Art, Blue-chip NFTs Drive Q2 NFT Market Growth

Consumers are continuing to show interest in NFTs in the face of agitated markets, with art and blue-chip collections among the highest performing sectors of the market, a new report from Nansen shows.

The blockchain analytics platform’s quarterly report on the state of NFTs (non-fungible tokens) analyzes Nansen’s six NFT indexes: Nansen NFT-500, Nansen Blue Chip-10, Nansen Social-100, Nansen Gaming-50, Nansen Art-20 and Nansen Metaverse-20. The indexes are weighted by market capitalization and denominated in ether (ETH).

Nansen’s NFT-500 index, which aggregates the performance of the leading 500 NFT collections on Ethereum, was up 49.9% on the year as of March 31. However, the index gave up most of those gains in Q2, clocking an 8.5% year-to-date change by the end of the quarter.

All NFT sectors recorded a bounce in terms of ETH-denominated sales in June, except for gaming NFTs, which are down more than 59% year to date.

Nansen NFT Indexes Performance; Source: Nansen

Blue-chips led the way in the larger NFT market’s upward movement at the beginning of June — the top 10 collections reported a 23.6% increase in market capitalization at the end of the quarter and a 17.9% increase in June alone.

Yuga Labs’ Meebits reclaimed its spot in Nansen’s Blue Chip-10 index, and Chromie Squiggle from Art Blocks also joined the leaderboard, replacing the NFT Worlds and World of Women collections.

There is little evidence to support a continued uptrend due to limited liquidity, the report suggests — the inflows into blue chips still mark “risk off” sentiment by NFT market participants.

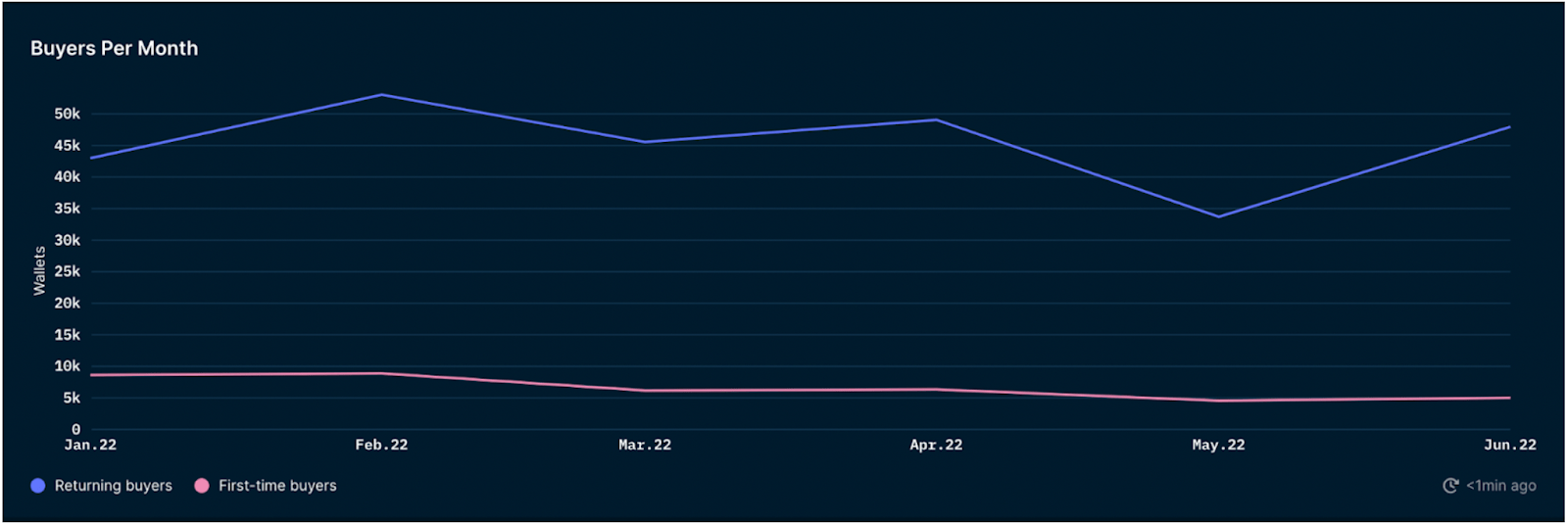

However, an analysis of NFT buyers on Ethereum shows a strong recovery in returning buyers in June and a slight recovery for first-time buyers.

Nansen NFT Trends: NFT Returning vs. First-time Buyers (Monthly); Source: Nansen

The active buyer count indicates the continued growth of the market and the development of NFTs as a sector, according to Nansen.

Recent free mint events, such as those of GoblinTown and Moonrunners, could be a possible explanation for the recovery in buyers, the report suggested.

Nansen analysts also found that art NFTs demonstrated the biggest increase of the month, with a 33.1% boost. This sector encapsulates physical and digital art, plus generative art NFTs, which accounted for 92% of market capitalization in the Art-20 index.

In addition to consistent transaction volume and significant buy-in for Chromie Squiggle, an art NFT collection that performed consistently in Q2 was The Currency by Damien Hirst, a collection of 10,000 NFTs, each corresponding to a piece of physical artwork.

While the Art-20 index saw a decrease in volatility, Blue Chip-10, Social-100, Game-50 and Metaverse-20 indexes showed an increase in volatility, in line with the broad market. The metaverse NFT sector remains the most volatile, a conclusion Nansen also reported in its previous quarterly analysis.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur