively.

Compared to previous bear markets, we are yet to see the amount of cash injected into the crypto sector plumb to pre-2021 levels. As the report points out, nearly $15.8 billion has been invested over the past two quarters. That’s more than all of the venture funding from 2017 to 2020, combined — when $15.3 billion was raised by the sector.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD